This post was originally published on this site

If you want a financially comfortable retirement with ample money available, you need to take two basic steps.

First, save plenty while you’re still working.

Second, withdraw the money in a way that will be unlikely to leave you out of money before you run out of life.

In a recent article I described how to design a withdrawal strategy that will keep your portfolio healthy if you have saved enough (but only enough) to meet your needs.

Read: A solution to the retirement crisis exists — but only on paper

That involves taking out a fixed percentage of the portfolio value in your first year, then adjusting upward every year to account for actual inflation.

If you retire with a portfolio that’s at least 25 times the size of the annual withdrawal you need (in other words, with $1 million if you need $40,000 from it the first year), you will most likely succeed.

That 4% withdrawal rate is recommended by many financial planners and advisers. But if those withdrawals must keep increasing with inflation, they don’t leave much “wiggle room” for bad times in the stock market.

There’s a better way. If you’ve saved more than enough to fund your first annual withdrawal, you can adopt what I call a flexible distribution plan.

In this case, you start by taking a percentage (let’s assume 4%) of your portfolio the first year. The other 96% remains invested, and one year later you take out 4% of the value at that time.

In an article in 2020, I called this The Ultimate Retirement Distribution Strategy. It can give you more money to spend, more money to leave to your heirs, and more peace of mind.

Depending on how much “extra” savings are in your portfolio, this flexible withdrawal strategy may let you safely take out 5% each year instead of 4%. That gives you a really nice cushion, as we shall see.

Read: Check out our new retirement calculator

True, this plan will require you to tighten your belt at times after the market declines. But after favorable market conditions, you’ll have more to spend.

It’s a smart way to manage your finances in retirement.

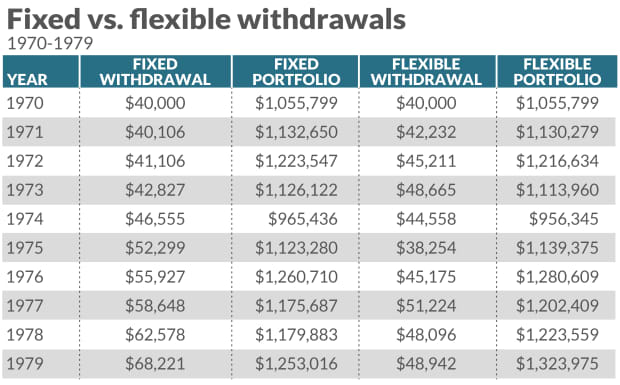

In Table 1, you can see the difference between fixed and flexible withdrawals, based on actual results and inflation starting in 1970 (a decade of unusually high inflation).

These calculations assume an annual need for $40,000 and an initial portfolio worth $1 million invested 50/50 in the S&P 500

SPX,

and bond funds. Columns labeled “Portfolio” indicate end-of-year value.

As you can see, in each case the value of the portfolio held its own through 1979.

But the flexible schedule produced much lower withdrawals in the second half of the decade. To simply keep up with inflation, a retiree needed $68,221 in 1979; the flexible arrangement produced just shy of $49,000 that year — providing only about 72% of the purchasing power a retiree had with $40,000 in 1970.

Saving “more than enough” before you retire isn’t necessarily easy, especially if you start seriously saving in your 40s or 50s.

Read: How to make up lost ground if you got a late start saving for retirement

You might need to postpone your retirement by a few years to do this. But as you’ll see in Table 2, the financial benefits can be impressive.

Table 2 is based on the same assumptions as Table 1 except for an initial portfolio value of $1.5 million instead of $1 million. This comparison shows what happens when you use a 5% flexible withdrawal rate vs 4%.

Although the 5% portfolio was somewhat smaller than the 4% one at the end of 1979, in later years it was never in any danger of running out of money.

It was worth $3.24 million at the end of 1985, $4.4 million at the end of 1990, $6.17 million at the end of 1995, and $8.52 million at the end of 2000. And of course the withdrawals kept rising as well.

In this hypothetical retirement starting in 1970, cumulative 5% flexible withdrawals gave you $129,699 more to spend in the first 10 years of retirement, compared with taking 4%. After 25 years of retirement, you would have taken out $204,213 more at 5% than at 4%.

Having ample money in retirement also has strong psychological benefits.

On an imaginary emotional scale, having more than enough money can help you “move the dial” away from fear and closer to comfort and security.

Here’s something else: Many people regard their finances (and their net worth) as a way of “keeping score” in how well they have lived their lives.

I don’t believe your net worth measures your value as a person. And I don’t recommend you live your life in retirement according to a “financial scoreboard.” But still, a higher score is always nicer than a lower score.

The key lesson is that the ideal way to start retirement is with more savings than you really need.

And as I will show in an upcoming article, that does not have to be as difficult as you might think.

For more, I’ve recorded a podcast on why I think flexible distributions are a luxury worth working for.

Richard Buck contributed to this article.

Paul Merriman and Richard Buck are the authors of We’re Talking Millions! 12 Simple Ways To Supercharge Your Retirement.