This post was originally published on this site

I don’t know when what I call the Blow-Off Top of the Bubble-Blowing Bull Market will end.

After 12 years being long and strong and having diamond hands without even knowing that term existed, maybe I’m wrong to turn more cautious.

Maybe the economy will reopen and rejuvenate the country in such a strong manner that corporate earnings in 2022 and 2023 will make today’s prices seem like bargains.

But I simply don’t think that’s the most likely outcome.

And if I’m right that we’re in the throes of the Blow-Off Top of the Bubble-Blowing Bull Market, I do not want to be overly long and on the wrong side of the great unwind when it does start.

I’m not calling for a near-term crash. I am saying that it’s likely going to be hard for the bulls to make as much money this year as they did last year.

Trading and investing are tough. There’s always someone on the other side of every trade you make. Always think about who that is and why they are willing to take the other side of your transaction. When you buy, why are they selling it to you at that price? When you sell, who is buying it from you and what are their motivations? Remember, I’ve talked before about how good analysis starts with empathy.

If I’m selling, who’s buying — and why?

So let’s answer this question right now. Who is buying stocks and cryptos from me when I’ve trimmed and sold for the past month or so? Sure, there are banks and institutions and hedge funds and family offices investing and trading, just as always. On the other hand, remember two years ago when I got back from a hedge fund investment conference in Abu Dhabi and everybody was desperate for returns:

Amid low interest rates and other investors’ focus on options, credit and currencies, “the lack of focus on traditional stocks and funds that invest in publicly traded stocks makes me think that there is probably more opportunity in such assets than people realize. I certainly see some very compelling long ideas in Revolutionary companies like WORK and TWTR and TSLA.”

Since that post, back a year and a half ago, Slack

WORK,

went from $21 to being bought out at $45, Twitter

TWTR,

went from $27 to $61, and Tesla

TSLA,

went from $81 to $616. And funds that were looking everywhere but in the stock market for big gains are … well, pretty much in the markets now and long a bunch of stocks and even long a few cryptos.

And now that those stocks and cryptos and most other assets have gone parabolic in the past year — coming on top of the 10-year bull market — the billion-dollar fund managers are joined by 23-year-old TikTok influencers doing bitcoin

BTCUSD,

trading astrology.

Yes, for real, and she’s very popular. She’s even been right about some of bitcoin’s action in the past few months! If you’re selling cryptos and fintech stocks right now, you’re selling to her and her followers. And also to my friend’s son, who just graduated from a tiny, rural school and whose unemployed uncle gave him $500 to “buy some cryptos. And make sure you get some fintech. I don’t know the symbol, but just look it up and you’ll do fine over the long run.” Bearish anecdotes everywhere I look, as I wrote recently.

Mr. Market

The other thing to remember about who’s on the other side of your trade is always to remember that there are smart, cutthroat traders and investors who went to the best schools and have access to more research and real-time data and instant trading access to all kinds of derivatives to layer into their bets. And the only thing they do all day, every day, is figure out how to take your money in mostly legal ways. They’re not playing around. They have no sympathy for you, even if they might empathize with you to better understand your motivations to better take your money.

Mr. Market is mean. He’s not nice. He can be cruel. He can force liquidations that create other liquidations. He can shut off access to capital. He can take down 200-year-old banks in a day. In one day.

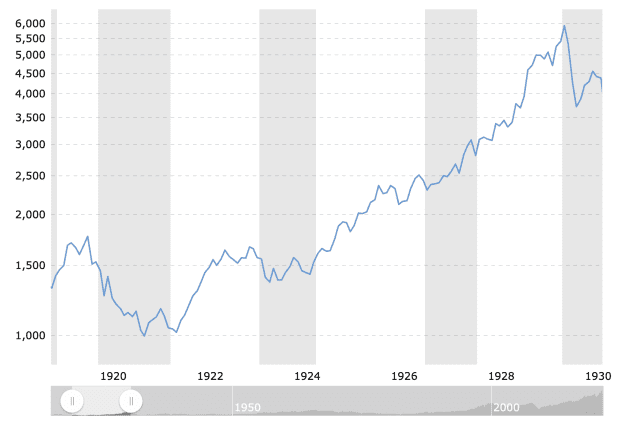

Sometimes the markets lead the economy and not the other way around. Ironically, when we were young, we were taught that the Great Depression started when the stock market crashed on Black Friday in 1929. But then when we get older, we were taught that it wasn’t actually the crash that created the Great Depression, rather the economy was already crashing and the stock market just didn’t realize it as it continued on its merry way toward a terrible Blow-Off Top of a nine-year Bubble-Blowing Bull Market that culminated with the Dow Jones Industrial Average

DJIA,

up 400% from the 1921 lows to the 1929 highs.

Learning from Soros

But looking back, it’s clear that both theories are equally right and wrong — the market crashed because the economy wasn’t as good as the market thought it was, and the economy crashed because the markets shut down access to capital for investment and growth.

It was “reflexive,” to borrow a term from the great hedge fund manager George Soros.

He wrote, and the concept is important to understand:

“I continued to consider myself a failed philosopher. All this changed as a result of the financial crisis of 2008. My conceptual framework enabled me both to anticipate the crisis and to deal with it when it finally struck…

“I can state the core idea in two relatively simple propositions. One is that in situations that have thinking participants, the participants’ view of the world is always partial and distorted. That is the principle of fallibility. The other is that these distorted views can influence the situation to which they relate because false views lead to inappropriate actions. That is the principle of reflexivity…

“Recognizing reflexivity has been sacrificed to the vain pursuit of certainty in human affairs, most notably in economics, and yet, uncertainty is the key feature of human affairs. Economic theory is built on the concept of equilibrium, and that concept is in direct contradiction with the concept of reflexivity…

“A positive feedback process is self-reinforcing. It cannot go on forever because eventually the participants’ views would become so far removed from objective reality that the participants would have to recognize them as unrealistic. Nor can the iterative process occur without any change in the actual state of affairs, because it is in the nature of positive feedback that it reinforces whatever tendency prevails in the real world. Instead of equilibrium, we are faced with a dynamic disequilibrium or what may be described as far-from-equilibrium conditions. Usually in far-from-equilibrium situations the divergence between perceptions and reality leads to a climax which sets in motion a positive feedback process in the opposite direction. Such initially self-reinforcing but eventually self-defeating boom-bust processes or bubbles are characteristic of financial markets, but they can also be found in other spheres. There, I call them fertile fallacies—interpretations of reality that are distorted, yet produce results which reinforce the distortion.”

Stay flexible

Far-from-equilibrium conditions was what we had in 2010-2013 when we loaded up on Revolutionary stocks and started buying cryptos like bitcoin. Far-from-equilibrium conditions might be what we have in front of us right now when I suggest getting cautious instead.

We don’t want to be permabulls. (You for sure don’t want to be a permabear!) We have to be flexible. We have to let our analysis and risk/reward scenarios dictate how much risk we’re taking and when. We have to pay attention to the cycles, the self-reinforcing cycles that drive economies and markets and valuations and earnings and societal interactions and bailouts and financial crises and bubbles and busts and, heaven forbid, just simple stagnation.

It’s as if everybody forgets that markets can bubble and crash and stagnate. They forget that markets can grind for years on end without making new highs, or without even making higher highs. Do you not remember telling your money manager sometime in 2010-2012 that “If I’d just handled the Great Financial Crisis (and/or the Dot-Com Crash) a little better, I’d be in better shape.” I used to hear people say that to me all the time. I haven’t heard anybody say that lately. Everybody’s having fun in this market … at least for now.

Most traders will tell you that they are “just trading the market that is in front of them.” Well, I don’t know when the bubble will pop, but I do know that I don’t want to be on the wrong side of this market when it does. And I do know that we won’t know the bubble has really popped until the self-reinforcing reflexive feedback loop has made it painful for the vast majority of people who are right now feeling wealthy, feeling secure, feeling like they’ve got this trading and investing thing all figured out.

We are all fallible. Be careful while it’s fun. Be bold when it’s painful. That’s how I’ve done it for the last 25 years. We were boldly buying these assets when it was painful for others. I’m careful right now because everybody else is having fun.

I spend a lot of time looking for new ideas and I won’t let my overall market outlook deter me from buying a new name or two. But I want to remain overall cautious and less aggressive than I have been for most of the last decade.

As a matter of fact, I might have at least a couple Trade Alerts that I’ll be sending out this week, one long and one short idea. Being flexible, see?

Cody Willard is a columnist for MarketWatch and editor of the Revolution Investing newsletter. Willard or his investment firm may own, or plan to own, securities mentioned in this column.