This post was originally published on this site

When Chipotle

CMG,

CEO Brian Niccol shared that the company has increased its menu prices by nearly 4%, some customers thought they knew exactly what to blame for pricier burritos: inflation.

“Let’s be real, Chipotle is the first of many companies that will begin to increase prices,” one person tweeted. “Inflation is real and [it’s] going to be reflected everywhere.”

Chipotle, however, told MarketWatch the price increase had little to do with inflation.

“

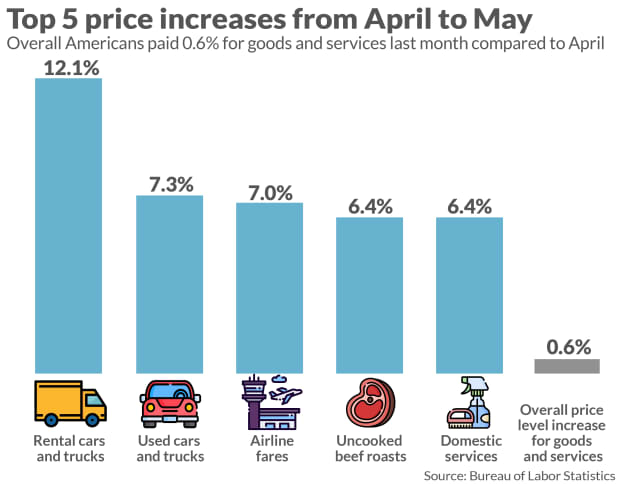

Rental cars and beef cost 12.1% and 6.4% more last month, respectively, compared to April

”

“The recent price increase is to offset the dollar cost of our wage increase, not to offset commodity inflation,” Erin Wolford, a senior spokesperson at Chipotle, told MarketWatch. Last month, the fast-food chain announced plans to increase wages so employees earn an average of $15 an hour by late June.

But the tweet wasn’t entirely wrong — consumers are paying more for a slew of goods.

Rental cars, airfare and uncooked beef roasts cost 12.1%, 7% and 6.4% more last month, respectively, compared to April, according to the latest monthly report from the Bureau of Labor Statistics that tracks how much Americans are paying for nearly 80,000 different goods and services.

The report, known as the Consumer Price Index, uses all the price data from the individual goods and services to estimate how much more or less Americans can expect to pay for goods across the board.

Data from the most recent CPI report estimates that Americans paid 0.6% more for goods overall compared to the prior month and 5% more compared to last May.

What inflation is and what it isn’t

By definition, inflation is an overall increase in prices of almost all goods and services — so yes, people in the U.S. are experiencing inflation currently.

But the fact that Chipotle is charging more for its food doesn’t inherently mean that there’s inflation, said Michael Weber, a University of Chicago Booth School of Business economist.

“Prices or costs go up and down all the time,” he said. “If across a whole range of goods, prices systematically and persistently go up, that’s what we call inflation.”

Case in point: At the height of the pandemic a pack of three 8 oz. bottles of Purell was listed for nearly $70 on Amazon

AMZN,

— more than four times what consumers paid for the same pack pre-pandemic, according to CamelCamelCamel.com, a site that tracks prices of good listed on Amazon. (Amazon didn’t respond to MarketWatch’s request for a comment.)

“

‘If across a whole range of goods prices systematically and persistently go up, that’s what we call inflation’

”

But consumers weren’t paying four times as much money for everything else they bought then, in fact, CPI data indicated they were paying less for most goods and services last March, April and May.

Nevertheless, it is easy to get confused about what inflation is and what it isn’t, said Sarah Foster, an analyst at Bankrate.com.

“If you’re someone who’s going to the grocery store on a regular basis or even to the gas pump, and you’re noticing that those prices are rising, that doesn’t always necessarily count as inflation,” she said.

Inflation is when “the cost of living has gone up across the board and what you have in your wallet today can’t really buy as much as you could have bought with it a year ago.”

It’s ‘normal’ for prices to increase

“In normal times, prices tend to rise by about 2% on any given year,” said Gregory Daco, chief U.S. economist at Oxford Economics.

But lately “price increases are faster than they otherwise would be in normal times.”

The pandemic, of course, has been anything but normal.

Movie theaters, restaurants, hair salons, gyms, and clothing stores had locks on their doors for months — and even when they were allowed to reopen most consumers weren’t rushing back immediately.

“

‘In normal times, prices tend to rise by about 2% on any given year’

”

That’s changed as more Americans get vaccinated against coronavirus and most states have lifted major pandemic restrictions, including mask mandates.

It makes sense that rental cars and trucks cost 12.1% more compared to last year, Daco said.

“Prices are rising because supply has not yet responded to the demand,” he added. And car rental companies cannot easily get their hands on more cars “because car companies sold the cars during the COVID crisis.”

Chip shortages, which are causing supply chain disruptions across a range of goods, are further propping up prices of new cars and trucks.

Eventually, the supply of chips will increase to meet the demand — or consumers may seek out other transportation options —- either way prices aren’t likely to stay where they are, said Daco. Just like the pack of three Purell bottles which now can be purchased for $14.67 on Amazon.

The verdict is still out on whether the inflation Americans are experiencing now will dissipate once people fully return to their pre-pandemic lives.

One of the most important economic figures in the U.S., Federal Reserve Chairman Jerome Powell, thinks it will.

Opinion: Here’s why higher prices for car rentals, airfares and blouses won’t lead to higher inflation

MarketWatch wants to hear from you! What’s costing you more money lately? Has inflation caused you to make any lifestyle changes?

Send me an email: elisabeth.buchwald@marketwatch.com