This post was originally published on this site

The market is seemingly adopting the idea that growth won’t get any better than it currently is, according to David Rosenberg, chief economist and strategist at Rosenberg Research and a longtime Wall Street veteran.

The idea that economic growth will be strongest in 2021 is hardly an out-of-consensus idea. The International Monetary Fund, for example, forecasts 6% global growth in 2021, followed by 4.4% growth in 2022. What’s new over the past few months, however, is that the stock market reflects that notion as well.

Related: What to expect if ‘peak everything’ already has happened and markets feel the force of gravity again

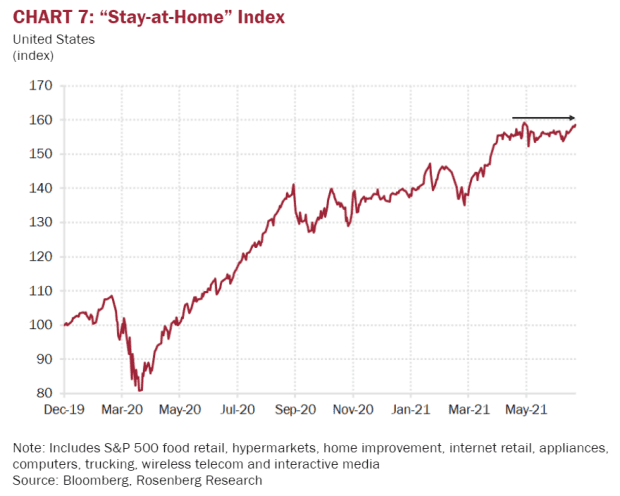

Rosenberg has put together his own charts on leading themes. His “stay at home” index — which includes S&P 500

SPX,

food retail, hypermarkets, home improvement, internet retail, appliances, computers, trucking, wireless telecom and interactive media — is showing signs of flattening.

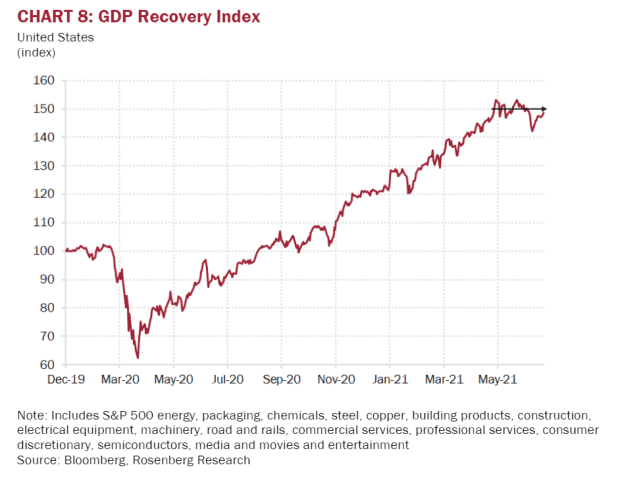

Also flattening is the “GDP recovery” index, consisting of S&P 500 energy, packaging, chemicals, steel, copper, building products, construction, electrical equipment, machinery, road and rails, commercial services, professional services, consumer discretionary, semiconductors, media and movies and entertainment.

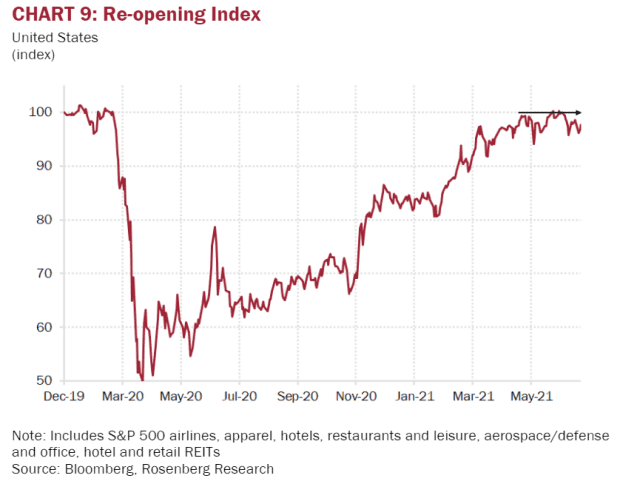

A “reopening index,” which includes S&P 500 airlines, apparel, hotels, restaurants and leisure, aerospace/defense and office, hotel and retail REITs (real-estate investment trusts), also is topping out.

Rosenberg says the fact that the gross domestic product recovery and reopening indexes are now treading water instead of making new highs, “indicates that the market is coming around to the view of ‘peak growth’ with a lot of the reopening and recovery news being fully in the price,” he said.

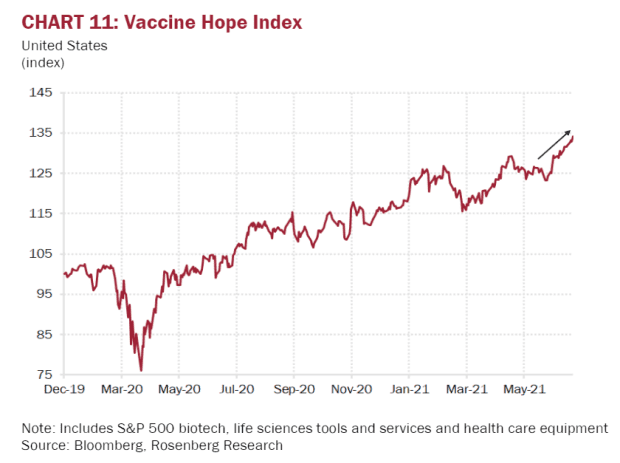

One index on the rise is his vaccine hope index, which includes S&P 500 biotech, life sciences tools and services, and healthcare equipment. To Rosenberg, that suggests COVID-19 fears haven’t fully abated with the growing concerns over the delta coronavirus variant — both at home and abroad.