This post was originally published on this site

If government regulators around the world thought Big Tech was too big last year, 2021 has not changed their mind.

Alphabet Inc.

GOOGL,

GOOG,

Amazon.com Inc.

AMZN,

Apple Inc.

AAPL,

Facebook Inc.

FB,

and Microsoft Corp.

MSFT,

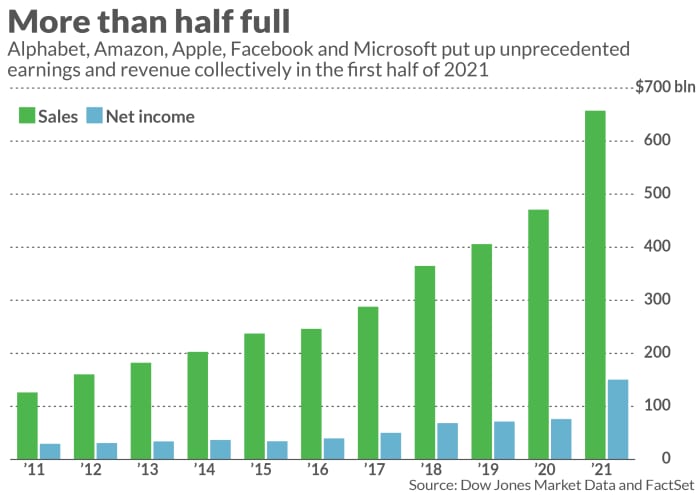

experienced an unprecedented first half of the year financially, with $650 billion in sales. If the second half plays out as analysts currently expect, those five companies would collectively top $1.4 trillion in revenue this year, adding to a pile of profit during the pandemic that could hit $500 billion.

All five companies revealed second-quarter financial results in the past three days, reporting a combined grand total — with the emphasis on “grand” — of $75.8 billion in profit and $331.6 billion in revenue. Big Tech blew away expectations and previous performance for the first half, continuing to find phenomenal success amid a global pandemic that has driven more commerce and consumption online.

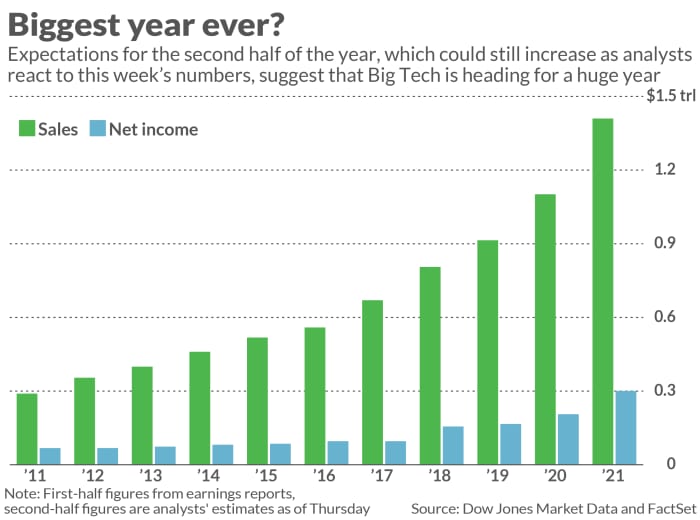

Growth for the second half of the year is currently expected to decelerate overall, but the companies’ revenue is still expected to beat both the first half’s total and last year’s second half by more than $100 billion. Estimates will change as analysts update their models, but Wall Street was looking for revenue of about $760.5 billion in the second half, based on FactSet estimates, a jump of about 21% from the year before, after 38% growth in the first half.

“There will be some moderation [in the second half], but it’s not like growth is falling off the staircase,” Wedbush Securities analyst Dan Ives told MarketWatch, adding that “digital transformation for the consumer and the enterprise is accelerating rather than moderating.”

If those projections come true, or anywhere close, the numbers would truly be staggering. The projected $1.41 trillion in revenue this year would be greater than the 2020 gross domestic product of Australia, the world’s 12th-largest economy according to World Bank figures, while profit would top $300 billion for the year and $500 billion for the two pandemic-affected calendar years of 2020 and 2021.

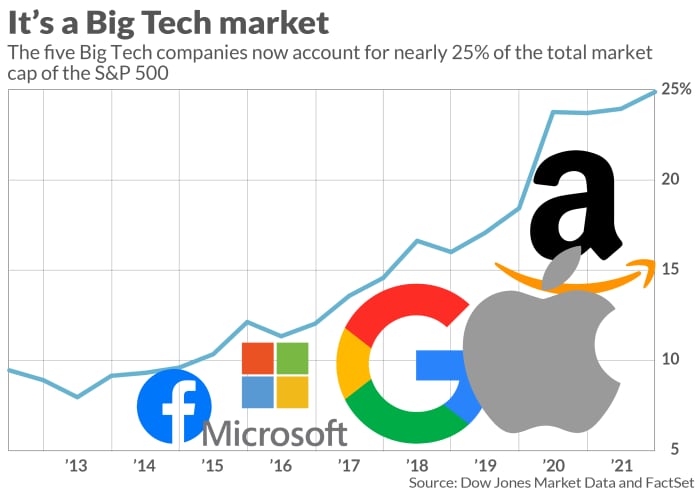

Continued gains from Big Tech are essential to the market at this point. The five Big Tech companies comprised 24.9% of the entire S&P 500 Index’s

SPX,

market capitalization as of the end of Tuesday’s session, according to Dow Jones Market Data, after growing as a percentage of that index for years.

Big Tech is getting dangerously close to a mark that one investment advisor said to look out for.

“Any time a sector gets to around 30% [of the S&P], something bad happens and it will go back down,” said Brendan Connaughton, founder and managing partner of Catalyst Private Wealth. His examples: the 1930s industrial sector, oil and energy companies in the the 1970s, and when dot-com bubble burst more than 20 years ago.

“Tech was over 30% of the S&P [in the early 2000s] and we saw it blow up,” he said. “At some point, things get too weighted and they unwind themselves.”

There are reasons to think that the current tech boom may have peaked with this quarter’s results, and Apple didn’t help with its expectations. Amazon’s sales growth seemed to stall in Thursday’s report, with Chief Financial Officer Brian Olsavsky divulging “some noticeable intra-quarter changes in our revenue run rate.” While Amazon’s AWS cloud business is still going strong, Olsavsky mentioned the impact of a gradual reopening from the pandemic on the company’s overall growth rate.

“I think the impact of people getting vaccinated and getting out in the world, not only shopping offline, but also living life and getting out. It takes away from shopping time,” he said. “It’s a good phenomenon, and it’s great and we just have to appropriately gauge our run rate going forward.”

We could see similar effects across the other companies, though Microsoft appears to have few weaknesses while largely escaping any regulatory scrutiny so far. Google and Facebook are benefiting from an explosion in online-ad prices, which also helped Amazon’s burgeoning ad business, but Pinterest Inc.’s

PINS,

results on Thursday suggested that users may actually be turning off their social-media apps to return to the real world. Facebook Chief Financial Officer David Wehner warned about decelerating revenue growth in the third and fourth quarter, “as we lap periods of increasingly strong growth,” though that may just be his thing.

Even without the same rapid growth rates, though, these companies have established themselves as powerhouses in important market sectors. They will continue to make astounding amounts of money from cloud computing, selling gadgets and services, and putting advertising wherever they can.

“Amazon will show some moderation, as we are coming back to restaurants and malls and shops etc., but I think the Street has underestimated the digital transformation,” bullish analyst Ives said. “We think it is $2 trillion in spending over the next decade.”

Big Tech stands to rake that cash in, but there will be a cost from regulators’ attention. Google, which has been hit with the most U.S. antitrust lawsuits, disclosed nearly $800 million in legal fees in the quarter.

With $18.5 billion in quarterly profit, though, that just seems like a reasonable cost of doing big business for Alphabet, and the rest of Big Tech.