This post was originally published on this site

Bitcoin was under pressure Monday, with the world’s No. 1 crypto trading near its lowest level since Jan. 1, according to data compiled by Dow Jones Market Data.

The decline for bitcoin

BTCUSD,

comes as general risk appetite on Wall Street was deteriorating, amid growing concerns about the spread of the COVID-19 delta variant and worries about growing tensions between China and the U.S., which come at a vulnerable time for asset valuations that have been broadly heading higher.

On Monday, bitcoin was changing hands at $30,820, off 2.7% on CoinDesk and down more than 50% from its mid-April peak. Ether

ETHUSD,

on the Ethereum blockchain was off by about 4%, changing hands at $1,822.60. Ether values are off nearly 60% from highs put in early May. Ether is trading around its lowest levels since June 27.

In other digital assets, dogecoin prices

DOGEUSD,

were down 5% at 17.5 cents, off more than 75% from its early May peak.

Check out: Why did the Dow tumble Monday? Economic growth is now a bigger worry than inflation.

The tumble in crypto has been in force for weeks and blamed on a regulatory crackdown in China. The People’s Republic has placed a ban on trading in bitcoin and the government also has banned popular apps from trading in crypto.

Monday’s trade for crypto comes as the Dow Jones Industrial Average

DJIA,

suffered its worst day since Oct. 28, falling 726 points or 2.1%. The S&P 500

SPX,

and the Nasdaq Composite Index

COMP,

also saw sharp declines. The equity selloff also coincided with a drop in benchmark 10-year Treasury yields

TMUBMUSD10Y,

to under 1.18%, reflecting a flight to the perceived safety of haven debt.

Crypto and stocks aren’t correlated but sometimes strategists view the assets as measures of risk appetite on Wall Street.

Bitcoin, meanwhile, has been knocking on the door of trading below $30,000, which is seen by some as a level of support that if the crypto falls beneath could fuel further selling.

However, Katie Stockton of Fairlead Strategies remains bullish on bitcoin in the short-term and long-term and sees the possibility of a breakout for the digital asset above $35,000 paving the way for a potential rally to $45,000.

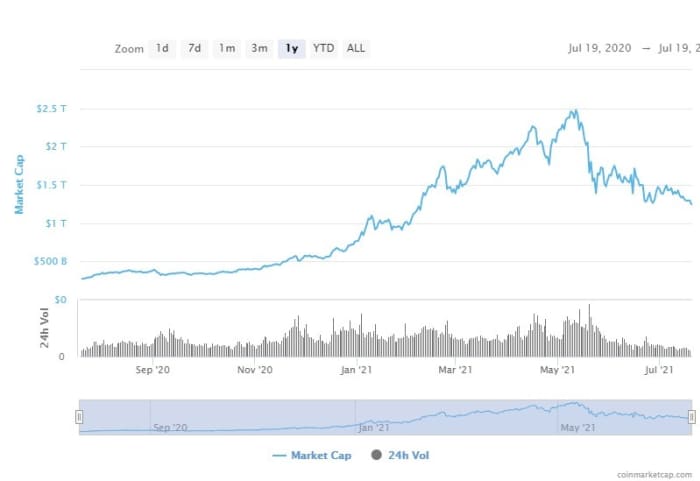

The crypto complex is off $1.3 trillion from a May peak at around $2.5 trillion, according to CoinMarketCap.com.

CoinMarketCap.com