This post was originally published on this site

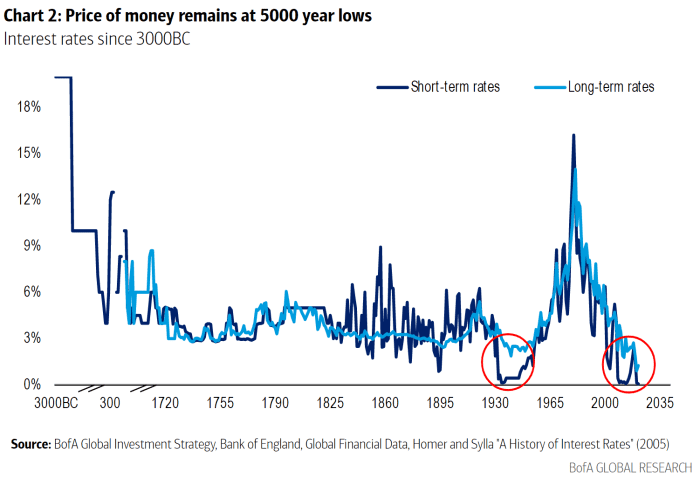

How is this for a historical comparison — interest rates are at a 5,000-year low.

That’s a finding in the latest Bank of America flow show report, which, in fairness, is a number that’s been trotted out before. It’s based on a 2005 book about the history of interest rates, but the chart is still incredible to examine.

“In the next 5,000 years, rates will rise, but no fear on Wall Street this happens anytime soon,” said David Jones, director of global investment strategy at Bank of America.

The Bank of America report pointed out there was a record weekly inflow to Treasury inflation-protected securities of $3.2 billion. The belief in low-rates also has inflows to tech stocks trending higher.

The 10-Year Treasury Inflation-Indexed security yielded a record low negative 1.15% on Thursday.

The 10-year yield

TMUBMUSD10Y,

was 1.25%.

The S&P 500 index

SPX,

closed Thursday as its second-highest level ever, though stock futures

ES00,

pointed to a lower start on Friday.