This post was originally published on this site

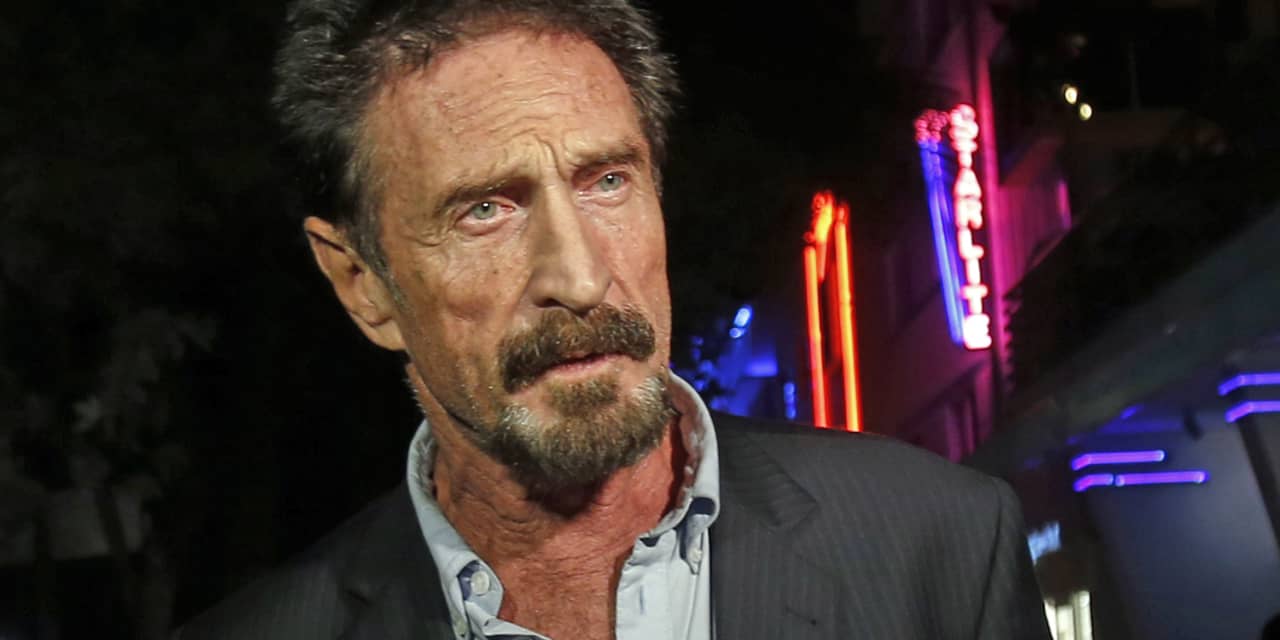

The fantastical story of antivirus-software entrepreneur John McAfee in his later years should be a cautionary tale to other genius CEOs, especially Elon Musk.

McAfee, who was found dead in his jail cell in Barcelona on Wednesday, was going to be extradited to the U.S. to be tried for financial crimes, including tax evasion and a cryptocurrency pump-and-dump scheme. In March, federal prosecutors alleged in a complaint that McAfee and one of his advisers, Jimmy Galen Watson, engaged in a scheme of fraudulent promotion on social-media platforms to investors of cryptocurrencies, including dogecoin.

“The defendants allegedly used McAfee’s Twitter account to publish messages to hundreds of thousands of his Twitter followers touting various cryptocurrencies through false and misleading statements to conceal their true, self-interested motives,” said Audrey Strauss, the U.S. attorney for the Southern District of New York, in a statement in March.

According to Strauss, McAfee, Watson and other members of McAfee’s cryptocurrency team “allegedly raked in more than $13 million from investors they victimized with their fraudulent schemes. Investors should be wary of social-media endorsements of investment opportunities.”

Sound a bit familiar, Elon Musk? The chief executive of Tesla Inc.

TSLA,

has been an avid supporter and promoter of cryptocurrency, adding more fuel to the hype and moving crypto markets with his tweets. In March, he tweeted that Tesla would begin to accept cryptocurrency for its electric vehicles, a month after Tesla acquired $1.5 billion of bitcoin

BTCUSD,

He then reversed that decision in May, because of his sudden concern about the amount of energy used by high-performance computers in bitcoin mining.

Earlier this month, Musk was accused of a pump-and-dump scheme by the CEO of South African financial services company Sygnia. Magda Wierzycka claimed Musk helped pump up bitcoin’s price through his tweets and Tesla profited by selling at a high point. Musk denied the allegations and said her comments were inaccurate, claiming Tesla only sold around 10% of its holdings to demonstrate that bitcoin could be liquidated easily without moving the market.

Even so, Musk’s actions on Twitter have raised concerns in the past with the Securities and Exchange Commission, which settled an enforcement action with Tesla in 2018 over his tweets. Recent correspondence obtained by the Wall Street Journal between Tesla and the SEC indicated that regulators told the company it had failed to enforce the order requiring his tweets to be pre-approved. It appears that the company and its board have taken a hands-off approach to Musk’s tweets and his comments on crypto. Musk even appeared on “Saturday Night Live” and did a sketch in which he joked that dogecoin was “a hustle.”

McAfee was a unique individual, and at times bizarre. As MarketWatch’s Jon Swartz noted, after interviewing him several times, McAfee was at times both “charismatic and destructive.” Musk has both of those characteristics as well. While he may not have all of the bizarre qualities of McAfee, Musk would do well to take note of McAfee as a cautionary tale.