This post was originally published on this site

I’m probably more cynical than your uncle, and more skeptical than your crazy cousin. But even I can’t see what isn’t there—no matter how much I might expect to.

We’re talking about inflation.

There seems to be a campaign under way to scare the heck out of people about rising prices, fueled by the lockdowns and the latest data. Maybe it just makes for compelling headlines.

Should you panic? And, maybe more importantly: What does this mean for your retirement funds, if you’re already retired, or for your investments, if you’re not?

The short answer is: Not as much as you’d think.

I confess: I was one of the many who figured we would presumably get inflation coming out of the last crash of 2007-9, when Uncle Sam started running crazy deficits and then buying his own IOUs, through the Fed, with money he printed in the basement.

It didn’t make sense to me, and I was in very good company.

But guess what? We didn’t get inflation—or at least consumer inflation (we got the massive inflation of asset prices on Wall Street instead, a somewhat different story).

So I did what we’re supposed to do when the data disprove our assumptions: I listened to the data.

Read: Eggs and pancakes for dinner: How one family is coping with food inflation

We’re now living through a financial experiment that looks about as crazy to me as the last time, and maybe even crazier. Regardless of the rights and wrongs, it involves absolutely unprecedented government intervention in society, business and the economy, staggering deficits, and yet more money printing. The federal government is now talking about further “stimulus” totaling trillions of dollars.

So it doesn’t seem unreasonable at all to worry once again about inflation. And many are doing so.

But…once again, the data are saying otherwise.

The key inflation figure I watch is not the Producer Price Index, the CPI (Consumer Price Index)-U, the CPI-W, the Personal Consumption Expenditures (PCE) index, let alone such political numbers as a “core” CPI figure that excludes food and energy prices. Instead I just watch the bond market’s forecasts.

Read: Planning for retirement? You should also plan for inflation

The bond market isn’t perfect, but its forecasts are probably the best we have.

And right now they’re saying that although inflation expectations have risen, especially when measured since the depths of last year’s crisis, they are still a far way from panic levels.

These forecasts can be extracted from the market prices of two types of U.S. government bonds: The regular kind, known as Treasurys, which pay fixed interest payments every year, and others, known as Treasury Inflation-Protected Securities or TIPS, which promise to pay interest payments that vary with inflation. The simple takeaway is that by comparing the relative market prices of these two types of bonds at any given moment, we can work out what the bond market thinks will happen to inflation in the years to come. And as I say, while it’s not perfect, it’s probably the best forecast we have because if someone actually knows the forecast is wrong they can make billions by betting against it.

Few people willingly lose billions of dollars making a wrong bet. Few people willingly pass up the opportunity to make billions of dollars, either. So if the bond market’s predictions are wrong, nobody yet knows it.

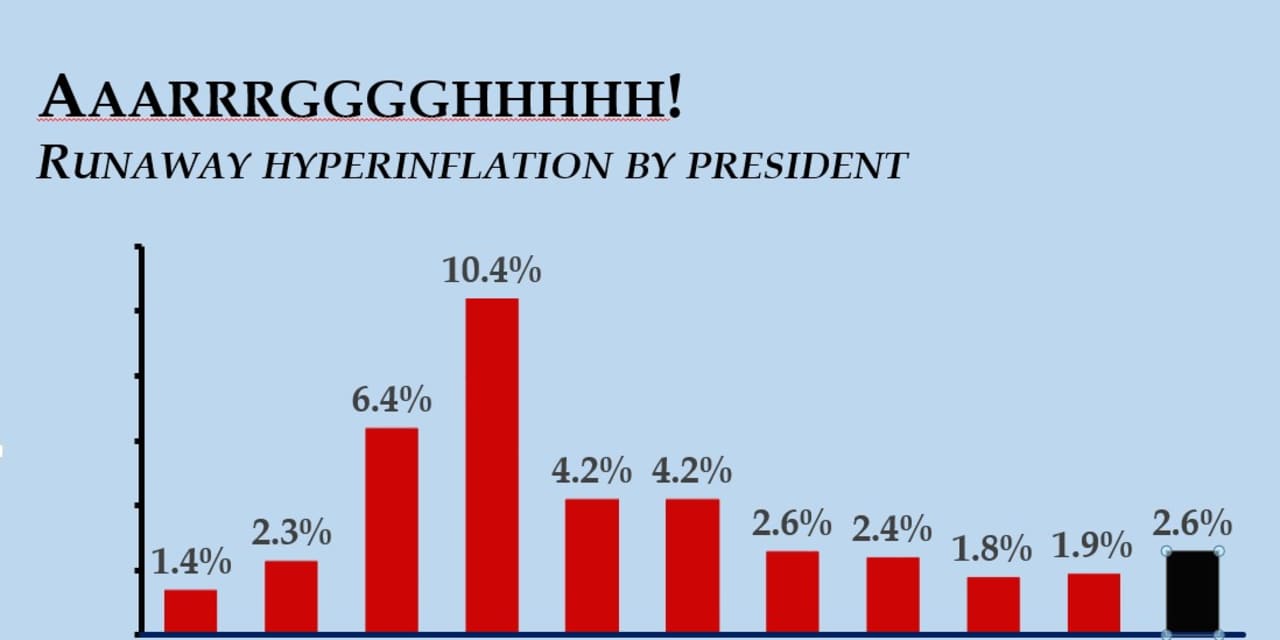

Right now, the bond market’s 5-year forecast for inflation is 2.6% a year. As you can see from the chart above, that’s notably higher than the actual average inflation rate we saw under Obama and Trump, as well as the one they saw all the way back in the days of Eisenhower. But it’s broadly in line with Kennedy/Johnson, Bill Clinton and Bush the younger. And it’s a far cry from inflation under the presidents of the 1970s and 1980s.

Like I said, I’m as skeptical as the next guy and more skeptical than most. I’m not carrying water for anybody, and if I could see rising inflation I’d be writing about it. But when I look at the bond market forecasts even further into the future, so far there is even less to worry about. The 10-year inflation forecast is 2.4% and the 30-year forecast just 2.3%.

Interestingly, these forecasts have been coming down in recent weeks, even while the headline writers have been fretting about inflation.

What’s going on? So far we’re following the playbook sketched out at the start of the year by strategist Joachim Klement at Liberum. He predicted we’d see a surge in headline inflation rates round about now, as all sorts of shortages worked through the economic system. You can’t shut down the world for a year and then just switch it back on again without issues. Right now there’s a sudden bidding war for homes and used cars, shortages of certain computer chips, and so on. There’s also a bidding war for labor: Meanwhile many potential workers say they’ve turned down jobs while they continue to receive unemployment through the crisis.

Inflation happens when there are more buyers than sellers. That can be a temporary phenomenon. Albert Edwards, strategist and gloom-monger in chief at SG Securities, has been accurately pointing out for more than 20 years that while everyone has been worrying about inflation, the real issue has been deflation. And once this crisis passes that could easily continue. The economy continues to support overproduction of many goods and services by so-called “zombie companies,” kept alive only by the Fed’s free money policies. (These companies may now account for as many as 20% of companies.) The crisis sped up technological change, and that is driving prices down, not up. Expect to see a lot of low-wage jobs replaced with automation instead of higher wages.

In a nutshell: Sure, inflation could come. We had better keep watching. But despite the headlines, I’m not panicking just yet.