This post was originally published on this site

U.S. corporate profit margins may finally start to decline. I say “finally” because it was almost 20 years ago that corporate profit margins rose to above-average levels, yet instead of regressing to the mean as on previous occasions, they have stayed at elevated levels more or less continuously ever since.

Wall Street’s graveyard is filled with the failed predictions of eminent analysts who predicted that corporate margins couldn’t remain so high for so long. In 1999, for example, none other than Warren Buffett of Berkshire Hathaway said that “you have to be wildly optimistic” to believe that corporate profit margins would stay above average for “any sustained period.” GMO’s Jeremy Grantham called profit margins “the most mean-reverting series in finance.”

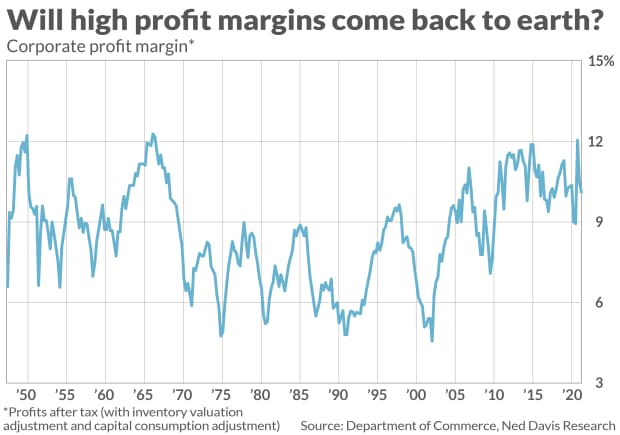

You can see what Grantham was referring to in the chart below. Prior to the last couple of decades, profit margins rising to above-average levels was the precursor to a decline to well-below-average levels of 7% or below. But this hasn’t happened since the internet bubble. The profit margin at the bottom of the Great Financial Crisis got close (7.8% in 2008), but quickly jumped back.

Joseph Kalish, chief global macro strategist at Ned Davis Research, contends that a perfect storm is brewing that could put “profit margins… under attack from all sides.” In an interview, Kalish speculated that the profit margin could decline significantly over the next couple of years — perhaps by enough to once again break below that 7% level.

If his prediction is right, then the U.S. stock market will almost certainly produce disappointing returns in coming years. That’s because corporate profits would be falling even as the economy is strong.

To illustrate, consider the following back of the envelope calculation. Let’s generously assume that corporate revenue will grow over the next four years at the same pace it did for the decade through year-end 2019. I picked that decade because it doesn’t include the coronavirus pandemic. Let’s also assume that the stock market’s price/earnings ratio stays constant, which is also an extremely generous assumption because it currently is higher than 94% of the time since 1970. Let’s keep other factors constant, such as dividend payout rates, share buybacks, and share issuance.

Given these assumptions, if the corporate profit margin declines by one percentage point each year over the next four years, the S&P 500

SPX,

at year-end 2024 will be 19% lower than at year-end 2020.

What’s causing this perfect storm?

Kalish identifies a number of factors that could conspire to cause profit margins to decline, including:

- Higher labor costs. “With a record number of job openings and anecdotal reports of shortages of skilled labor,” companies will quite likely have to pay more for labor.

- Higher interest costs. With the economy re-opening and inflation heating up, it seems likely that corporations will have to pay more in interest in coming years.

- Taxes. This category includes both direct (through higher corporate tax rates) and indirect (taxes on production and imports). President Joe Biden has already signaled his intent to raise corporate taxes, and Kalish points out that the administration “could be looking for new sources of revenue from indirect taxes.”

To be sure, Kalish said, several potentially countervailing forces could mitigate the downward pressure on profit margins. Labor costs would not rise as much as they would otherwise if productivity or labor-force participation were to increase, for example. Still, the odds don’t look good. Kalish says he “can’t recall a time when so many components were at risk” of causing profit margins to tighten.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

More: Stocks to buy and those to avoid as U.S. economy runs faster than the Indy 500