This post was originally published on this site

Etsy Inc.’s acquisition of London-based resale site Depop jolts the e-commerce retailer even more deeply into two key markets that will help grow the business — Gen Z shoppers and secondhand sales.

Etsy

ETSY,

announced last Wednesday that it will acquire Depop for $1.625 billion. Etsy had about $2 billion in total liquidity as of March 31, including $1.8 billon in cash. And the company expects Depop to be accretive to Etsy’s topline growth rate.

The deal is expected to close in the third quarter of 2021.

Founded in 2011, Depop generated $650 million in gross merchandise sales and $70 million in revenue in 2020.

But perhaps of equal value are the secondhand and Gen Z shoppers who visit the site.

According to the acquisition announcement, about 90% of Depop’s active users are under the age of 26. It’s the 10th most visited site for U.S. Gen Z consumers.

And a report released by Bain & Co. and Depop last week called “How Gen Z’s empathy, awareness and fluidity are transforming business as usual” reiterates the importance of the secondhand market to young shoppers.

The study found that 60% of Gen Z consumer decision-making is influenced by reducing their environmental footprint, and 45% are influenced by commitments to use eco-friendly materials. Ninety percent said they’ve made their daily lives more sustainable, with fashion practices playing a key role.

“This is a generation leading change at global scale – they are increasingly influencing the consumption behaviours of older generations, and are rapidly gaining spending power,” said Peter Semple, chief brand officer at Depop, when the report was released.

Also: Lululemon launches resale program, limited-edition collection made with eco-friendly dyes

Etsy projects that the resale market will reach $64 billion by 2024.

“This is truly astounding growth compared with traditional fast fashion which generally grows in the single digits,” said Josh Silverman, Etsy’s chief executive, speaking on a call following the acquisition announcement.

“Among the trends often highlighted in driving this phenomenon are younger consumers who favor the concept of sharing over owning, consumers desire to access used goods at a discounted value price, the rise of the digital consumer and environmental consciousness.”

Etsy plans for Depop to continue operating as a standalone business with its existing management team. Etsy also owns Reverb, a marketplace for new, used and vintage musical instruments.

“The Depop acquisition adds another differentiated and well-run platform to Etsy’s expanding portfolio of brands, selectively leveraging M&A to enhance the company’s already strong positioning in the handmade and one-of-a-kind e-commerce space,” wrote Canaccord Genuity in a note.

Canaccord rates Etsy stock buy with a $270 price target.

“We see the acquisition as addressing what was an important need in Etsy’s assortment — used clothing,” wrote D.A. Davidson in a note. “Considering the success Etsy had operating Reverb, which sells used musical instruments,

we believe the company has the potential to add used merchandise in more categories.”

D.A. Davidson rates Etsy stock buy with a $234 price target.

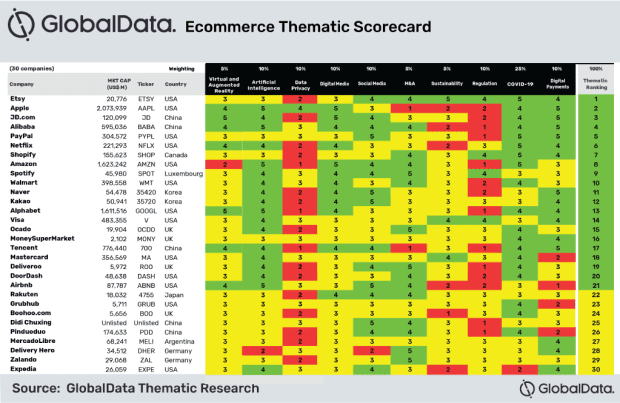

The acquisition launched Etsy to the top of the GlobalData E-commerce Thematic Scorecard.

“GlobalData has improved Etsy’s social media score to 4/5 following the Depop acquisition, due to Depop’s unique online community, which marries social media and the sharing economy, revolutionizing secondhand shopping,” said Sarah Coop, thematic analyst at GlobalData, in the report.

“Etsy has future proofed its business and consolidated its position as a sustainability leader by acquiring Depop. Depop’s slow fashion and social media expertise makes the acquisition on trend for a sustainable and innovative future.”

Etsy shares have slumped 6.3% for the year to date, but have soared more than 111% over the past year.

The Amplify Online ETF

IBUY,

is up 7.1% for 2021 so far. And the S&P 500 index

SPX,

has gained 12.4% for the period.