This post was originally published on this site

An earlier version of this report misidentified the Invesco exchange-traded fund that upped its position in financials during the 2008-09 crisis. It was the smart-beta Invesco FTSE RAFI US 1000 ETF that identified opportunities in banks during that period. The error has been corrected.

Hello, again: If meme stocks have got you on edge, we can’t blame you, given the persistent turbulence in trading in AMC Entertainment Holdings AMC and GameStop Corp GME.

The socially fueled trading trend is even spreading to other stocks like Clover Health Investments Corp. CLOV and Wendy’sWEN, and the Securities and Exchange Commission’s head Gary Gensler reiterated that the regulator is monitoring the trend for any signs of shenanigans.

As per usual, send tips, or feedback, and find me on Twitter at @mdecambre to tell me what we need to be jumping on. Sign up here for ETF Wrap.

What’s the buzz?

We spoke to John Hoffman, Invesco’s head of exchange-traded fund and indexed strategies for the Americas, earlier this week, and he explained how Invesco Dynamic Leisure and Entertainment ETF’s

PEJ,

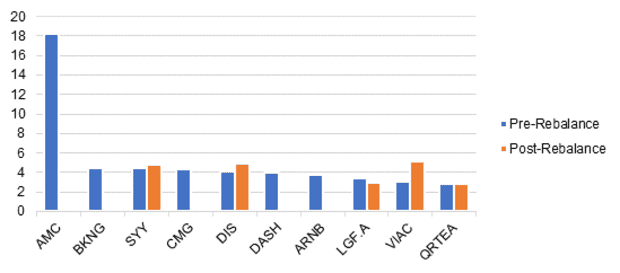

rebalancing at the start of this month resulted in the smart-beta ETF kicking out highflying meme stock AMC.

PEJ, referring to the Invesco ETF’s ticker symbol, also is an important reopening trade, with inflation and the economic recovery front of mind.

Meanwhile, Invesco also is working on two crypto-focused ETFs, according to CoinDesk

Are you not AMC Entertained?

The story of PEJ is fairly simple but interesting because it arguably highlights some of the benefits of smart-beta products.

The ETF, which uses factors such as momentum, value, and earnings growth, among others, in an effort to outperform the broader market, punted on AMC because it no longer fit the criteria for inclusion as designated by the smart index it replicates.

PEJ is pegged to the Dynamic Leisure & Entertainment Intellidex Index and is reconstituted quarterly in February, May, August and November.

In this situation, on its quarterly rebalance AMC was kicked out of the index and so was also removed from the fund. As a result, “you’re removing the emotion from the investment process…and you are doing it systematically,” Hoffman said.

CFRA’s Todd Rosenbluth said that the ETF avoided domination by AMC, which a number of funds, including briefly PEJ, have faced, given the surge in value of the asset that is raising concerns among critics skeptical of the movie chain’s ability to produce revenues and earnings to match its newfound market value. AMC boasts a market cap of about $22 billion.

CFRA

Expedia Group Inc.

EXPE,

and Yum China Holdings

YUMC,

replaced AMC in the ETF, Rosenbluth noted.

Hoffman said that PEJ is being used as a reopening play in the economic recovery from the pandemic and drawing strong inflows. It is up 33% so far this year, which is a healthy return, considering that the Dow Jones Industrial Average

DJIA,

and the S&P 500 index

SPX,

are up nearly 13% so far in 2021 and the Nasdaq Composite

COMP,

has gained over 8%. The small-capitalization Russell 2000 index

RUT,

is up more than 17%.

Hoffman said that the design of Invesco smart-beta funds have yielded periods of very strong performance at economic inflection points, including back during the 2008-09 financial crisis.

Back in 2009, PEJ delivered a 42% annual return, and followed that up with a 42% gain in 2010, FactSet data show.

PEJ’s expense ratio is 0.65, meaning the fund will cost $6.50 annually for every $1,000 invested.

Another Invesco smart-beta fund, Invesco FTSE RAFI US 1000 ETF

PRF,

upped the ante on financial stocks during the financial crisis in 2008-09, spotting value in beaten-down bank share prices.

Visual of the week

Bloomberg via ASYMmetric ETFs

via ASYMmetric ETFs

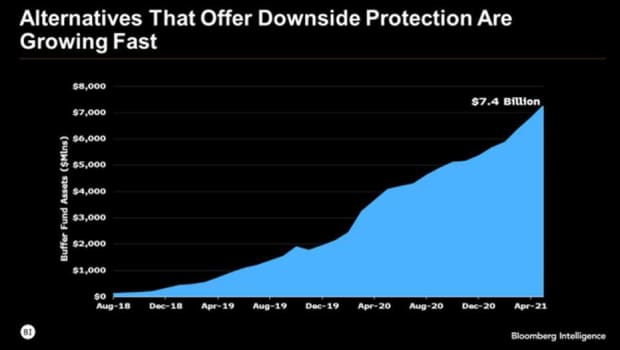

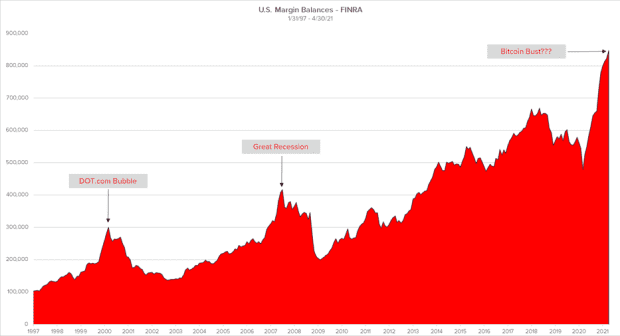

Darren Schuringa, CEO and founder of ASYMmetric ETFs sent us over the attached charts as a way to highlight what he described as elevated anxieties by investors amid the meme-stock and speculative market fervor.

“The current meme stock feeding frenzy, bounces in bitcoin, and precipitous pullbacks in some tech names have ETF investors on edge,” he wrote in emailed comments.

“Increased volatility coupled with skyrocketing margin balances are signs of a market top,” he warned.

Midday Thursday, stocks were modestly higher and bitcoin

BTCUSD,

was trying to clamber higher after key metrics on consumer inflation and joblessness in America were released.

The good and the bad

| Top 5 gainers of the past week | %Return |

|

Invesco DWA Healthcare Momentum ETF PTH, |

5.9 |

|

VanEck Vectors Biotech ETF BBH, |

5.2 |

|

SPDR S&P Biotech ETF XBI, |

4.9 |

|

Invesco WilderHill Clean Energy ETF PBW, |

4.8 |

|

iShares Biotechnology ETF IBB, |

4.6 |

| Source: FactSet, through Wednesday, June 9, excluding ETNs and leveraged products. Includes NYSE, Nasdaq and Cboe traded ETFs of $500 million or greater |

| Top 5 decliners of the past week | % Return |

|

Amplify Transformational Data Sharing ETF BLOK, |

-5.2 |

|

ETFMG Prime Junior Silver Miners ETF SILJ, |

-4.9 |

|

KraneShares CSI China Internet ETF KWEB, |

-4.6 |

|

VanEck Vectors Junior Gold Miners ETF GDXJ, |

-4.3 |

|

iShares MSCI Global Gold Miners ETF RING, |

-4.2 |

| Source: FactSet |

Is there a bitcoin ETF yet?

No.

However, Invesco filed for a pair of bitcoin and blockchain-pegged funds.

The provider filed to offer the Invesco Galaxy Blockchain Economy ETF and the Invesco Galaxy Crypto Economy ETF, public filings show.

The offering resembles a number of crypto-adjacent offerings, including those from Amplify Transformational Data Sharing ETF

BLOK,

VanEck Vectors Digital Transformation ETF

DAPP,

and Bitwise Crypto Industry Innovators ETF

BITQ,