This post was originally published on this site

Having medical issues is bad enough, but being weighed down by medical debt? It’s enough to make you sick.

A new study by the Journal of the Medical Association (JAMA) shows that Americans were saddled with some $140 billion in unpaid medical bills last year—up 75% from 2016.

But the true amount of medical debt held by Americans is certainly much higher, given that the JAMA figure only reflects debt which is held by collection agencies—the nice folks who call you at dinnertime asking for money. It’s a situation that affects nearly one in five Americans—18%—according to the JAMA report, which is based on a study by the credit rating agency TransUnion.

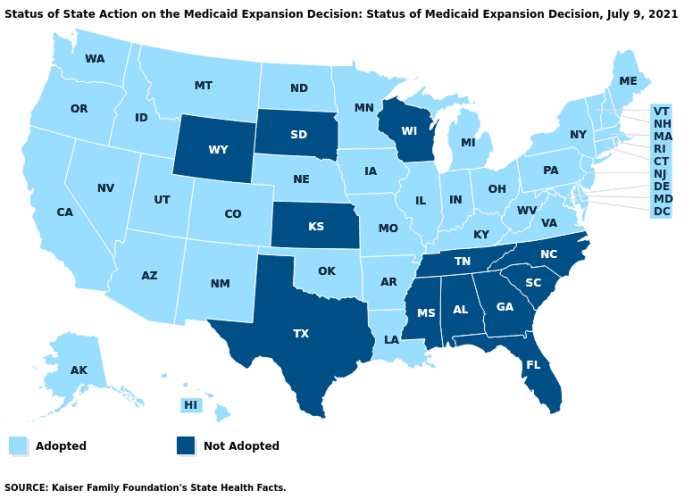

The data appears to skew along political lines, meaning that debt is concentrated in states that have not participated in the Affordable Care Act’s Medicaid expansion program. That program, launched by then-President Barack Obama in 2010, has enabled millions of Americans to be covered by Medicaid—if their governors and state legislatures approved such expansion.

Among the dozen states that have not adopted Medicaid expansion over the years, most are in the pro-Trump south. There are four other red states that have also refused to expand Medicaid: Texas, Kansas, Wyoming and South Dakota. The list, compiled by the Kaiser Family Foundation, includes one other state that—barely—went for Biden last year: Wisconsin.

In turn, it hardly seems surprising, says JAMA, that:

- Debt is highest in southern states (all of which voted for Donald Trump in 2016 and again—with the exception of Georgia—in 2020)

- Debt is lowest in northeast states (all of which voted for Hillary Clinton in 2016 and Joe Biden in 2020)

The refusal of politicians in these dozen states to allow Medicare expansion has hurt the very citizens that vote for them—leaving millions without health coverage and on the hook for bigger medical bills.

Meanwhile, there’s a vicious cycle at play here that hurts people holding medical debt. When bills pile up each month, some are simply more urgent than others. The National Consumer Law Center has a simple rule: “Prioritize debts whose nonpayment immediately harms your family.”

This means that people in debt tend to first pay bills that are simply more important, like utility and auto loans. After all, not paying your electric or gas bill could result in having these things shut off, and skipping your car loan—auto loan debt grew in 2020 to a record $1.37 trillion, says credit rating agency Experian—could result in your car being repossessed.

Medical bills, as a result, tend to get short shrift—and that’s why they’re increasingly being handed over to the oh-so-friendly collection agencies. You might get unpleasant letters and phone calls, but at least the lights will stay on, and you’ll still have your car.

The problem, though, is that folks who don’t—can’t—pay medical bills wind up with lower credit ratings, which will make future loans even more expensive. Banks might say no to credit card applications, a landlord might reject an applicant as too financially risky, and so forth. Again, this is a vicious cycle that can trap Americans who want nothing more than to escape debt, climb the economic ladder and have a better life.

This is an issue that is high on the agenda with President Biden and Congressional Democrats, some of whom are pushing for federal intervention to provide coverage for millions of Americans who have been shut out of Medicare expansion. But some Democrats say that there are bigger priorities than spending billions to fix a problem that has been created by Republican obstructionism. “There are many competing priorities,” Texas Democrat Lloyd Doggett told the New York Times last month.

Meanwhile, there’s no question that medical debt also skews heavily toward senior citizens. The National Council on Aging puts it bluntly:

“Medical debt poses the most significant barrier to economic well-being.” It cites a study showing that out-of-pocket medical expenditures in the five years prior to an individual’s death totaled more than $38,000, leaving 1 in 4 seniors approaching bankruptcy.”

Medical costs rise as we age, and they tend to rise faster than inflation (the Social Security cost-of-living raise this year was just 1.3%, for example). To this we can add the fact that millions of older Americans are living on fixed incomes, and in turn, many of them are in states where politicians, for whatever the reason (my guess is blind political partisanship), haven’t done much, if anything to help. Yet they keep getting re-elected. What a country we live in.