This post was originally published on this site

Does it feel like you’re on a retirement treadmill, working harder and harder and yet falling further and further behind?

You’re not alone. The financial markets have been playing an incredibly cruel joke over the last couple of decades on retirees and near-retirees.

That’s because the very thing that’s caused stocks to rise has also been the very thing that’s caused your portfolios to not go as far in retirement. The markets simultaneously giveth and taketh away.

This “thing” that has both played a big role in the stock market’s extraordinary recent performance, and caused your retirement portfolio to not go as far, is declining interest rates. To illustrate, we need to go through the thought experiment of imagining where retirees would be today if interest rates had not declined in recent years.

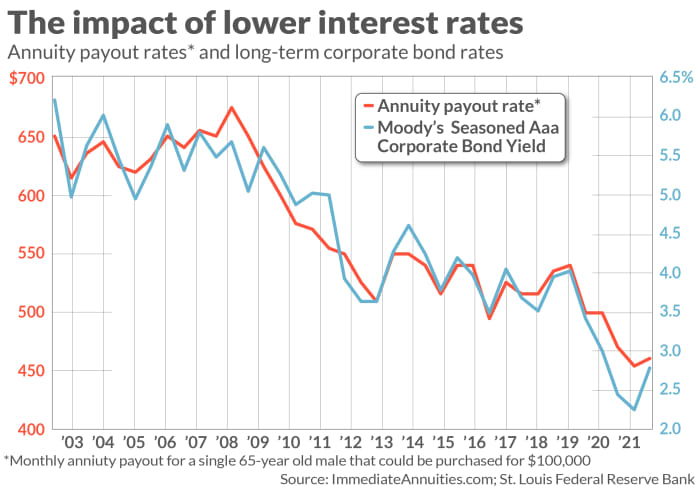

Let’s first focus on the stock market. Recall that earnings multiples rise as interest rates decline, since those lower rates increase the present value of companies’ future earnings. In 2008, for example, investment grade corporate bonds yielded 6.4% (as judged by Moody’s AAA Corporate Bond Yield Index). Today they yield 2.8%, less than half as much.

Sure enough, over this 13-year period the Cyclically-Adjusted Price/Earnings (CAPE) ratio has more than doubled from 16.4 to 38.0. Had the CAPE ratio stayed constant over this period, the S&P 500

SPX,

today would be trading for less than 1,900—versus its actual current level of near 4,400.

To be sure, declining interest rates are not the only cause of the more-than-doubling of the CAPE ratio since 2008. But you get the point: You owe declining interest rates a big debt of thanks for how much your equity holdings have appreciated over the last 13 years.

Annuity payout rates

Turning to the other half of the equation, let’s focus on annuity payout rates. They aren’t the only way to illustrate how far your portfolio will go in retirement, but it’s one of the standard ways that researchers use to make historical comparisons.

As the accompanying chart shows, annuity payouts have been coming steadily down over the last 13 years, in near lockstep with investment grade bond yields. In 2008, for example, a 65-year old single male with $100,000 could have purchased an annuity with a guaranteed monthly payout of around $675. Today, with $100,000 he could only purchase an annuity paying $460 monthly.

To purchase an annuity today whose payout is as good as it was in 2008, a 65-year-old single male would need close to $150,000.

Clearly, annuity payout rates, bond yields, and the stock market are in a rough equilibrium. This suggests retirees and near-retirees should be careful what they wish for. They may say they want the Federal Reserve to continue supporting the stock market with an ever-easier money policy, but it’s not clear they’ll in the end be better off even if the Fed accommodates and the stock market responds accordingly.

There’s a silver lining to this rough equilibrium, however: Higher interest rates are not as terrible as they might otherwise seem, even if they cause the stock market to fall. That’s because the reduced value of your equity portfolio would now go further in retirement.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com.