This post was originally published on this site

Founded by lumber tycoon William Boeing in Seattle in 1916, Boeing has grown to become one of two major plane manufacturers in the world, and a major U.S. defense contractor.

It has hit plenty of turbulence along the way. But few jolts were as rough as the double whammy that laid the aerospace giant low in the past two years. Boeing Co.’s

BA,

sales simply got crushed by the 2020 Covid-19 pandemic and the 2019 grounding of one of its most promising lines of planes, the 737 MAX, following tragic crashes.

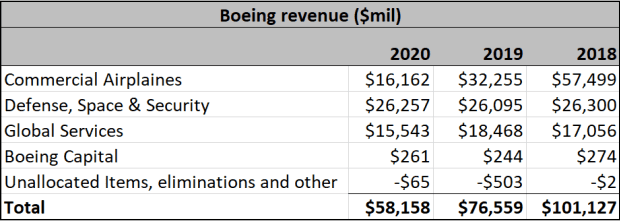

Here you can see what happened to sales in its main business segment.

Company filings

The sharp 72% decline in sales of commercial planes last year, compared with 2018, was offset to some degree by fairly stable sales in the defense and space segment. This division sells military aircraft, weapons systems, satellites and spy tools. Services—which provides aftermarket maintenance and spare parts for aircraft—also offered some stability. Boeing also alarmed investors by taking down billions in debt to make it through. (More on this problem in a second.)

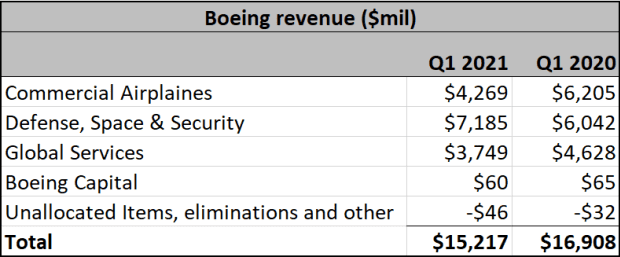

The negative sales trends continued in the first quarter.

Company filings

All of this looks bad.

But here’s the key for investors: Sales (and the stock) fell sharply in the past two years because of reversible problems. At these levels, the stock looks cheap relative to its potential and its history, says Tony Bancroft, an analyst at the value shop Gabelli Funds.

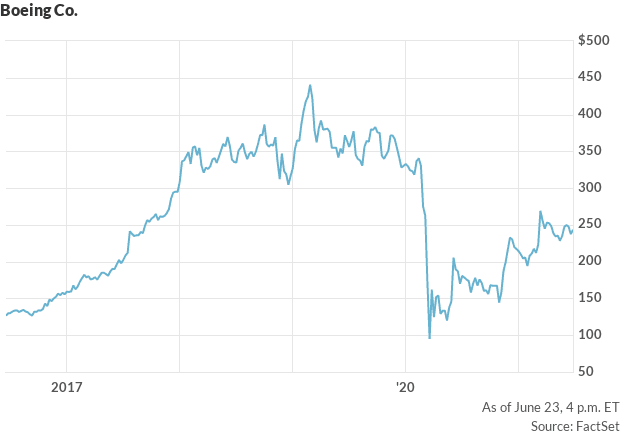

I concur—which is why I suggested Boeing in my stock letter Brush Up on Stocks (link in bio below) at $180 in August 2020 and reiterated it in late September at $165. I also continue to own it. Boeing’s stock still trades 47% below its pre-pandemic high of around $449. Here’s why it’s going back up there.

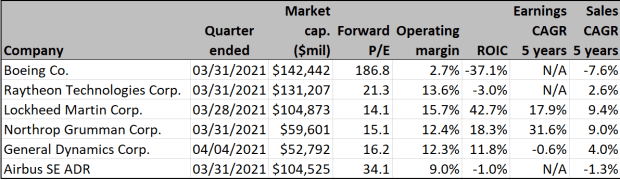

Here you can see that Boeing has the most room to improve compared with competitors. The sky-high price-to-earnings ratio is a reflection of how suppressed earnings are, but this will only be temporary.

FactSet

A break in the turbulence

During the past seven months, the outlook for Boeing has improved remarkably — reflected in the 62% move in the stock price from $150 to $244. The S&P 500

SPX,

and Dow Jones Industrial Average

DJIA,

are up only around 27% over the same period. Here are the two main developments behind the move, and why these issues will continue to unwind and push the stock higher.

1. COVID-19

The pandemic took a big toll on Boeing’s main customers, the airlines. But did you know this? Last year, the downturn wiped out all airline earnings generated by the group since WWII, according to Jefferies analyst Sheila Kahyaoglu. That’s bad news for Boeing.

But domestic leisure travel has come back with a vengeance, as the U.S., China, Russia and parts of Europe have recovered. There’s more to go, as more people get confident about being in planes. Business travel is picking up, too. By 2023, global passenger traffic will surpass pre-Covid-19 levels, predicts the International Air Transport Association (IATA) driven by economic strength, more coronavirus vaccinations, and pent-up demand.

Related: Americans are still hesitant about getting on a plane

The air-travel revival will have an immediate effect on sales of narrow-body planes used for shorter hops, such as Boeing’s 737 MAX. Sales of wide-bodies—for long haul trips—are unlikely to recover until a COVID-19 vaccine is more widely distributed globally, says Morningstar analyst Burkett Huey. The lift for sales of Boeing’s 787 Dreamliner for the long-haul market may take longer, though sales are already picking up. Baird analyst Peter Arment predicts international travel won’t really snap back until 2023.

Breaking news: Orders for new aircraft, other durable goods bounce higher in May

MAX problems

Tragically, two fatal accidents grounded the 737 MAX in March 2019. Deliveries of the plane resumed in the fourth quarter after the Federal Aviation Administration (FAA) agreed to let it fly again. By now, more than 165 countries have approved the resumption of 737 MAX flights.

This means sales are snapping back. Last week Ryanair Holdings PLC

RYAAY,

received its first MAX out of the 210 it plans to buy. Boeing is also filling orders from Southwest Airlines Co.

LUV,

United Airlines Holdings Inc.

UAL,

Alaska Air Group Inc.

ALK,

and Dubai Aerospace Enterprise, among others. As of the end of May, the company delivered almost 100 737 MAX planes. The company says about half of the 400 or so 737 MAX in inventory will be delivered by the end of 2021, and most of the rest by the end of 2022.

The final big hurdle for Boeing is recertification of the MAX in China, which is back at pre-pandemic air travel levels. “There is a very large backlog for MAX orders from Chinese airlines,” says Jefferies analyst Kahyaoglu. “More MAX were delivered to China before the grounding than any other country.”

China approval of the MAX will likely happen in the second half of the year. It is not yet priced-in, because of ongoing uncertainties about the U.S.-China relationship. China knows it holds a strong card to play here. So, there’s a chance approval could drag out. “This is important for the whole U.S. aerospace industry, so it is a powerful card for China,” says J.P. Morgan analyst Seth Seifman.

“I’m confident it will happen,” says Boeing CEO Dave Calhoun.

Going forward, Boeing will benefit from the same two megatrends that helped it before the pandemic. The first is the growth of low-cost carriers. Greater competition following airline sector deregulation boosts aircraft demand. Next, Boeing gets a lift from the emerging middle class in the developing world. When people earn discretionary income, one of the first things they love to do is travel.

Cash, debt and cash flow

Boeing took on $25 billion in debt last year to make it through its twin crises, following a 2019 borrowing spree. It had $63.5 billion in debt at end of 2020, compared with $27.3 billion at end of 2019. These debt levels—and debt-rating downgrades—have investors worried. So, a continued pickup in sales is crucial. Fortunately, that will likely play out—and boost cash flow.

“We expect the first quarter was the most challenging quarter from a cash perspective, and we expect the trend to improve for the remainder of the year as we ramp up 787 and 737 deliveries,” Boeing CFO Greg Smith said in the first quarter conference call in late April.

Baird analyst Arment expects negative free cash flow of $8.4 billion this year, and a return to positive cash flow of $4.5 billion in 2022, and $11.8 billion in 2023. He expects over $20 billion in debt paydowns during 2022-2024. The 737 accounted for 40% of Boeing’s free cash flow pre-pandemic, so sales trends for this plane are key.

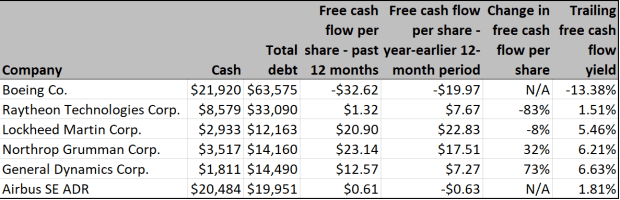

Here is a summary of Boeing debt levels and cash flow, again showing how much room there is for improvement—which will play out as sales trends continue to improve.

FactSet

Backlogs

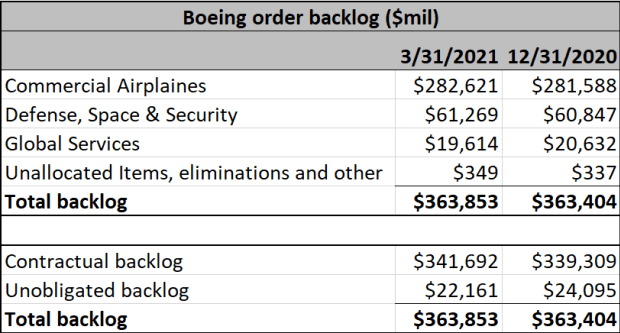

One factor that reduces uncertainty for Boeing investors is the large backlog of orders.

Company filings

“Boeing has been through two huge crises, and it still has firm back-orders,” says Bancroft at Gabelli Funds. “Customers haven’t left because they know the sector will recover even if it might take a while for business and long-distance travel.” Customers are also reluctant to renege on orders because of large down payments. And since there are only two major suppliers—Boeing and Airbus SE

EADSY,

—airlines aren’t keen on ruining relations with one. Boeing’s backlog will soon begin to grow as orders pick up and cancellations decline, predicts Goldman Sachs analyst Noah Poponak, who has a buy rating and $307 price target on the stock.

Moat

Investors such as Warren Buffett look for moats around businesses because they protect sales and pricing power. Boeing has a large moat for several reasons, says Morningstar’s Huey. First, it is tough to break into aircraft manufacturing because it is so expensive, and lead times from design to production are so long. Next, aircraft companies are heavily regulated, and it’s hard to learn how to navigate these waters. Boeing has 1,500 people working on regulatory matters, says Huey. Customers get locked-in because of the need for aftermarket parts and services.

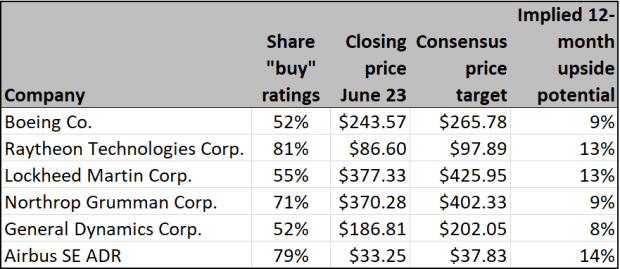

Wall Street’s Opinion

FactSet

Risks

A big risk is that U.S.-China trade relations worsen. This would delay recertification of the 737 MAX in China. Next, given China’s “Made in China 2025” strategy, the country may decide to rely on narrow-body jets made by its own aircraft manufacturer, Comac. Coronavirus variants could develop and cause another lockdown. An economic downturn could happen for other reasons. A strengthening of the dollar

BUXX,

could hurt sales since about half of Boeing’s backlog comes from abroad.

Important dates

- July 27—Second-quarter earnings.

- Oct. 26—Third-quarter earnings.

Michael Brush is a columnist for MarketWatch. At the time of publication, he owned BA. Brush has suggested BA, LUV, UAL and JPM in his stock newsletter, Brush Up on Stocks. Follow him on Twitter @mbrushstocks

Don’t miss: 5 smart ways to shift your investments as the Fed gets ready for a big move