This post was originally published on this site

Investors interested in Chinese stocks are looking at China’s population trends with understandable alarm. Some demographers see China’s population falling by 48% between now and the year 2100, which presumably would have a devastating impact on the country’s economy. In an attempt to avoid this impending crisis, China recently announced that married couples can now have up to three children.

The country’s previous policy was to allow families to have up to two children. Prior to that, families were only allowed to have one child. Yet since the adoption of the two-child policy in 2015, the Chinese birth rate has continued to decline.

Read: China will allow couples to have three children to counter the aging of its population

While this picture certainly seems grim, investors can safely ignore it. Demographic trends have an impact on stocks, but many decades into the future. Furthermore, trends that may be bearish for the stock market at one point in the future may actually be bullish at another.

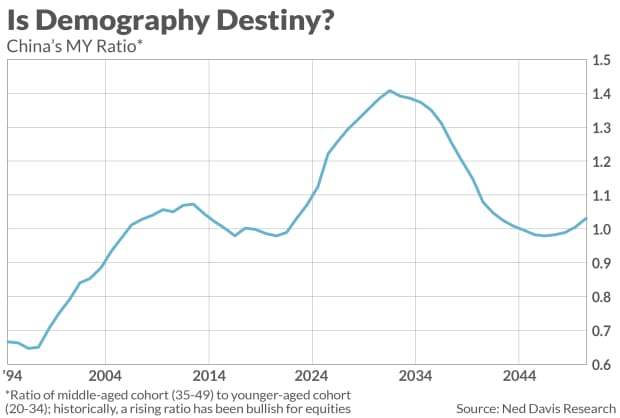

Consider the demographic indicator that, according to Alejandra Grindal, chief international economist at Ned Davis Research, “is effective in identifying secular trends in equity markets.” This is the so-called MY Ratio, which reflects the ratio of the number of those aged 35-49 (“middle aged”) to those aged 20-34 (“young”).

This means that it will be 20 years before any increase in births this year or next will impact the MY Ratio and, by extension, the stock market.

Moreover, from then until 14 years thereafter, the impact of any uptick in births this year will be bearish. That’s because the higher birth rate will increase the denominator of the ratio, which in turn will reduce the overall value of that ratio. Only starting in the mid-2050s will any increased births this year increase the numerator of the MY Ratio and its overall value relative to what it would have been otherwise.

How myopic is the stock market?

This wouldn’t be so irrelevant to today if the stock market took the long-term future into account. But researchers have found that investors collectively don’t appear to look further than four- to eight years into the future. That’s not nearly long enough for the stock market to immediately react to changes in birth rates.

This investor myopia was documented by a fascinating study published in the American Economic Review by Joshua Pollet of the University of Illinois at Urbana-Champaign and Stefano DellaVigna of the University of California at Berkeley. The professors focused on companies whose profitability will eventually be greatly impacted by demographic shifts. They found that it wasn’t until that impact was just four- to eight years away that it started showing up in stock prices, even though it had been evident for many years prior. The professors concluded that investors are “short-sighted and neglect information beyond a horizon of four to eight years.”

Using their research as a template, any increased Chinese birth rate in the next couple of years wouldn’t have a bullish impact on Chinese equities until four to eight years prior to 35 years from now. That’s 2048 at the earliest.

The clock is ticking on the Chinese stock market. As you can see from the chart below, courtesy of data provided by Ned Davis Research’s Grindal, the country’s MY Ratio peaks in 2031, and then embarks on a couple-decade decline. If investors anticipate that inflection point four to eight years in advance, the demographic tailwinds in the Chinese stock market could shift to headwinds within the next several years. There’s little the Chinese government can do to change that.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

More: China lifts 2-child policy to 3, as demographic crisis looms

Plus: U.S. national lab report found COVID-19 Wuhan-leak theory plausible