This post was originally published on this site

Bitcoin was under fresh selling pressure Tuesday, dragging the world’s No. 1 crypto to lows not seen since late May. However, at least one technical analyst, says that the slump in bitcoin prices doesn’t represent a decisive breakdown of its uptrend until the asset registers weaker closes today and tomorrow.

“Short-term momentum has deteriorated, but not to the degree with which we have a ‘sell’ signal (in the daily MACD),” Katie Stockton, technical analyst and founder Fairlead Strategies, told MarketWatch, referring to the moving average convergence divergence, a measure of momentum in an asset.

“A close above the 20-day [Moving average] would be a bullish short-term development,” the analyst said.

At last check, bitcoin

BTCUSD,

was trading at $32,850.88, down over 10%, on CoinDesk. The crypto is up over 13% in the year to date but losing ground steadily since the start of the year. Prices were around their lowest since May 23, according to Dow Jones Market Data. Bitcoin is down nearly 50% from its mid-April peak at $64,829.14.

CoinDesk analyst and author Damanick Dantes said that resistance for bitcoin stands around $40,000, with support around $30,000.

Bitcoin has been under pressure for weeks but its slide has deepened in recent action, after U.S. authorities said that they recovered millions in bitcoin paid to the hackers who launched a cyberattack on Colonial Pipeline last month. a major East Coast fuel pipeline.

Overall bitcoin’s price slump has been weighing on the broader crypto complex.

Dogecoin

DOGEUSD,

the popular meme virtual currency engineered in 2013, was down over 12%, changing hands at 32.5 cents. The crypto that is primarily supported by individual traders on sites like Reddit and Discord, is down 56% from its peak back in early May. To be sure, dogecoin is up nearly 7,000% in the year to date.

The world’s No. 2 most valued crypto, Ether

ETHUSD,

running on the Ethereum blockchain, was trading 12% lower, at $2,489.89. Ether is well off its mid-May high at $4,382.73. Ether is up over 200% so far in 2021, despite its slump.

By comparison, the Dow Jones Industrial Average

DJIA,

and the S&P 500 index

SPX,

are both nearly 13% so far in 2021, while the Nasdaq Composite

COMP,

has seen a rise of 8.5% in the year to date, FactSet data show.

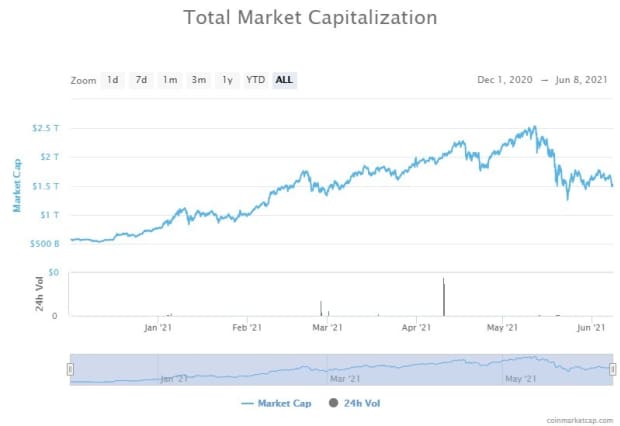

Still, the total market value of crypto at $1.495 trillion is off by about 40% from a peak near the middle of May, according to CoinMarketCap.com.

CoinMarketCap.com