This post was originally published on this site

Another big update from interest rate-setters at the Federal Open Market Committee is due Wednesday afternoon and investors shouldn’t be faulted for bracing for a bearish reaction to the June Fed policy statement which has market participants on edge watching for a word on tapering asset purchases and inflation.

But Federal Reserve Chairman Jerome Powell’s record with the stock market isn’t a stellar one. To be sure, that’s probably not high on the central banker’s priority list today — maximum employment and price stability are the Fed’s dual mandates —but investors may be preparing for a bit of choppiness in stocks nonetheless.

So far Wednesday, the Dow Jones Industrial Average

DJIA,

the S&P 500 index

SPX,

and the Nasdaq Composite Index

COMP,

have been idling ahead of the policy update due to be released at 2 p..m. Eastern Time, followed by Powell’s news conference at 2:30 p.m.

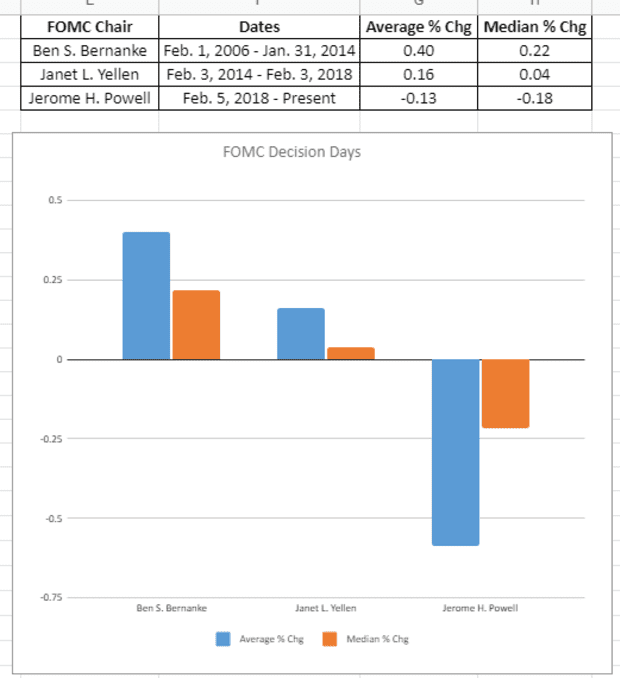

However, the S&P 500 has declined on average more times than not during Powell’s chairmanship of the Fed, compared with those led by Janet Yellen, now U.S. Treasury Secretary, and former chairman Ben Bernanke.

The average decline of the S&P500 index for Powell on Fed decision or update days is a loss of 0.13%, and the median is 0.18%. By comparison, Yelllen presided over an average gain of 0.16% and Bernanke oversaw average rise of 0.40% on Fed days, according to Dow Jones Market Data.

Dow Jones Market Data

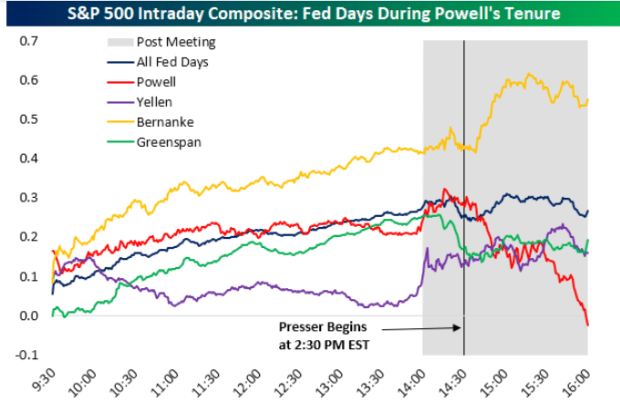

Data from Bespoke Investment Group offers a slightly broader look at Powell’s comparative stock-market performance, including a comparison with Alan Greenspan, who led the Fed from 1987 to 2006.

Bespoke Investment Group

As previously mentioned, Powell isn’t likely to be focused on his stock-market performance as much as the investors are in the short term.

This meeting, even though major adjustments to policy or benchmark interest rates, which stand at 0% to 0.25%, aren’t expected, could prove a challenging one for Powell.

The potential for pitfalls appear numerous. Not all investors are sold on the Fed’s consensus view that inflation will be transitory, caused by the demand and supply shocks as the economy recovers from the pandemic. And any attempt by Powell to point to a time when the Fed may scale back some of its easy money policies, notably its monthly purchase of $120 billion in Treasurys and mortgage-backed bonds, without causing a disruption in the bond or stock markets, or both, may also be a challenge.

In 2013, Bernanke told lawmakers that the central bank could begin to pare back the bond purchases implemented in the 2007-09 recession if the economy continued to improve and the market’s didn’t react well.

Read: Taper tantrum? Only if somebody wakes the U.S. bond market

Analysts say that this time the Fed is likely to give ample lead time in making such declarations in order to avoid a so-called taper tantrum.

Treasury traders hate inflation because it means that coupon payments and principal in the future aren’t worth as much in a rising price environment. Evidence of pricing pressures tends to drive selling in bonds, as a result.

However, bonds have been fairly sanguine about evidence of hotter inflation, so far.

Yields for the 10-year Treasury

TMUBMUSD10Y,

and the 30-year

TMUBMUSD30Y,

are lower than they were at the Fed’s April 28 policy update.

Meanwhile, bulls can at least take heart in the fact that equity indexes are trading near record highs, even if Powell’s statment delivers a characteristic stumble lower.