This post was originally published on this site

If you want to be reminded why it’s such a good idea to own your own home in retirement, listen up to Matthew Fine.

He’s the guy who’s taken over Marty Whitman’s old mutual fund, Third Avenue Value

TVFVX,

(up 66% in the past 12 months, incidentally). And in his latest letter to his investors he’s pointed out something that he has been watching and a lot of Wall Street hasn’t.

In a nutshell: The official inflation figures are a bit of a crock (my word, not his, of course). And the reason is that actual house price inflation is running way, way ahead of the official house price inflation.

Not sure where to live in retirement? Our tool can help you decide

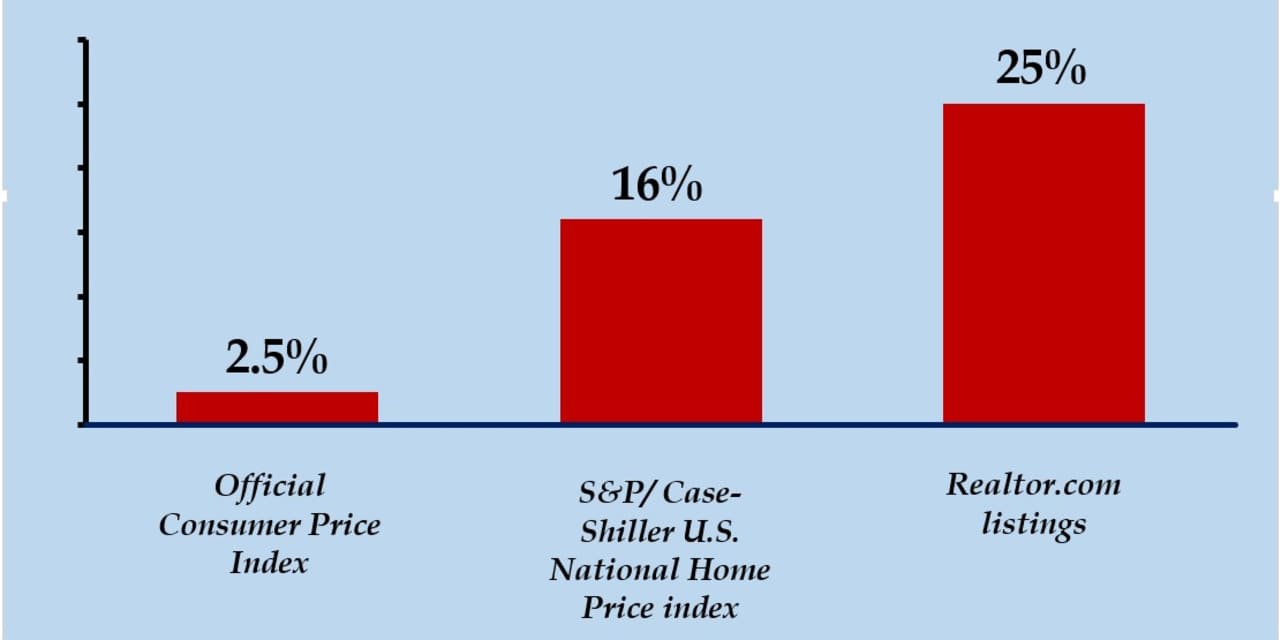

You can see the numbers in my chart, above.

The number on the left is what the U.S. Labor Department, which compiles the official inflation data, says is the increase in housing costs from January 2020 through April of this year. (I’ve used what they call the “Shelter” number, which excludes all the other homeownership costs like utilities. This is just the cost of owning the home.)

The number in the middle is what the nationally-recognized S&P/ Case-Shiller U.S. National House Price Index says has happened to house prices over the same period.

The number on the right is what Realtor.com—which, like MarketWatch, is owned by News Corp.

NWSA,

—says has happened to average listing prices over the same period.

Hmmmm.

Nothing to see here, folks! Move along!

Fine is an inflationista: He thinks inflation is likely to be higher than the Federal Reserve expects, and less “transitory.” He has a number of arguments to do with low, low interest rates, and material and labor shortages as the world reopens. But one of them is this issue with the official inflation figures and housing.

“As it relates to inflation as depicted by the Consumer Price Index (CPI),” he writes, “the measurement of housing costs appears to be substantially disconnected from reality.”

“The U.S. government has estimated rental rates for primary residences to be growing at 2% or less in recent months,” Fine writes. After talking to homeowners, he adds, it reckons “market rental rates for owner-occupied homes have been growing slightly above 2% recently and at a decelerating pace.”

I added the italics. You can see why. Have you seen any decelerating pace in real estate costs lately? Where are these people talking to homeowners?

And this isn’t trivial. Shelter costs account for about one-third of the total official inflation figure. Yet the government has to guess at it. The biggest number? They ask owners how much their home would cost to rent. Yes, really.

OK, so house prices and housing costs aren’t the same. You don’t have to buy a new home every year. The collapse in mortgage rates means your monthly housing costs go down, even if house prices stay the same or go up. This is why the government focuses on “rents” rather than purchase prices.

But the numbers here aren’t that helpful for the Labor Department either.

According to the official figures from the Labor Department, rents nationwide rose about 2.5% in the 12 months to June.

But Realtor.com tracks rents too, using actual market data through its website, and it has a different inflation figure.

Try: 8.1%. Yep. In other words, the private market’s estimate of housing cost inflation is more than three times the “official” number.

Make of this what you will.

Now think about this from the point of view of someone who retires and who doesn’t own their own home. They’re going to be exposed to rents that are rising, on average, 8% a year.

But their Social Security annual cost-of-living increases are tied only to the official inflation, which put rent inflation at just 2.5%.

Whether these number discrepancies are anomalies, or something more sinister, is another story. But these retirees will be getting poorer in real terms, year after year. (And people who are renting in their senior years are likely to be least able to afford that to begin with.)

There is some debate about whether it’s better to rent, or own your own home, in retirement. It’s reasonable to say that one size doesn’t fit all, and what will be the right decision for some people will be the wrong one for others. Homeowners carry costs and responsibilities, and may find it difficult to sell up when they need to. Renters face fluctuations in rent, and lack control over a very basic element of the quality of life. (A friend in his 80s rented and was glad never to have to deal with the hassles of homeownership ever again.)

But retirees, and future retirees, ought to weigh these inflation data carefully when they think about the issue. Housing is our biggest inflation risk. And owning a home offers at least some protection. Social Security, it seems, doesn’t.

A friend of mine with a good job is lucky enough to live in a rent-controlled apartment in San Francisco. He and his wife hope to retire somewhere like Napa a decade or more from now. When we were talking a while ago, I suggested he look at buying a home (or, maybe better, land) there sooner rather than later. Otherwise by the time they retire they may find themselves priced out. (He hasn’t yet.)

If I didn’t own a home now, I’d at least hold REITs or real-estate stocks to help hedge future housing costs. It would certainly have helped future retirees recently. The Vanguard Real Estate Index Trust (VNQ) is up 55% in the past year. The iShares Residential and Multi-Sector Real Estate trust (REZ), 66%.

Could the market know something about housing inflation that the CPI doesn’t?