This post was originally published on this site

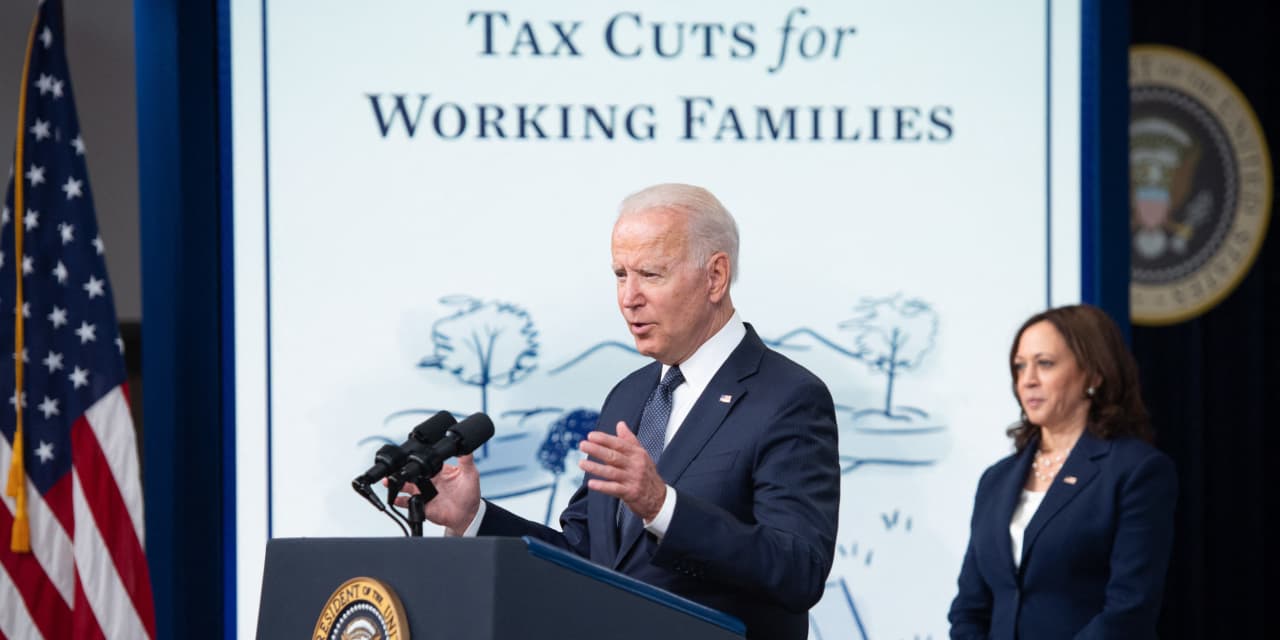

President Joe Biden on Thursday talked up new government payments to American families that have started hitting bank accounts — and called on Congress to support his proposal to make them last beyond next year.

“It’s a middle-class tax cut,” Biden said in a brief speech in Washington, D.C.

“It’s just like the wealthy get tax cuts for a lot of things — it’s a tax cut for your children, having children. This can make it possible for a hardworking parent to say to his or her child, ‘Honey, we can get you new braces now. We can get you a tutor to help you in that math class you’re having trouble with.’”

His remarks come as the federal government on Thursday began sending out up to $300 a month per child to millions of families. These expanded Child Tax Credit payouts stem from March’s $1.9 trillion stimulus law.

“I say to my colleagues in Congress: This tax cut for working families is something we should extend — not end — next year,” Biden also said.

With the first round of payments, about $15 billion went out to families of nearly 60 million children, according to the Treasury Department and Internal Revenue Service.

The monthly payments are slated to amount to $300 per child under age 6, or $250 per child aged 6 to 17. They’re due to come for this year’s last six months, beginning this month and running through December, so the total amount disbursed in 2021 for a younger kid will be $1,800, while those with an older kid get $1,500.

Then next year at tax time, parents or guardians of children under age 6 are due to get another $1,800 per child, bringing their total CTC haul for the 2021 tax year to $3,600, while those with the bigger kids receive another $1,500 for a total of $3,000. That’s because the $1.9 trillion stimulus law, known as the American Rescue Plan, increased the CTC amounts to $3,600 or $3,000, up from an earlier level of $2,000, with half coming through the monthly installments.

Full CTC payouts are slated to go to individuals making up to $75,000 and to joint filers making up to $150,000, with the payments phased out above those income levels. The Biden administration has estimated that payments will go to about 39 million U.S. households, representing 88% of American families with kids.

DJIA,

traded mixed Thursday as investors weighed Capitol Hill testimony from Federal Reserve chief Jerome Powell, along with earnings reports and economic releases.

Now read: Child Tax Credit payments to boost spending at Walmart, Amazon, Wingstop, other consumer brands

Opinion: Americans don’t want socialism shoved down their throats