This post was originally published on this site

Harley-Davidson Inc. is scheduled to report second-quarter results before Wednesday’s open, with Wall Street expecting the iconic motorcycle maker to swing to a profit on revenue that more than doubles from a year ago to pre-pandemic levels.

The results will likely include a continued touting of “The Hardwire” strategy that was unveiled in mid-January, the third named strategy introduced in three years.

Chief Executive Jochen Zeitz said in April that the success of The Hardwire is “rooted in desirability,” which he called a “motivating force driven my emotion.”

The idea is to preserve the value of its motorcycles, as inventory and mixed headwinds led to lower pricing and margins and a surprise fourth-quarter loss, while also increasing riders’ appetite with the introduction of new models, including Harley’s first electric bike.

The Hardwire plan followed the completion of The Rewire that was announced in July 2020, which helped transition the company from its “More Roads” plan introduced in July 2018 aimed at “building” new motorcycle riders.

Investors initially cheered The Hardwire’s new focus on its profitable business lines. After plunging 17.2% on Feb. 2, the day disappointing fourth-quarter results were reported and The Hardwire was introduced, the stock

HOG,

soared 56.2% to close May 17 at a more-than three-year high of $51.96.

Since then, however, it has pulled back about 15% through midday trading on Tuesday.

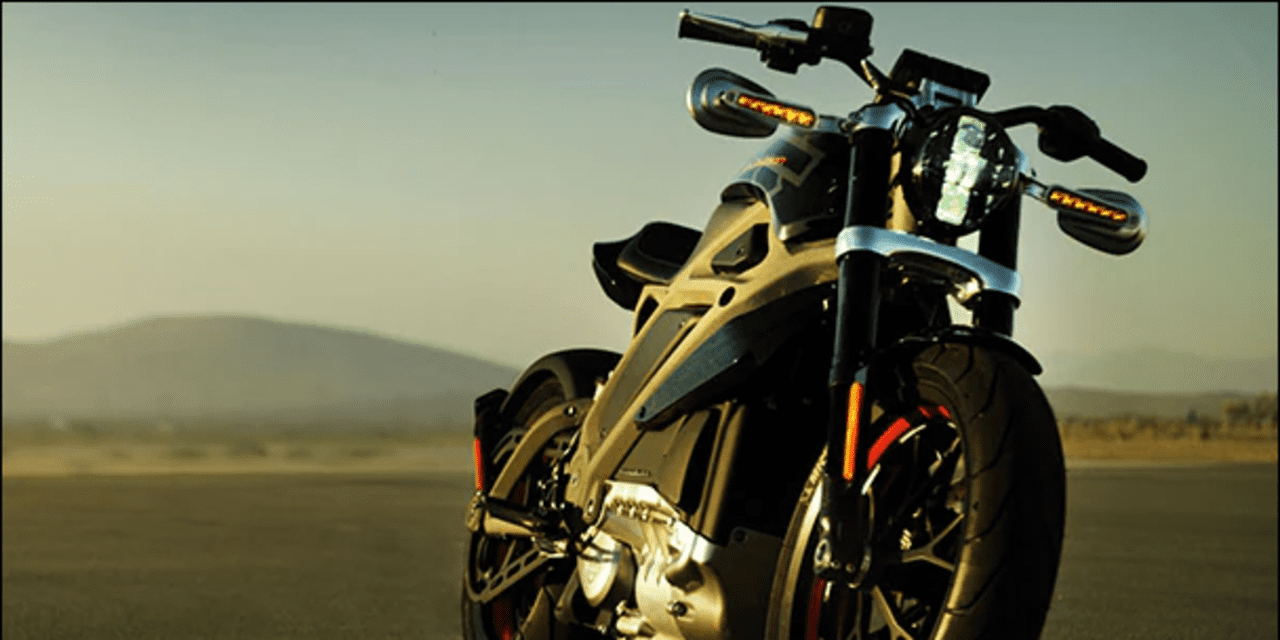

The pullback continued even as Harley introduced two new motorcycle models in the past two weeks. The first was the electric LiveWire ONE for the “urban” rider, starting at $21,999, with “instant acceleration” and 146 mile range. The second was the Sportster S performance bike, with a low center of gravity, starting at $14,999.

UBS analyst Robin Farley said she believes the introduction of those two models, coupled with the elimination of the lightweight, entry-level Street models in January, suggests Harley is no longer pursuing younger and new riders.

“After years of trying to make inroads with new riders and younger riders, Harley is taking a detour,” Farley wrote in a note to clients. “Since Harley had not been successful in its efforts to attract younger riders anyway, they perhaps feel that they won’t be missing much without them going forward.”

Farley noted that previous management had sacrificed near-term profitability with the lower priced entry-level bikes, with the longer-term view that new riders would eventually move up to larger more profitable bikes. She’s concerned that the new approach may improve profitability in the short term, but doesn’t provide the potential for that growth in the longer term.

Another concern is that Harley’s focus on increasing price points for its bikes, in an effort to stoke demand and desirability, by decreasing supply may not work. Farley said the company is apparently targeting up to 200 dealer closures in the U.S., which is much more than she had previously expected.

“Reducing production doesn’t necessarily stimulate demand for a product when sales have been declining for 6 years,” Farley wrote. “Harley shipments were down roughly 40% from peak 2006 levels in 2019 even before the pandemic.”

Farley reiterated the neutral rating she’s had on the stock for the past year and the price target of $33, which is 25% below current levels.

The stock has shed nearly 5% over the past three months, but has rallied 20% year to date. In comparison, the S&P 500 index

SPX,

has gained 4.8% over the past three months and advanced 15.4% this year.

What Wall Street is expecting

Earnings: The average estimate of 14 analysts surveyed by FactSet is for the company to swing to earnings per share of $1.21 from an adjusted per-share loss of 35 cents in the same period a year ago. The estimate marks a sharp increase from 88 cents at the end of March.

Estimize, a crowdsourcing platform that gathers estimates from buy-side analysts, hedge-fund managers, company executives, academics and others, has a much higher consensus EPS estimate of $1.25.

Revenue: The FactSet consensus is for revenue of $1.39 billion, which more than double the $669.3 million reported a year ago. The estimate has increased from $1.20 billion at the end of March, and would be the highest total since the second quarter of 2019.

The Estimize revenue consensus is $1.41 billion.

Motorcycles are expected to rise 148.6% to $1.11 billion, while parts and accessories revenue is expected to grow 26.2% to $212.9 million.

Full-year outlook: In April, the company had increased its full-year 2021 revenue growth guidance range to 30% to 35% from 20% to 25%. The FactSet 2021 revenue consensus of $4.34 billion implies 32.9% growth.

The company had also said it expects 2021 the motorcycles segment operating income margin of 7% to 9% and capital expenditures of $190 million to $220 million.