This post was originally published on this site

For some reason that I do not fully understand, Social Security beneficiaries love to get a cost-of-living adjustment (COLA). Mind you, I do view automatic indexing of benefits as a wonderful feature of our Social Security program. Without such adjustments, retirees would see their standard of living erode as they age, unless the government regularly increased benefit amounts.

Read: A wake-up call for retirees who don’t get enough sleep

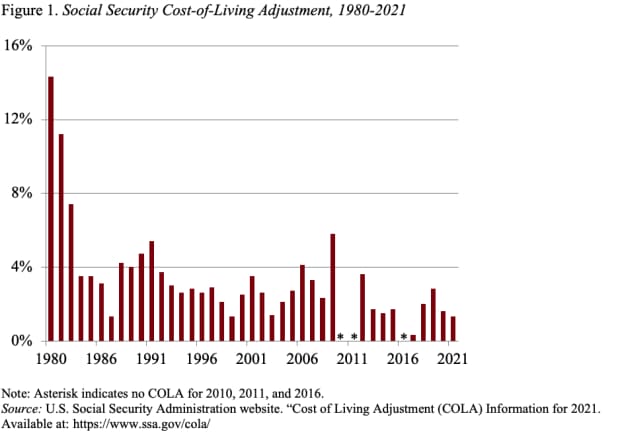

But the idea behind these COLAs is to maintain the existing purchasing power of current benefit levels. That is, the adjustment is to compensate retirees for the higher prices they had to pay in the previous year. The bigger the price increase, the larger the COLA. No price increase, no COLA. The announcements of “no COLA” in 2010, 2011 and 2016 (see Figure 1), however, were met with a huge outcry. (A separate issue, not addressed here, is whether the price index used for determining the Social Security COLA — the CPI-W — is the best index for capturing the inflation faced by retirees.)

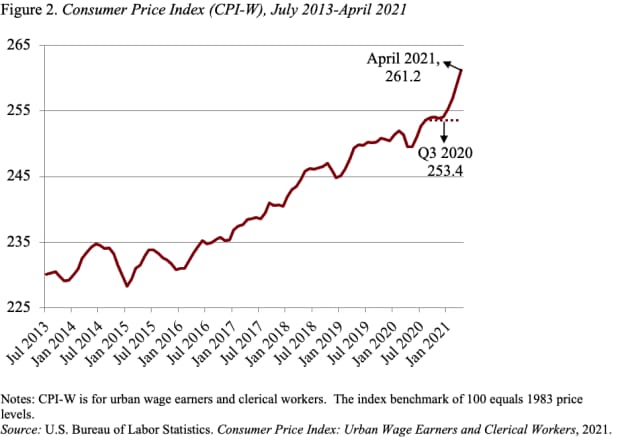

For COLA fans, the increase in the CPI in April to 261.2 (4.6% year-over-year) is definitely good news. While we don’t know whether this jump is a short-term spike as we emerge from the pandemic or an indication of more permanent inflationary pressures, it will most likely lead to higher Social Security benefits in 2022. The question is how much higher.

Read: 5 rules investors can learn from Bernie Madoff

Since the COLA first affects benefits paid after Jan. 1 of next year, Social Security needs to have figures available before the end of 2021. As a result, the adjustment for 2022 is based on the increase in the CPI for the third quarter of 2021 over the third quarter of 2020. We know the 2020 number (see Figure 2), but we need data through September to calculate the third-quarter average for 2021.

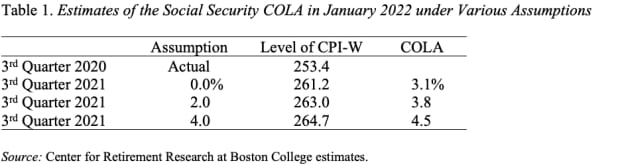

The only option is to make some assumptions. Table 1 shows what the COLA would be if we saw no further price increases (0%) over the next five months, and if we saw prices increase at an annual rate of 2% or 4% during this period. This exercise suggests that the COLA will be more than 3% and less than 5%. We’ll know more in the coming months.

A COLA, however, does not raise the value of real benefits; it is simply an attempt to prevent the erosion of purchasing power. So, in theory, beneficiaries should be equally happy with no inflation and no COLA as with 4% inflation and a 4% COLA. But that just doesn’t seem to be the case.