This post was originally published on this site

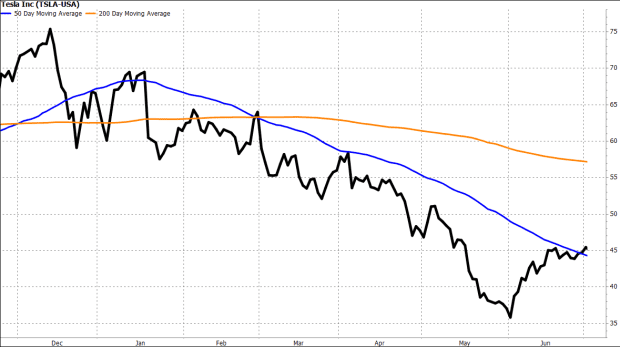

Barring a massive rally, Tesla Inc.’s stock chart will produce the first bearish “death cross” pattern in more than two years on Friday, which some market technicians could view as a warning of further losses.

The electric vehicle industry leader’s stock

TSLA,

rose 1.3% to close Thursday at $652.81, reversing an earlier loss of as much as 3.8% at the intraday low of $620.46. It rose 0.6% in premarket trading Friday.

Ahead of Friday’s open, the 50-day moving average (DMA), which many Wall Street chart watchers use as a guide to the shorter-term trend, is set to fall to $629.61 from $630.44 at Thursday’s close.

Meanwhile, the 200-DMA, which is viewed by many as a dividing line between longer-term uptrends and downtrends, is set to open at $630.75, up from $629.61 at Thursday’s close.

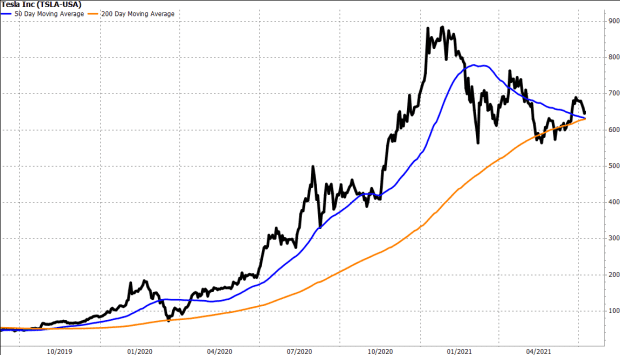

That puts the 50-DMA on track to close below the 200-DMA on Friday, which would snap a 20-month streak in which the 50-DMA has been above the 200-DMA.

Don’t miss: Tesla releases a cheaper Model Y in its battleground China market.

Also read: China’s retail sales of passenger card declined in June.

The point where the 50-DMA crosses below the 200-DMA is referred by technical analysts as a “death cross,” which many believe marks the spot a shorter-term pullback evolves into a longer-term downtrend.

FactSet, MarketWatch

At current prices, the stock would have to soar nearly 12% to roughly $728.95 on Friday to keep the 50-DMA above the 200-DMA, according to MarketWatch calculations of FactSet data.

Death crosses aren’t usually seen as good market timing tools, given that their appearances are telegraphed far in advance. To some, they only represent an acknowledgment that a stock’s pullback has lasted long enough and/or extended far enough to consider shifting the narrative on the longer-term outlook.

Tesla’s stock hasn’t closed at a record since Jan. 26, and was recently trading 26% below its record of $883.09. Meanwhile, other Nasdaq-listed megacapitalization stocks like Apple Inc.

AAPL,

Microsoft Corp.

MSFT,

Amazon.com Inc.

AMZN,

and Alphabet Inc.

GOOGL,

have all set fresh records this week, and Facebook Inc.

FB,

shares closed at a record last week.

Tesla shares have shed 7.5% year to date, while the Nasdaq Composite Index

COMP,

has gained 13.0% and the S&P 500 index

SPX,

has advanced 15.0%.

And Tesla’s death cross could still warn of further losses.

The last Tesla death cross appeared on Feb. 28, 2019, about two months after it reached a multi-month closing peak, and after closing 15% below that peak. The stock tumbled another 44% before bottoming out three months later.

Tesla’s last ‘death cross’ appeared in 2019, and the stock kept falling

FactSet, MarketWatch

If it’s any consolation to Tesla investors, the stock charts of some rival EV makers have already produced death crosses: Nio Inc.’s

NIO,

appeared on May 24 and Nikola Corp.’s

NKLA,

appeared on Nov. 3, 2020.