This post was originally published on this site

Sales of electric vehicles in China are likely to double this year, with Chinese EV makers sidestepping chips and parts shortages and getting creative around charging.

That’s from analysts at Deutsche Bank in a note Monday highlighting June sales of what they called the “Fab Four” Chinese EV makers, Nio Inc.

NIO,

XPeng Inc.

XPEV,

Li Auto Inc.

LI,

and privately held WM Motor Technology Group Co. Ltd.

Citing statistics from the China Association of Automobile Manufacturers, the analysts said that EV sales, including battery-powered and plug-in hybrids, represented between 14% and 15% of the overall sales mix for the month.

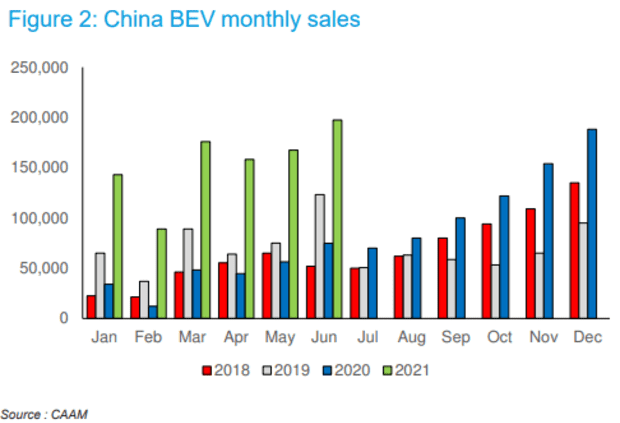

“With the strong start (year to date) and our belief that adoption will accelerate as the year progresses, helped by introduction of new compelling models, we forecast (battery electric vehicle) sales doubling to over 2.0m units in 2021 and (new-energy vehicle) sales of 2.5m,” equivalent to more than 10% of the overall sales mix, the analysts said.

See also: Tesla’s sales show company is weathering chips shortage better than other auto makers

In a separate note, Deutsche Bank lauded Nio’s “Power Day” in Shanghai last week, saying the EV maker continues to focus on “quickly growing and improving its charging infrastructure.”

Unlike the U.S. and other countries, EV owners in China often cannot rely on home charging, as most households in China lack conditions to install private chargers especially outside of main cities. Public charging stalls are often busy and using them can be time-consuming.

Related: U.S. falls further behind China and Europe in making electric vehicles

To sidestep that, Nio has pioneered “battery as a service,” launching its program last year. People buy a Nio car without the battery and pay as you go, swapping depleted batteries with fully charged ones depending on need.

The program has the added benefit of making the car cheaper, and offers a solution to some longstanding EV ownership barriers such as dealing with battery degradation, whether to upgrade a battery, and lower resale value with an older battery.

Nio’s “ability to seamlessly integrate multiple methods of energy replenishment into its ecosystem has resonated extremely well with Chinese customers,” with nearly 3 million battery swaps conducted since the program’s inception.

The company is targeting increasing battery-swap stations by about 200 in the third quarter to end the year with between 500 and 700 stations, compared with around 300 stations currently. The long-term plan is to add 600 swap stations a year.

Aside from battery swapping, Nio is working on several new types of

superchargers but did not disclose details, the analysts said.

American depositary receipts of Nio have lost 5% so far this year, but have tripled in the past 12 months. That compares with gains of around 16% and 38% for the S&P 500 index

SPX,

in these same periods.

Li Auto’s ADRs have gained 14% this year, while shares of XPeng have lost 7%.