This post was originally published on this site

Like a pinball stuck in a machine, markets have been wedged in. The S&P 500

SPX,

hasn’t seen a move greater than 0.4% in either direction for the last seven consecutive sessions. If the stock market were to close for the entire rest of the year, a 12% rise in the S&P 500 certainly wouldn’t be a bad result, but it’s worth examining why there’s so little movement right now.

It might be worth looking at the benchmark asset for all securities, the 10-year Treasury

TMUBMUSD10Y,

After surging from below 1% to as high as 1.78%, the yield on the 10-year Treasury has just kind of drifted. That’s despite sensational economic data, including the 70 reading registered on the IHS Markit services purchasing managers index released Thursday.

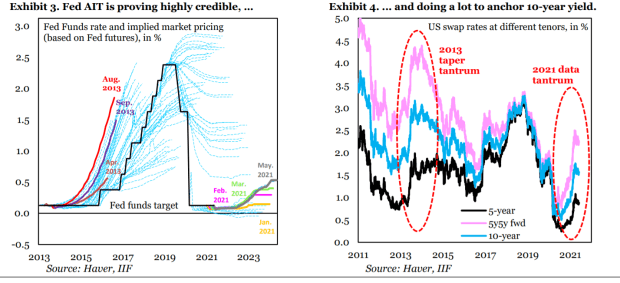

The Institute of International Finance, the trade body for banks, said what’s going on is that markets are believing the Federal Reserve. In particular, they think the Fed average inflation targeting program is anchoring longer-term yields.

Compared with the 2013 taper tantrum, IIF’s economists led by Robin Brooks say it’s notable how few Fed rate hikes are priced in.

The surprisingly weak April payrolls report, they note, was an 8-standard deviation surprise, yet it did little to move bonds in either direction. “To break the stalemate on the 10-year, payrolls will need to show real progress on labor market recovery, which is still outstanding,” they said.

The IIF rejects the idea that slowing Chinese credit growth is the real reason markets have hit pause. “That impulse doesn’t even correlate with China’s GDP, let alone global activity,” they say.

Payrolls report on tap

U.S. job creation accelerated in May, but the 559,000 new nonfarm positions reported by the Labor Department missed economist expectations. The unemployment rate did slide to 5.8% from 6.1%.

The knee-jerk market reaction was a rise in U.S. stock futures

ES00,

NQ00,

on the view the Federal Reserve won’t rush a decision to curtail its bond-purchasing program. The yield on the 10-year Treasury fell to 1.62%, and the dollar fell vs. the Japanese yen

USDJPY,

President Joe Biden is due to discuss the jobs report at an event in Rehoboth Beach, Del., according to the White House schedule.

Outside of the payrolls report, finance ministers are gathering in London, to discuss digital taxation, climate change disclosure and the global economic recovery, among other topics. As a convenient example of the tax issues surrounding the world’s technology giants, the Irish Examiner reported that Microsoft

MSFT,

paid no corporate tax on the $315 billion it earned in the country last year.

Bill Ackman’s special-purpose acquisition company, Pershing Square Tontine Holdings,

PSTH,

is nearing a transaction with Universal Music Group that would value the world’s largest music business at about $40 billion. Universal is currently held by French media conglomerate Vivendi

VIV,

which had previously said it was considering an initial public offering for the unit.

Movie chain and meme stock AMC Entertainment

AMC,

dropped 7% in premarket trade. Analysts at Wedbush raised their price target on AMC to $7.50, which is considerably below the $51.34 it closed at on Thursday.

The European Commission and U.K. competition authorities say they opened a formal antitrust investigation to assess whether social-media giant Facebook

FB,

violated competition rules in advertising.

Random reads

A chicken nugget was sold on eBay for nearly $100,000.

Grounded forever? Two Utah girls stole their parents’ car to drive to the beach. It didn’t go well.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.