This post was originally published on this site

Oil prices have been topping $70 a barrel lately, climbing almost 50% on the year, as more of the global economy emerges from pandemic lockdowns and gets back into the swing of things.

But the midyear gains also shouldn’t come as a complete shock, given the past outperformance of crude versus stocks and other financial assets, when the cost of living has climbed.

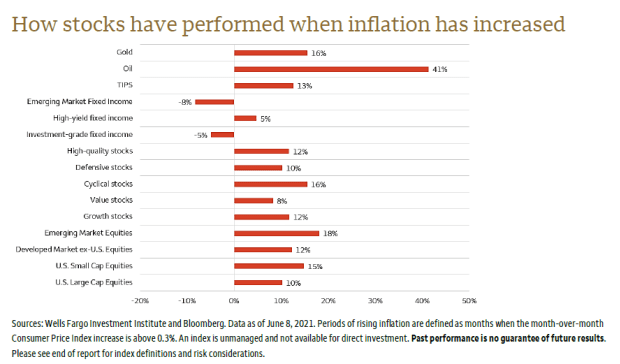

“Our research shows that investments associated with tangible assets may be an option for investors concerned with higher inflation,” wrote Wells Fargo Investment Institute’s Chao Ma, a global portfolio strategist, in a Tuesday note.

The following chart shows Ma’s findings, namely, that when inflation rises, oil prices outperformed with a 41% gain, following by emerging market equities at 18%, while gold

GC00,

and cyclical stocks both climbed 16%

What’s climbed the most with inflation? Oil.

Wells Fargo Investment

To compile the tally, Ma tracked asset prices in periods when the Consumer Price Index advanced by more than 0.3% on a monthly basis, over roughly the past two decades. The two sectors that produced negative prices during inflationary periods were emerging markets fixed-income and investment-grade fixed income.

To be sure, financial markets have been on a tear over the past 15 months, helped by trillions of dollars worth of pandemic fiscal and monetary stimulus rippling through the U.S. economy. A key question will be: how much higher can assets climb?

Equities as a group generated “impressive returns” over fixed income during past periods of rising prices, enough to outpace the impact of inflation, according to Ma, who called past stretches of economic expansion and rising interest rates “a backdrop a lot like we see now.”

One notable exception in the past was Treasury Inflation-Protected Securities, Ma wrote. The iShares TIPS Bond ETF

TIP,

which tracks inflation-linked Treasury notes at least a year out in maturity, was up 0.4% Tuesday, but down 0.2% on the year.

Investors recently have been grappling with how best to position for inflation, whether lasting or temporary, as well as the eventual pullback of extremely accommodative monetary policy during the pandemic.

A more hawkish Federal Reserve policy update last week led to gyrations in the dollar

DXY,

the U.S. Treasury market

TMUBMUSD10Y,

stocks and other financial assets. Following the sharp retreat in stocks last week, on Tuesday stock indexes, including the Dow

DJIA,

S&P 500

SPX,

and Nasdaq Composite

COMP,

were pushing higher for a second day.

Global benchmark Brent crude

BRN00,

futures also briefly topped $75 a barrel Tuesday for the first time in more than two years, while the U.S. benchmark West Texas Intermediate crude

CL00,

was trading near $72 a barrel.

Brent crude could hit $80 a barrel in the third quarter of this year, according to a new forecast from BNP Paribas, which expects prices to fade to $70 by the end of 2022. For WTI, the bank calls for a peak price of $77.5 a barrel over the same stretch, before a retreat to $67.

“Overall, we favor equities in the current environment of economic expansion and rising inflation,” Ma wrote, adding that the Wells preference is for cyclical equities sectors, including financials, industrials, materials, communication services and energy, but also small-cap U.S. equities

RUT,

and emerging market stocks.

See: Inflation scare? The stocks that perform best—and worst—when prices rise