This post was originally published on this site

You can throw Cathie Wood’s ARK Invest in the ring of companies hoping to eventually offer a bitcoin-back exchange-traded fund?

According to a regulatory filing on Monday, Wood’s has filed to launch the ARK 21Shares Bitcoin ETF, with the 21, perhaps, a tacit reference to the 21 million bitcoin

BTCUSD,

that will ever be produced of the world’s No. 1 crypto by creator Satoshi Nakamoto.

Wood’s prospectus is a part of a growing list of ETF providers and fund managers who are seeking to offer crypto in an ETF wrapper to the masses.

A spokeswoman for ARK Invest said that the company couldn’t comment on its plans.

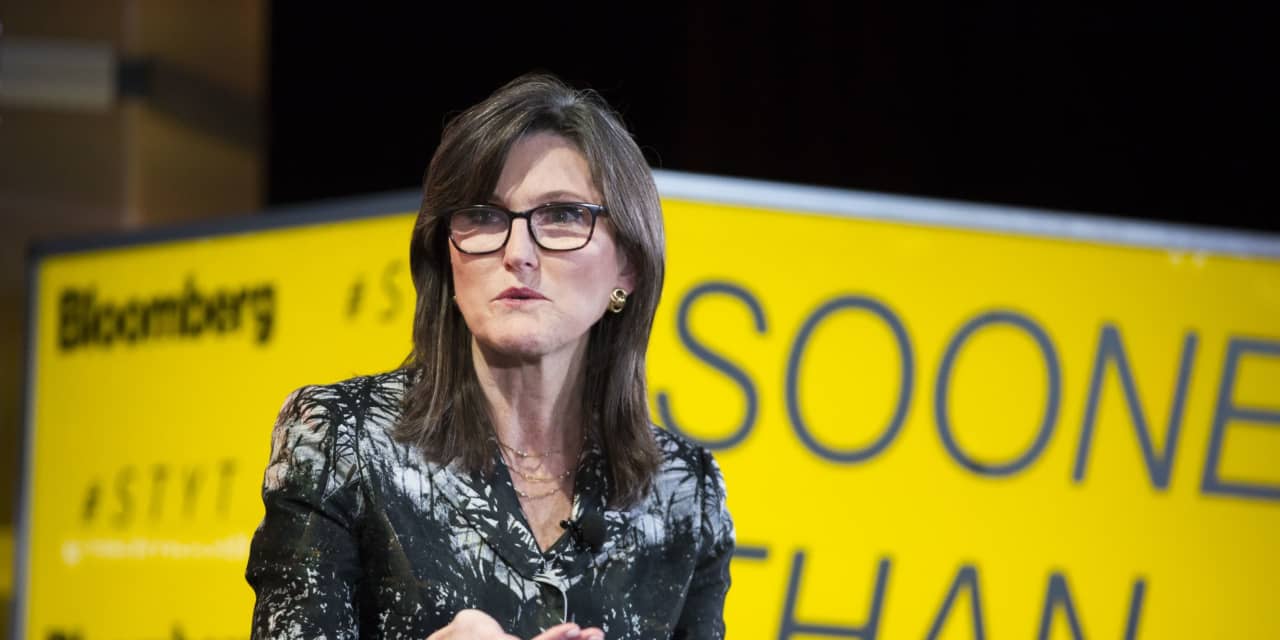

The ARK Investment Management CEO and prominent promoter of technologies that she perceives as disruptive, has estimated that bitcoin’s price, currently at around $34,000, down about 50% from its mid-April peak, could hit as much as $500,000 if all institutions were to assign a mid-single-digit allocation to the virtual asset, putting it on their balance sheets.

ARK Invest’s actively managed ETFs have been on the recovery after swooning in the spring, amid a rotation out of large-cap tech names. Barron’s reported that her fund has gained an average of 22% since May 13, with the flagship ARK Innovation

ARKK,

leading the chart, up over 30%.

A bitcoin ETF has been the holy grail of the crypto industry, but one that looks increasingly unlikely to be achieved this year under Gary Gensler, the newly minted commissioner of the Securities and Exchange Commission.

A bitcoin ETF is seen as offering wider accessibility to average investors seeking access to direct crypto exposures.

Wood’s ambitions to list a bitcoin ETF may pit her against Grayscale Bitcoin Trust

GBTC,

a closed-end fund holding bitcoin, which is considered one of the biggest crypto funds. There also have been plans afoot for Grayscale trust to eventually convert to an ETF from its current structure. However, it has not yet applied to do so.

Ark Invest has been a big investor in GBTC of late.