This post was originally published on this site

The most valuable asset in Adam Sharkey’s portfolio isn’t Bitcoin

BTCUSD,

or Tesla

TSLA,

stock, but rather his 2017 used Hyundai

267250,

Sonata Hybrid that’s been driven more than 32,000 miles.

At the start of this year, the car was worth nearly $12,700, according to data from Kelly Blue Book. Now its value has leapt to nearly $18,600 — an almost 50% increase, and more than half the price he originally paid for the vehicle which he bought new in 2017. It’s also more than four times the growth rate of Sharkey’s 401(k) over the same period of time.

“

‘Man, the No. 1 asset in my portfolio is a 2017 Hyundai Sonata Hybrid. What the heck is going on?’

”

Sharkey, 29, keeps close tabs on the value of his investments, tracking them each month on a Microsoft Excel

MSFT,

spreadsheet. “Over the last few months, I was like ‘Man, the No. 1. asset in my portfolio is a 2017 Hyundai Sonata Hybrid. What the heck is going on?” said Sharkey, who is based in McKinney, Texas.

“I’d probably sell this thing if it didn’t mean I’d just have to turn around and go buy another car,” Sharkey, who sells power tools to factories around the Dallas area, told MarketWatch.

In normal times, cars are all but guaranteed to depreciate the second you drive them out of a dealership lot. But as a result of global microchip shortages and heightened demand for used cars, prices have hit all-time highs.

The average used vehicle cost an all-time high of $26,457 this month, according to Edmunds.com, a site that tracks car prices.

Used vehicle price increases accounted for one-third of the large rise in inflation last month, according to the Labor Department. Prices shot up a record 10% in April and another 7.3% in May, as inflation spiked 5%, the biggest 12-month increase since 2008.

Adam Sharkey’s used 2017 Hyundai Sonata Hybrid has appreciated more than four times the rate of his 401(k).

Courtesy of Adam Sharkey

Some used cars are worth more than their original sticker price

Lorenzo Galindo, 26, was able to take advantage of the hot used-car market.

Galindo, who is also based in the Dallas Fort Worth area, bought a 2018 Honda Accord Sport with 33,000 miles for $21,000 in March. He liked how the car drove, but found it difficult to drive with his two dogs — a German Shepherd/Golden Retriever mix and a Dutch Shepherd mix, weighing around 70 pounds each.

He read several articles about the record increase in used-car prices, which prompted him to check if the used car he owned for roughly three months had also appreciated.

“

Lorenzo Galindo’s 2018 Honda Accord Sport was worth $4,500 more than he paid for it. He sold it, and paid off four credit-card bills.

”

To his surprise, it was worth around $4,500 more than he originally paid for it. At first, he thought it would be too much of a hassle to sell it, he told MarketWatch. But after consulting his parents and his girlfriend he decided to sell the car for $25,500 to Shift, a peer-to-peer online car marketplace.

“The consensus was to make a profit and move into something I’ll actually like,” Galindo said. He then used proceeds to pay off three of his four credit card bills for that month in order to lower his credit-card balance and apply for a loan for a new car at a lower interest rate. “Two birds one stone,” he said.

“

The third round of stimulus checks released by President Biden likely had a role in boosting the demand of used vehicles.

”

Now he’s driving a 2021 Mazda

7261,

CX-5 that he bought new for $37,000 including taxes and fees earlier this month. “It’s incredible how much used cars have appreciated,” said Pat Ryan, the CEO of CoPilot, an online car-shopping platform.

The third round of stimulus checks, which were distributed after President Biden signed a third stimulus package to law on March 11, likely had a role in boosting the demand of used vehicles, Ryan told MarketWatch.

“We were already seeing a pretty vibrant used-car market,” Ryan said. “Right around mid-March, things just spiked. I can’t say it was caused [by stimulus checks] but it was incredibly closely correlated with the timing of the stimulus checks.”

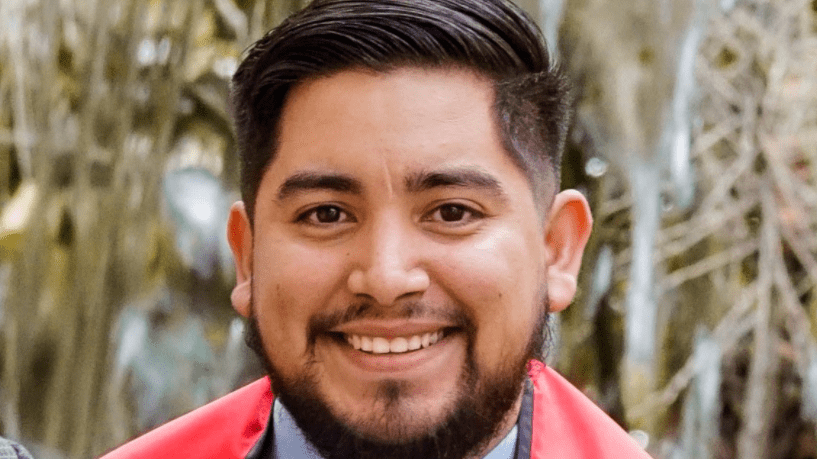

Lorenzo Galindo, pictured, made a $4,500 profit when he sold a used car he bought three months ago.

Courtesy of Lorenzo Galindo

Other ways to benefit from the hot used-car market

What is your used car worth? Check sites like Edmunds, Kelly Blue Book, CarMax

KMX,

and CoPilot to see what your vehicle is worth. You may find out your car is worth more than you thought.

Normally, you’re more likely to pocket more money from selling directly to a consumer as opposed to a dealership. However, there is much more time involved in coordinating a time to meet and find an interested buyer, said Ryan, who obviously has a vested interest in people using services like CoPilot.

Ryan paints a bleak picture of consumer-to-consumer deals. “You’ll probably do as well as you would selling it to a consumer” and you won’t have to deal with meeting a stranger at a 7-Eleven parking lot “wondering if they’re going to buy my car or they’re going to rob me.”

“

When selling a used car online be willing to negotiate, and remain patient when answering a prospective buyer’s questions

”

However, Kelley Blue Book has advice for people who are willing to sell directly to a buyer, including being willing to negotiate and being patient when answering a prospective buyer’s questions. “If you’re selling a run-of-the-mill, slightly beat-up 10-year-old commuter car, it’s tough to beat Craigslist. Listing is free, there are no fees after the sale and you can post lots of pictures,” according to the site.

“The drawback is that Craigslist searches are limited to a relatively narrow geographical area. Plus, Craigslist seems to be a magnet for scammers and crazies. Listing platforms like KBB.com and Autotrader.com spread word of the impending sale farther afield, and will most likely filter out scammers,” the company says.

“For more unique and higher-value cars and trucks, eBay and Bring-a-Trailer – with their auction-style listings, can be a good way to maximize your sale price,” it adds.

Car owners should also consider refinancing their auto loan, said Jon Salzberg, director of the auto division at Credit Karma. Given that the value of used cars has appreciated it creates a rare opportunity to potentially qualify for a better interest rate on a car loan.

Car loan interest rates are typically calculated based on the value of your car, which is expected to continue to depreciate, when you apply for the loan. But in many cases the opposite is happening now, so Salzberg says lenders may be able to offer you a better rate since your car may be worth more.

So was it worth it? If the used-car market wasn’t so hot, Galindo said, “it wouldn’t be worth my time to go through the car buying process and getting more inquiries on my credit.” But for a quick $4,500 profit, he added, it was a no-brainer.