President Joe Biden’s budget deficits threaten to ignite the kind of inflation that followed the Vietnam War and Great Society, and Federal Reserve Chairman Jerome Powell appears content to enable him.

The president inherited most pieces for a robust recovery.

The $4 trillion in COVID relief enacted through December closed the gap between aggregate demand and potential GDP in February to $380 billion. Ignoring warnings about the potential to overheat the economy, the March American Rescue Plan sent state governments, small businesses, the unemployed and others $1.9 trillion in additional stimulus—five times the output gap.

Demand outstripping supply

Americans are now spending more than global factories can provide, bottlenecks abound on everything from copper to computer chips and potato chips—and prices are jumping.

See MarketWatch’s complete coverage of inflation.

Powell has been telling us that inflation expectations in financial markets are not building but that only indicates he’s persuaded bond buyers, not business leaders or consumers, who are bidding up prices for homes and everyday items.

Components associated with the reopening of the economy—for example, car rentals, lodging, airfares and restaurants—accounted for about half of the recent jump in the consumer price index. But during the Great Inflation of the 1970s, Fed Chairman Arthur Burns discounted jumps in a succession of items as temporary or one-offs until finally, it was conceded high inflation was a permanent feature of the landscape.

Suppose Biden stuck $100 vouchers—printed by Powell—for takeout food under the windshield wipers of every car parked in Ocean City, Md., every week during the summer season. Do you suppose the prices for hamburgers and pizza at the seaside resort would rocket?

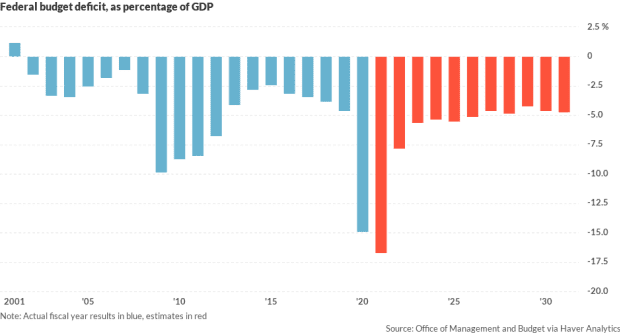

Federal deficits are projected by the Biden administration to decline slowly and to remain near 5% of gross domestic product for the rest of the decade.

Now Biden would like to add to aggregate demand with his $6 trillion 2022 budget, and Powell is supporting him by keeping interest rates at depression levels and printing money to purchase about $1.4 trillion in government and mortgage-backed securities this year.

Is it any wonder that prices for homes are jumping out of sight and beyond the reach of many first-time buyers and especially working-class Americans, minorities and single mothers?

Fed miscalculations

Biden is proposing the biggest budget outlays since World War II even though the U.S. economy by this summer will have made up all the lost growth imposed by the COVID recession.

We have had two significant bouts with high inflation since World War II. The jolt caused by the Korean War proved temporary as budget restraint resumed with the end of the conflict. The Great Inflation was ignited by the combination of the Vietnam War and Great Society spending during the Johnson administration and accelerated by the oil crises of the 1970s.

During those years, Fed Chairmen Burns and William Miller made policy that was grounded in overestimates of potential GDP and employment and the output gap. At his most recent press conference, Powell’s expression of optimism about the future elasticity of labor supply may reflect a similar miscalculation.

Also, Burns was skeptical about the potency of monetary policy to curb inflation and inflation gradually ratcheted to double digits from 1979 to 1981.

Even with millions of workers still displaced by COVID, the economy is again bumping up against capacity limits and skilled labor shortages. Meanwhile, changes in what Americans buy, how they shop and hybrid work patterns have made many jobs in service activities and much commercial real estate in big cities obsolete.

Now Biden is proposing a federal budget with deficits exceeding $1.3 trillion a year indefinitely. A responsible budget would instead more narrowly focus on shoring up infrastructure, boosting technology industries, and training workers permanently displaced by COVID.

To meet the shortage of workers with digital skills, Levi Strauss

LEVI,

is retraining retail employees with an intensive two-month program in statistics, coding, neural networks and other machine-learning techniques. Biden should leverage such private-sector efforts with support and relocation assistance for workers displaced by the pandemic.

Powell should stop enabling reckless federal spending by ending rock-bottom interest rates

FF00,

and phasing-out the monetization of new federal debt with purchases of Treasuries

TMUBMUSD10Y,

and mortgage-backed securities. But that would put Powell out of step with the Treasury secretary and White House economic advisers who likely hold the strings on whether Biden nominates him for a second term.

We need better economics at the Fed but most of all we need more backbone—not a lawyer arguing the president’s case for big deficits.

Peter Morici is an economist and emeritus business professor at the University of Maryland, and a national columnist.

More on inflation:

Robert Powell: Do retirees need to be worried about inflation?

Rex Nutting: Here’s why higher prices for car rentals, airfares and blouses won’t lead to higher inflation

Stephen Roach: The ghost of Arthur Burns haunts a complacent Federal Reserve that’s pouring fuel on the fires of inflation

Joseph Stiglitz: The fear of inflation is a red herring designed to distract us from the need for policies to reduce inequality

James K. Galbraith: Here’s why fears of surging inflation are off-base