This post was originally published on this site

Bullish investors in bitcoin aren’t all jazzed about the long U.S. Memorial Day holiday weekend ahead.

The sun, the fresh air, barbecues, the first major summer break, as more doses of COVID vaccines have hit the arms of Americans and those in other parts of the world. That setup appears to be taking a back seat to growing agita about bearishness that could further crystallize in the coming days for bitcoin

BTCUSD,

and the broader crypto complex, including dogecoin

DOGEUSD,

and Ether

ETHUSD,

on the Ethereum blockchain.

“There’s a bloody crypto weekend coming,” Yves Lamoureux, president of macroeconomic research firm Lamoureux & Co., told MarketWatch on Friday.

U.S. markets are closed Monday for Memorial Day but crypto markets are open 24 hours.

Lamoureux isn’t the only one harboring Memorial Day anxieties. Billionaire digital-asset entrepreneur Barry Silbert tweeted that he hopes that bitcoin takes the weekend off.

A report on CoinTelegraph speculated that bitcoin still could skid to $20,000 or below. The asset was most recently changing hands at $36,199, down over 7%, on CoinDesk. Bitcoin is up 24% year-to-date, but off 44% from its mid-April peak at $64,829.14.

Technical analyst at Katie Stockton, who runs Fairlead Strategies, told MarketWatch that bitcoin has benefited from short-term oversold conditions for the past couple of weeks, stabilizing near $34K support.

However, she said it is struggling with its 200-day moving average. Technical analysts use moving averages as gauges of long term and short-term momentum in an asset.

“My short-term gauges are pointing higher, but we have no convincing intermediate-term ‘buy’ signals,” Stockton said.

With this in mind the technical analyst said that support near $34,000 may be in jeopardy after more of a bounce, “so we have our eyes” on $27,000 “as a possible entry.”

Dogecoin prices, the popular meme crypto engineered in 2013 as a lighthearted riff off the proliferation of bitcoin alternatives, is changing hands at 31.6 cents, down over 6%. The altcoin is down nearly 60% from its all-time peak earlier in May. That said, the digital-asset is up 6,500% in the year to date.

The No. 2 crypto by market value, Ether, was down 9% and changing hands at $2,528, up nearly 240% thus far in 2021.

However volatile, the gains in crypto have mostly outstripped those for conventional assets (with the exception of meme stocks like AMC Entertainment Holdings

AMC,

and GameStop Corp.

GME,

).

The Dow Jones Industrial

DJIA,

was up 0.2% Friday and up about 13% in the year’s first six months or so. The S&P 500 index

SPX,

was 0.1% higher on the session and looking at a year-to-date rise of about 12%, while the Nasdaq Composite Index

COMP,

was up 0.1% and headed for a gain of 6.7% so far this year. Gold futures

GC00,

meanwhile, were up 0.4% on the day and rising 0.6% year to date.

Lamoureux says that weekends for crypto have become notoriously treacherous “because liquidity dries up” and “if there is blood in the water sharks will pressure this lower and kill the weak competition that was in trouble.”

The investor and strategist said that leverage in the system also has played a role on amplifying moves in digital assets.

A report from Barrons.com written by Avi Salzman explained that there are essentially two bitcoin markets: one dominated by mainstream brokers, like Coinbase Global and Robinhood, and other dominated by investors using derivatives, people who care less about crypto prices rising and are more focused on making money based on directional moves in assets.

Volatility can breed volatility in such an environment, particularly if few investors are willing to step in the staunch the carnage as downturns takes hold.

There is no one narrative that accounts for the shift in momentum for bitcoin and its ilk. A number of reports have pegged it to comments from China to Japan, but the moves for crypto aren’t always synchronized with the headlines.

To be sure, the crypto community has historically viewed slides as buying opportunities, prime for long-term investors.

However, new investors may face challenges trying to stomach major dives.

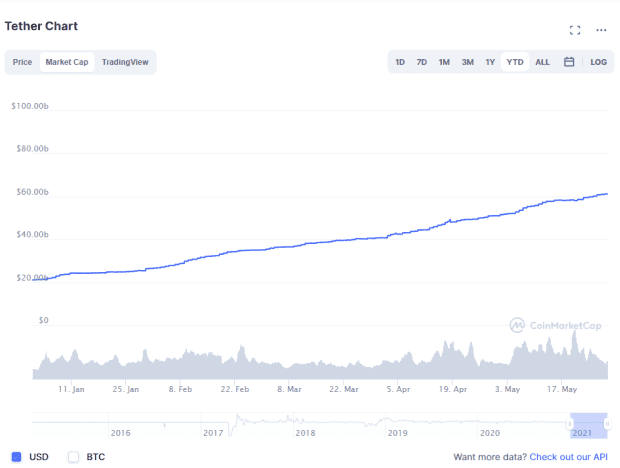

Lamoureux said that one, big factor that should serve as support for bitcoin and mainstream crypto has been the ascent of stablecoins, such as Tether

USDTUSD,

whose price typically has a fiat currency peg and more consistent prices.

Stablecoins like Tether, tend to be seen as a gateway into crypto because they can ease transactactions in other crypto using stablecoins. Tether’s market value has been on a steady rise.

CoinMarketCap.com