This post was originally published on this site

The U.S. municipal bond market is known for being many things: staid, stuffy, well-suited to capital preservation, if not growthy opportunity. But now, lopsided metrics of supply and demand, with no relief in sight, suggest it might be outright shrinking.

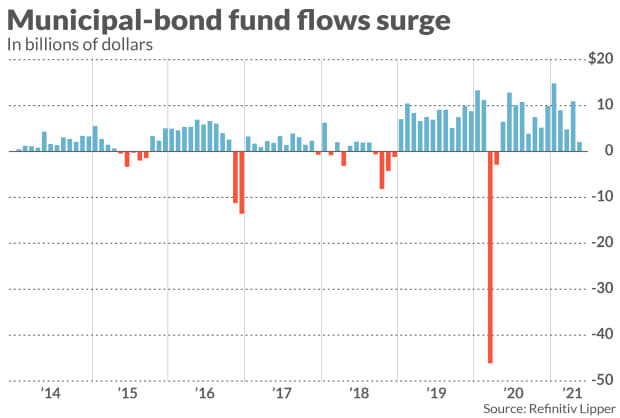

Investors have poured record amounts of money into muni funds, even as a series of events have conspired to keep state and local government entities from issuing enough debt to satisfy investors. Some corners of the market are so tight that funds are turning money away, noted Brian Steeves, portfolio manager for Rye Brook, New York-based Belle Haven Investments.

“It’s a food fight,” Steeves told MarketWatch.

To be sure, some of the current skew is due to normal seasonal market patterns, said Cooper Howard, director of fixed income strategy for Charles Schwab. Muni bonds pay their coupons, or mature, leaving lots of cash looking for a home.

So far this year, issuance has been relatively stable. Through May, state and local governments had issued about $188 billion of bonds, according to data from the Municipal Securities Rulemaking Board, compared to $152 billion during the same period in 2019.

But many analysts question whether that will continue.

“Bankers and buyers may both see less activity than needed, the influx of Federal cash and surging state and local revenues cut borrowers’ needs for working capital,” wrote analysts at Municipal Market Analytics in a June 7 note. “State and local governments, which are not yet showing a strong rebound in hiring, are also likely a few quarters away from restarting traditional new money infrastructure plans in earnest.”

That backdrop is, in part, what’s helped turbo-charge demand.

As previously reported, weekly money flows into muni funds have smashed weekly records multiple times this year.

“The American Rescue Plan went a long way to help ease credit concerns,” Schwab’s Howard said in an interview. Ongoing economic re-openings and state and local budgets coming in less-bad than many had feared also helps, as do investor concerns that their income taxes might rise at some point.

For now, those macro tailwinds are boosting demand beyond what might normally seem reasonable. A closely-watched metric, the ratio of 10-year muni yields to those of comparable U.S. Treasurys

TMUBMUSD10Y,

is about 60%, well below the more normal level of 80%, and suggesting investors are paying quite a bit more for muni bonds than sovereigns.

“Investors are simply ignoring how rich munis are right now and money keeps pouring in,” Steeves said.

That means that in one section of the market, for high-yield munis, “there’s just not enough deals.” That was the conundrum facing the Invesco High Yield Municipal Fund, which announced in May that it would close to new investors.

Large funds are now essentially forced to buy any deal that comes out, Steeves said, leaving portfolio managers with little opportunity to distinguish themselves from competitors, and resulting in zero price discovery in that portion of the market.

Perhaps even more unsettling is the notion that things might get worse from here. With the possibility of even more money earmarked for infrastructure spending coming from Washington, local governments are likely to wait and see whether they can hold off on issuing more debt.

What’s more, while “municipal bond” is often assumed to be synonymous with “tax-exempt,” issuers are increasingly turning to taxable bonds instead. Investors are starved for any kind of paper, and there are fewer rules and regulations around taxable issuances. Taxable debt made up 30% of muni issuance last year, Howard said, up from 10% historically.

“The muni market is shrinking,” Steeves said.

Read next: Washington wants to bring back Build America Bonds. The muni market isn’t buying it