This post was originally published on this site

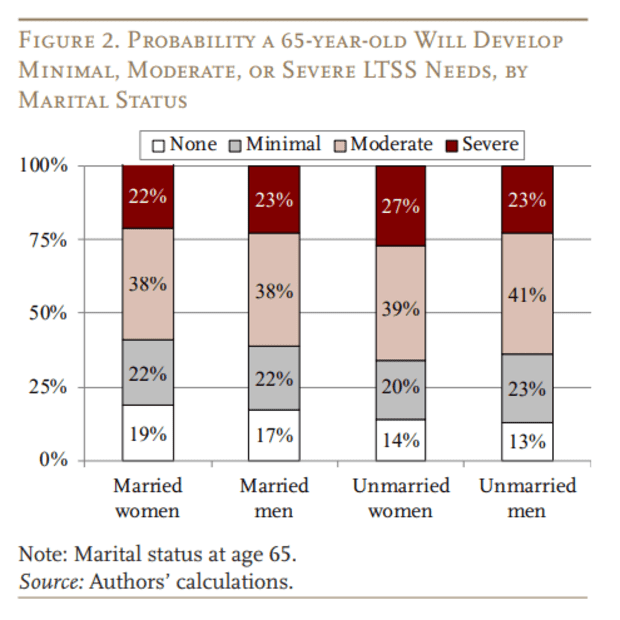

Only one-fifth of 65-year-old Americans won’t need long-term care services. Everyone else can expect to require some level of it — and about a quarter of these retirees will have “severe needs” for this assistance, a recent study found.

Long-term care assists individuals in “activities of daily living,” which include bathing and eating, and in some cases, grocery shopping and cooking. For some people, this care is administered at home, while others may have to go to a nursing home or assisted living facility.

About 38% of older Americans will experience “moderate needs” and 22% will have “minimal needs” for long-term care services, the Center for Retirement Research report found. The researchers sifted through two decades of data from the Health and Retirement Study, and took into account the intensity and duration of these long-term care needs.

See: What will long-term care cost you?

The requirements for long-term care services can differ by sociodemographic characteristics. For example, married couples may be less likely to need this care because they have one another to rely on for everyday assistance, compared to their single counterparts.

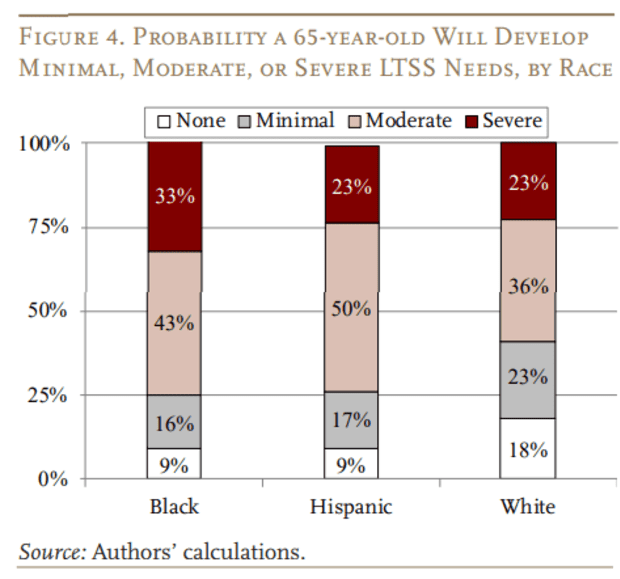

Race was also a factor in how much long-term care assistance an individual may need. A third of black 65-year-old Americans will have severe needs for long-term care services, compared to 23% of Hispanic and 23% of white individuals. Approximately 9% of black and 9% of Hispanic retirees will have no need for this care, compared to 18% of white Americans, the study found. This finding was surprising to researchers, considering Hispanics tend to live much longer than whites or blacks.

Also see: Traditional long-term care policies can still work

The lack of long-term-care planning can potentially erode an individual’s retirement assets. The average annual cost of long-term care in 2020 was between $93,000 and $106,000 for a nursing home, $55,000 for a home health aide and almost $52,000 for an assisted-living facility, according to a report from Genworth, which provides long-term care and life insurance.

Long-term-care insurance is one way to lower the expenses associated with these services, since Medicare and many other medical insurance policies do not have substantial coverage for these concerns. The premiums for these policies vary, however, based on age and gender, as well as medical history, and can be expensive. Individuals may want to weigh how much coverage they need, and if it is worth the premium if they eventually never need these services in the future. Here’s more about this type of insurance and how to plan for it.

Families may also want to discuss how loved ones will handle long-term care needs, and if anyone will take on the role of caregiver. “The big question is whether those who need help will have the resources available either in terms of family or friends to receive informal support or sufficient finances to pay for formal support,” the researchers noted.

Read: Young people should start planning for this depressing eventuality now