This post was originally published on this site

The delta variant of the coronavirus that causes COVID-19, has been very much in focus in recent sessions, as it continues to spread across a number of countries worldwide.

The variant, first identified in India, is already dominant in the U.K. and is growing in prevalence in several other countries, including Germany, Italy and France. The World Health Organization said Wednesday the variant has been detected in 96 countries, while the U.S. Centers for Disease Control and Prevention has classified it a variant ‘of concern’ and said late last month it accounts for 20% of all U.S. cases

So what does the delta variant mean for stocks?

JPMorgan strategists answered that question in a note earlier this week: The variant doesn’t pose risk for markets and could even provide a boost for value stocks and yields, they said in a note.

“The delta variant should not have significant repercussions for the pandemic situation in developed markets (e.g. Europe and North America, which have [made] strong progress in vaccinations) due to the level of population immunity,” said the strategists, led by chief global markets strategist Marko Kolanovic.

They said the market was reacting to delta variant fears in the same way it did to concerns around the alpha variant (B.1.1.7), also known as the U.K. variant, back in February — with a decline in yields and value stocks. But that market positioning isn’t justified, they said, and will lead to a move higher in bond yields, value and cyclical stocks, as it did earlier this year.

“The situation is similar to February’s B.1.1.7 scare, when defensive positioning (bonds, growth stocks) in anticipation of doom resulted in a month-long rally in bond yields, value and cyclical stocks, and a decline in bonds and growth stocks,” they said.

The strategists expect the same to happen this time as investors assess the delta variant. They also noted that oil, one of the most sensitive assets to COVID-19, has been unaffected by delta variant concerns.

“We reiterate our view to go long reflation, cyclical and value trades, and sell growth and defensive positions,” they added.

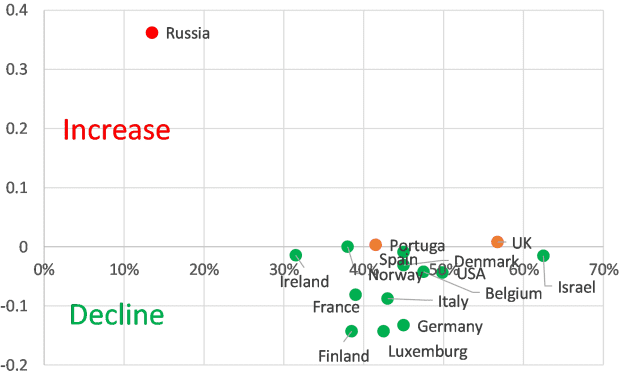

They came to their conclusion on the delta variant’s impact after analyzing data from 15 countries most affected by the variant in June. Only Russia recorded a marked jump in its fatality rate, but the strategists pointed out the country has only vaccinated 14% of the population.

June % change in peak COVID-19 mortality vs. vaccination rate in 15 countries most affected by the delta variant.

Source: JPMorgan Global Markets Strategy

They noted that in the U.K., for example, cases have increased by around 14,000 a day but deaths have increased by approximately nine a day. The picture is similar in Portugal, another country where cases have risen sharply — 900 a day — but deaths have increased by approximately one a day. “This is consistent with findings that vaccines effectively prevent worse outcomes in delta variant infections,” they said, noting that most deaths occurred in unvaccinated people.