This post was originally published on this site

Investors should stay underweight bonds as inflation and value trades should continue to benefit from the economic reopening, according to JPMorgan Chase & Co.’s strategists.

The recommendation comes after a recent decline in bond yields prompted questions from JPMorgan

JPM,

clients on its strategists’ conviction surrounding the “pro-cyclical trade,” the bank’s global markets strategy report Monday said. “In other words: ‘do bonds know something about macro fundamentals that equities and commodities don’t?’”

“No,” the strategists said in the report. “We advise clients to stay in reflation, reopening, inflation and value trades that we expect to be boosted by a summer reopening of the global economy.”

With the pace of inflation picking up, investors are watching for economic and rate-hike forecasts to emerge from the Federal Reserve’s two-day policy meeting this week. Fears that rising inflation in a strengthening economy may result in higher interest rates have spurred a rotation away from growth stocks in 2021, with many equities investors favoring value and cyclical bets instead.

Meanwhile, the decline in 10-year Treasury yields this month has left some investors perplexed, particularly after the U.S. government released data last week showing the pace of inflation soared to a 13-year high of 5%. Yields on bonds fall when their prices rally.

“Do not read too much into this month’s bond rally,” the JPMorgan strategists said. “The decline in bond yields since the start of the month is not due to markets seeing receding inflation.”

Technical drivers are likely behind the recent rally in bond prices, as opposed to fundamental beliefs about value, according to the JPMorgan report. For example, “volatility-sensitive investors” may have adjusted their positions due to a decline in rate volatility, while some money managers “may be reluctant to keep short duration exposure” into the Federal Open Market Committee’s two-day, rate-setting meeting commencing Tuesday.

Bond investors worry about inflation because it erodes the value of their holdings. That can prompt them to sell, pushing up yields. But in the face of soaring inflation — and a debate over whether its transitory — 10-year Treasury yields fell to a three-month low hit last week of about 1.46%.

See: Is inflation eating up all the interest you’re earning on 10-year Treasury notes?

“Last week’s bond rally suggests some position squaring,” the strategists explained. “This has caused a disconnect in the inflation theme across asset classes, creating an opportunity for investors to tactically add to the inflation theme in fixed income by reducing duration in core markets.”

Bond valuations look “rich” with yields around a three-month low, according to the JPMorgan strategists. Their survey of clients from June 7-14 found that most were more likely to decrease their bond portfolio duration in the coming days and weeks, according to the report.

Read: Here’s what the market wants — and doesn’t want — to hear from Powell on inflation at Fed meeting

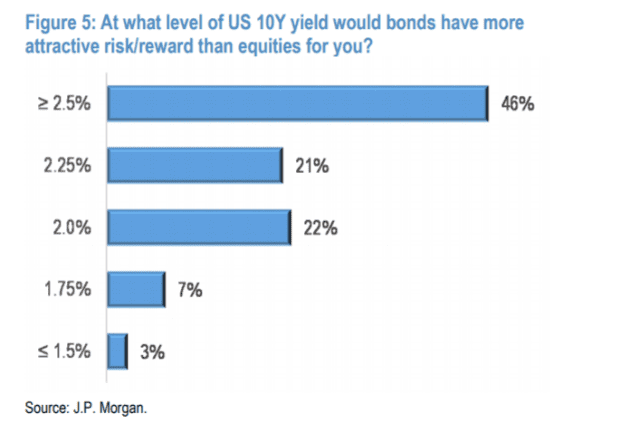

The JPMorgan survey also found that 58% of its clients expect to increase their equity exposure over the coming days and weeks, with 46% respondents signaling the 10-year Treasury yield would need to exceed 2.5% to have a better risk and reward profile than equities.

Yields on the 10-year Treasury note

TMUBMUSD10Y,

moved higher Monday, trading at 1.499%.

“The rally in government bonds and compression in inflation breakevens since the start of the month has taken investors by surprise,” the strategists said. “This is particularly so given it has taken place against a backdrop of economic data continuing to point to an acceleration of both growth and core inflation pressures at a global level.”