This post was originally published on this site

A survey of fund managers found nearly three-quarters think the current spike in consumer prices will calm down.

As the Federal Reserve embarks on a two-day meeting to set monetary policy, the monthly survey of global fund managers by Bank of America found 72% believed inflation to be transitory.

U.S. consumer prices shot up by 5% in the 12 months ending May, with the core consumer-price index rising by the fastest in 29 years. Chair Jerome Powell and his colleagues at the Fed say these inflation readings will only be high temporarily.

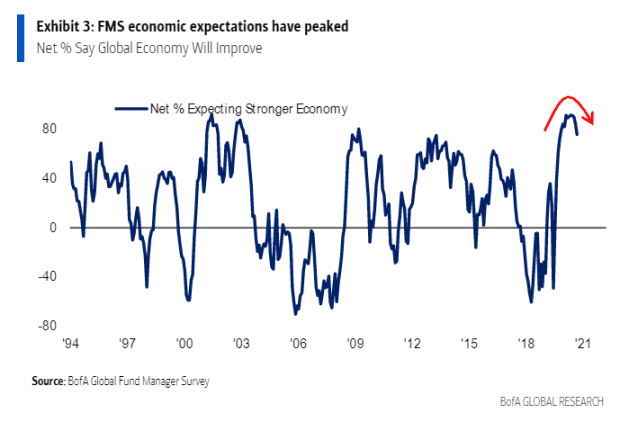

Fund managers were still bullish on the global economy, though less so, with a net 75% saying they expect the global economy to improve, which is down 9 percentage points from the April survey. Since 1994, the prior peak optimism readings were followed by a 75-point drop in the 10-year Treasury yield.

Inflation expectations also fell, with a net 64% expecting higher inflation in the next 12 months, down 19 points from April.

By 48% to 34%, investors said the economy was in the middle of the cycle rather than the start of it.

Investors were overwhelmingly positioned for higher yields, with commodities, materials and banks leading the way. The allocation to bonds was at a three-year low.

Bank of America said it surveyed 224 panelists managing $667 billion in assets.

The S&P 500

SPX,

ended Monday at its 29th record high of the year, with a 13% gain in 2021.

The yield on the 10-year Treasury

TMUBMUSD10Y,

settled just below 1.50%.