This post was originally published on this site

This bull market is in late innings, according to the “market timing popularity cycle” indicator. I informally created this indicator in a series of columns two decades ago. It focuses on the relative popularity of market-timing vs. buying and holding. It works because their popularity waxes and wanes in predictable ways according to where we are in the market cycle.

Market timing is most popular at the bottom of bear markets and least popular at the late stages of a bull market. Buy-and-hold behavior is the reverse. Currently buy-and-hold is more popular than it has been in at least a decade, which is why this indicator is suggesting the bull market’s end is near.

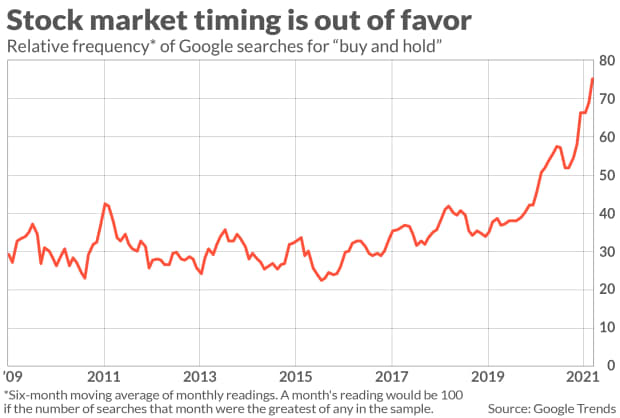

This is shown in the chart below, which plots the growing frequency since 2009 of Google searches of the phrase “buy and hold.” March 2009 was the bottom of the bear market wrought by the Great Financial Crisis, and, sure enough, Google searches of “buy and hold” were relatively rare at that time. With 100 on the chart’s vertical axis indicating the point of greatest monthly frequency, searches then were around 30 (on a six-month moving average basis).

There’s been a steady uptrend ever since, and the comparable reading today for “buy-and-hold” is close to 80. To be sure, the frequency of “buy and hold” searches on the internet isn’t exactly the same as believing in it or pursuing the strategy. But the two undoubtedly are related. Lack of interest is surely correlated with fewer Google searches of the phrase, for example.

Why the Market Timing Popularity Cycle works

The Market Timing Popularity Cycle works because of human nature and our contrasting beliefs at bull-market tops and bear-market bottoms. As bear markets grind on, investors who previously believed in buying and holding will finally throw in the towel. That’s when headlines will start appearing that “buy and hold is dead.”

Buy-and-hold investors throw in the towel at such times because they will almost certainly be losing more money than market timers — including those with no ability. Even monkeys switching at random between the market and cash will be beating a buy-and-hold, since time spent in cash will be profitable when the market itself is going down. This reality becomes harder and harder for the buy and holders to take.

Just the reverse process will take place during bull markets. Now it’s the market timers’ turn to lag a buy-and-hold strategy, since any time spent in cash will lose ground to a rising market. By the end of a long bull market, many erstwhile market timers will throw in the towel and become converts to the latter-day religion of buying and holding. Now the headlines will read: “Market timing is dead.”

A truly unscientific indicator

I want to stress that this indicator doesn’t claim pinpoint accuracy, nor can it. Even when it is right it can be months early in flashing warning signs.

That’s important to keep in mind since there are other indicators suggesting that the bull market’s top is still several months away. I discussed one such indicator recently, for example, when I focused on the three S&P 500

SPX,

sectors that typically perform well in the final three months of bull markets. Since those sectors currently do not have the best three-month trailing returns, this comparison suggests the top is not immediately imminent.

So I got lucky on those prior occasions when I used the indicator to identify changes in the market’s major trend that were close at hand:

- One week before the bottom of the 2007-2009 bear market — on Mar. 2, 2009 — I wrote a column on market timing’s new-found popularity in which I concluded that “the final low may be closer than we think.”

- Six months before, in October 2008, I used this indicator to conclude that the bear market’s bottom was not yet at hand. I pointed out that “we have yet to see adherents of buying and holding becoming converts to market timing.”

- In March 2003, I devoted a column to the conversion of a prominent believer in buy-and-hold into a market timer. I wrote that “we’re closer than ever to the final low of the 2000-2003 bear market.” That column appeared on Mar. 11, 2003, the exact day of the successful retest of the market’s bear market low that had been hit the prior October.

I was not so prescient in 2017 or in 2013. Those counterexamples should serve as yet another reminder not to use this indicator as anything more than a straw in the wind. Nevertheless, this “straw” definitely suggests that we’re closer to the end of the bull market than its beginning.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

More: Why the bull market in stocks won’t be over until these 3 S&P 500 sectors sing

Also read: These are the 30 value stocks that top investment newsletters like best right now