This post was originally published on this site

Stock indexes pulled back from record territory Thursday as concerns about economic growth came into focus, but equities still could get a boost next week from the kickoff of second-quarter earnings.

Big banks, including JPMorgan Chase & Co.

JPM,

and Goldman Sachs Group Inc.

GS,

are due to report earnings Tuesday, followed a day later by Bank of America Corp.

BAC,

Citigroup Inc.

C,

and Wells Fargo & Co.

WFC,

and by Morgan Stanley

MS,

on Thursday.

After setting the tone for the past 15 months, earnings at the big U.S. public banks are expected to surge about 204% in the second quarter from the doldrums of a year ago, according to BofA Global analysts.

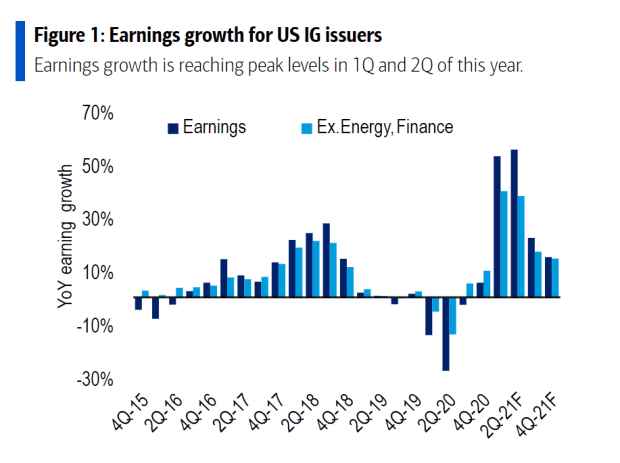

That compares with an already dramatic 55.5% earnings growth rate expected for the broader universe of U.S. investment-grade companies for the same stretch.

Q2 on pace for peak earnings.

BofA Global

While earnings are expected to book a pandemic peak in the second quarter, the above chart also illustrates how sharp they fell a year ago, when households and much of the economy hunkered down amid the pandemic.

More broadly, companies in the S&P 500 index

SPX,

are expected to see a 63.6% increase in earnings in the second quarter from a year before, which would mark its highest 12-month climb since the fourth quarter of 2009, according to FactSet analysts.

“Since it is likely to be a record-setter for growth, it is critical that investors not lose sight of these significant fundamental developments,” Joseph Amato, chief investment officer for equities at Neuberger Berman, wrote this week about the coming corporate reporting season.

“Should the momentum in earnings continue — and we think it will — we believe the market can remain resilient as policymakers adjust their thinking.”

The S&P 500 and Nasdaq Composite

COMP,

hit fresh records this week, but stocks slumped Thursday as investors gauged how much longer the Federal Reserve might keep up its support for the economy running at full throttle. Concerns also have been raised about whether the economy can grow at the Fed’s 2% target over time, and about the COVID-19 delta variant.

Atlanta Fed President Raphael Bostic said Wednesday that the central bank’s eventual tapering of monthly asset purchases would be gradual, a day after June’s Fed minutes highlighted discussions at the central banks about the timing and possible first steps to reduce its large-scale purchases. The 10-year Treasury yield

TMUBMUSD10Y,

fell to 1.287% Thursday, its lowest since Feb. 18, according to Dow Jones Market Data.

“Markets don’t typically go up or down in a straight line,” Amato wrote, adding that markets can become even more volatile in a bull market, “especially with central banks adjusting their policy stance as the recovery sets in.”

Read: Here’s your chance to buy bank stocks before rising interest rates boost profits