This post was originally published on this site

A rally by bitcoin on Monday wasn’t all about a help-wanted ad from Amazon.com Inc., crypto analysts said.

The ad, seeking a “digital currency and blockchain product lead” got credit for getting the ball rolling as it stoked expectations the e-commerce and cloud computing giant could soon begin accepting bitcoin for payment. That theme was reinforced after City A.M., a London-based financial news organization, cited an unnamed Amazon

AMZN,

official saying the company was considering doing exactly that by the end of the year and launching its own token in 2022.

Amazon denied the report. “Notwithstanding our interest in the space, the speculation that has ensued around our specific plans for cryptocurrencies is not true. We remain focused on exploring what this could look like for customers shopping on Amazon,” a spokesperson said in an emailed statement.

See: Bitcoin surges as Amazon hunts for cryptocurrency lead

Bitcoin was trading within a whisker of $40,000 in afternoon trade, up 13.4% at 34,906.38 in recent action. What else was driving the bounce? Here are three other factors that analysts said might be in play.

Squeeze play?

Short covering — in which investors who bet bitcoin prices would continue to fall liquidate positions— appeared to be part of the picture, analysts said. Short covering can add to rallies as wrong-footed investors scramble to exit positions by buying bitcoin.

“According to data from Skew, nearly $800 million in BTC short positions were liquidated on Sunday evening,” wrote analysts at Fundstrat. Data from Bybt.com showed that more than $771 million in bitcoin positions had been liquidated in the 12 hours ending at 12 a.m. Eastern on Monday, with nearly $721 million coming from short covering.

Some analysts saw explanations around positioning as more credible when it comes to the rally than the Amazon developments. The move “probably speaks more to the flighty nature of positioning in the crypto space, given that any move by Amazon to adopt cryptos is likely to be some way off,” said Michael Hewson, chief market analyst at CMC Markets, in a note.

Technical breakout

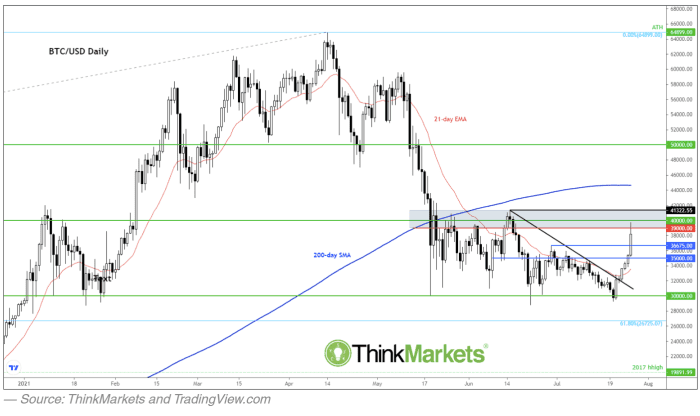

The rally may also have some technical momentum, which also begets more buying, said Fawad Razaqzada, analyst at ThinkMarkets, in a Monday note.

“Prices had been coiling for several weeks and when they finally broke above the bearish trend line a few days ago, we have been seeing a few back-to-back ‘green’ or in my case white candles,” he said, referring to candlestick analysis. In particular, he was noting candles marking out sessions in which the closing price was higher than the opening price (see chart below).

ThinkMarkets

“It is clear that some speculators relying on price action must have decided it was the right time to get back on board,” Razaqzada wrote.

“Key resistance” around $40,000 — the shaded area on the chart — remains intact for now, he noted. It will take a “clean break” above that zone “to tilt the bias completely back to full-on bullish,” he said, warning that traders will otherwise need to proceed “with a higher degree of caution as this could turn out to be a short-lived spike.”

Anticipating Tesla

Razaqzada and other analysts noted that cryptos appeared to find their footing last week after Tesla Inc.

TSLA,

Chief Executive Elon Musk appeared on a panel discussion alongside Jack Dorsey, the CEO of Twitter Inc.

TWTR,

and Square Inc.

SQ,

and Cathie Wood, CEO of ARK Invest.

Read: Bitcoin rises as Elon Musk says, ‘I might pump, but I don’t dump’

Tesla Inc., which holds a bitcoin stake, was due to report quarterly results after the closing bell on Monday.

“Are we also seeing some pre-emptive buying ahead of Tesla’s earnings today?” Razaqzada asked. “It could be that some speculators are anticipating pro-crypto remarks from Tesla CEO Elon Musk or his team when the electric car maker produces its quarterly results after the stock markets close tonight. So do watch out for that possibility.”