This post was originally published on this site

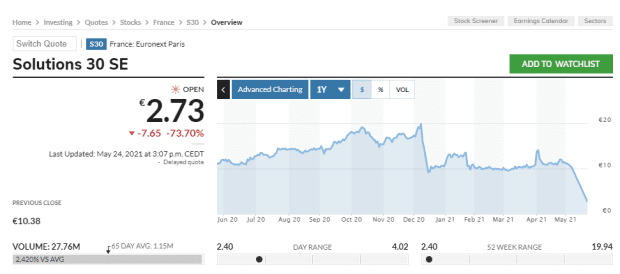

One of the most shorted stocks in France fell as much as 77%, after its auditor refused to sign off on its annual report.

Solutions 30, a midcap provider of information-technology services, dropped, as EY said it didn’t have sufficient evidence supporting the legality of certain transactions and whether transactions were made with management members.

According to Whale Wisdom, Solutions 30 trailed only manufacturing company Vallourec

VK,

retail company Casino Guichard-Perrachon

CO,

and air carrier Air France-KLM among Paris-listed companies in the percentage of short bets against it, with hedge funds Lansdowne Partners and Gladstone Capital Management among the firms betting on its decline.

The stock had been halted since May 10 at the company’s request, and was worth €1.1 billion ($1.3 billion) before the EY announcement. The stock ended 71% lower.

Solutions 30 said it may delist and look for a new auditor, as it said it strongly disagrees with EY’s view. It says as of Dec. 31 there was €159 million in cash in its bank accounts, and it also listed what it said were the related-party transactions at issue.

Short selling research firm Muddy Waters said it has been short since May 2019, as it published its eighth comment on the company.

“We analogize the present situation to this: Imagine if you thought your partner is cheating on you with another. You arrive at your house at a moment you believe the cheating is taking place, and see your partner’s car in the driveway, along with an another, unknown car. You enter and stop outside your shared bedroom. The door is closed, and you hear sounds from inside indicating both parties are putting in gold medal performances. But the door is locked — you cannot open it. You are now EY,” said a new Muddy Waters report.