This post was originally published on this site

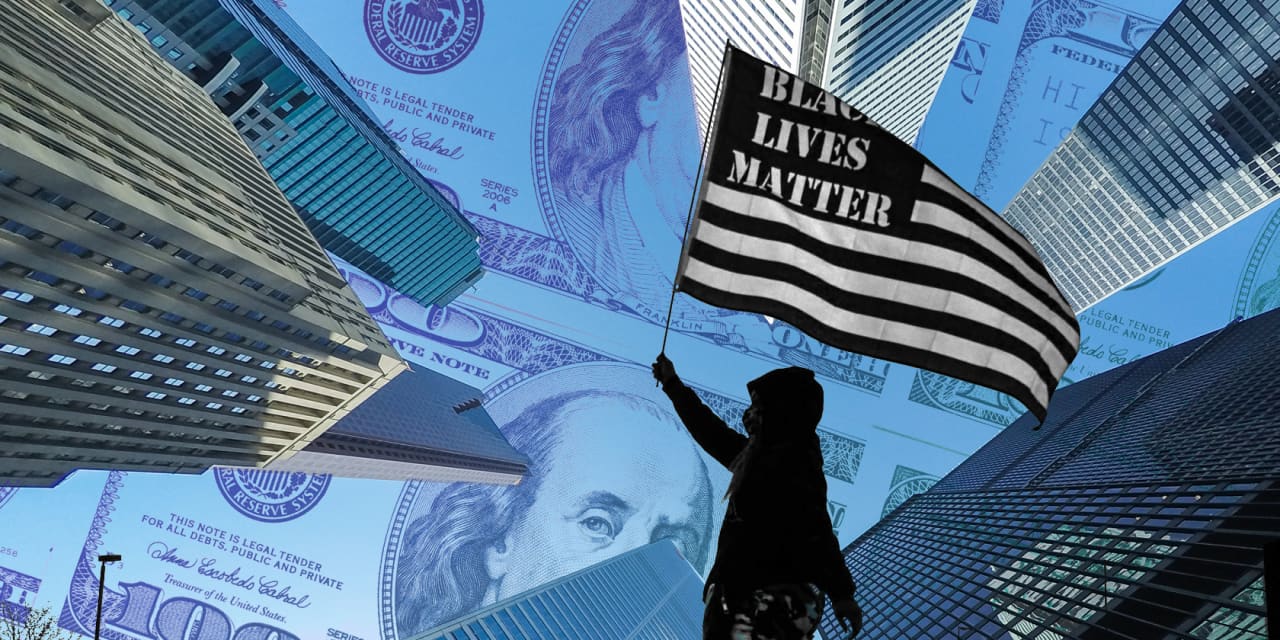

In an effort stemming from the murder of George Floyd and at the behest of a Connecticut state official, a who’s who of financial institutions on Tuesday promised to address the effects of racial disparities in financial services by investing billions of dollars to support Black and Latinx communities.

Eighteen banks and asset managers have signed on to four main commitments over the next five years: $10 billion toward minority-owned businesses through contracting, funding and more; investments in Black and Latinx communities through topic-focused and regional initiatives; putting money in the financial-services industry talent pipeline to address under-representation; and transparency around diversity, equity and inclusion.

Among the financial institutions on board are BlackRock Inc.

BLK,

Morgan Stanley

MS,

JPMorgan Chase & Co.

JPM,

Goldman Sachs Group Inc.

GS,

Bank of America Corp.

BAC,

and Citigroup Inc.

C,

They are partnering with the Connecticut Office of the Treasurer and the Ford Foundation on an initiative called “Corporate Call to Action: Coalition for Equity & Opportunity,” which officially launched last fall but is now announcing its main goals. They’re referring to it as the CEO Coalition.

The wide-ranging initiative comes as many of the banks face pressure from shareholders and others to follow through on their expressions of solidarity last year with the Black Lives Matter movement, which arose after Floyd, a Black man, was killed by then-Minneapolis police officer Derek Chauvin. Chauvin was convicted of the murder last month.

See: Companies declared ‘Black lives matter’ last year, and now they’re being asked to prove it

Connecticut State Treasurer Shawn Wooden, the driving force behind the alliance, wrote an op-ed last year, after Floyd’s death in May. A Black man and father of two Black teenage boys, Wooden wrote in the Hartford Courant that government, law enforcement and social and financial institutions have failed to solve the “existential crisis” of the killing of unarmed Black people: “It is time for the wealthy and privileged to start pulling the levers of power they hold. Wall Street and corporate America, I’m speaking to you.”

In an interview with MarketWatch, Wooden said his op-ed sparked a positive response from chief executives of companies around the nation. He took advantage of that, reached out to the Ford Foundation, and the CEO Coalition was born.

“I have a front-row seat to Wall Street,” he said. “I have these relationships and an opportunity to make lasting change.”

Earlier this year, 16 of the partners in the alliance committed to publicly release their EEO-1 reports, a federally filed breakdown of their workforce and leadership demographics — a move that tracks internal progress. Now come the four main commitments, which address both internal and external issues.

“It had to be more than just a moment of nice statements, quite frankly,” Wooden said. “It had to be a real commitment… where the work would last beyond more than the moment. And we wanted to be able to measure the results.”

Because Wooden’s office and the Ford Foundation are leading the charge, they are responsible for keeping the initiative on track and reporting on the progress toward the initiative over the years, although there will be working groups focused on each of the commitments.

“The real challenge for corporate America is to sustain momentum,” said Darren Walker, president of the Ford Foundation. “We saw genuine, sincere efforts. We also saw some performative acts. What the treasurer and I want to see is follow-through.”

Ebony Thomas is senior vice president of ESG and Public Policy and the Racial Equity & Economic Opportunity Initiatives executive at Bank of America. She and Joe Gianni, Bank of America president in the Hartford market, said this initiative is in line with work the bank has been doing for a while.

“It’s obviously amplified,” Taylor said. “The urgency has been different.”

Gianni referred to a $1 billion-plus commitment Bank of America made last year toward racial justice and gave examples of how it has worked out so far, mentioning partnerships with different organizations for manufacturing jobs, and with the state for health-care jobs. The “real jobs at the end of the tunnel” don’t have to be financial-services jobs for the bank to invest in them, he said.

Bank of America, like other financial institutions, has put substantial investments into these types of initiatives, but it also opposed a shareholder resolution this year that asked it to conduct a racial-equity audit. That proposal included mention of the bank’s less-than-stellar record on approving home loans to minorities, and the dearth of diversity in its C-suite.

But Thomas said Bank of America is already transparent about its efforts around racial justice, equity, diversity and inclusion.

“This year we released a Human Capital Report for the second year in a row,” she said. “We know folks, not only shareholders but others — and our employees — are asking for transparency.” Gianni added that Bank of America has been releasing its EEO-1 report for years.

The other members of the coalition are UBS Group

UBS,

T. Rowe Price Group

TROW,

Aberdeen Standard Investments, AllianceBernstein

AB,

Bridgewater Associates, Franklin Templeton, Invesco Ltd.

IVZ,

Schroder Investment Management North America Inc., The Hartford, Teachers Insurance and Annuity Association of America (TIAA), Vista Equity Partners and Wellington Management.

The partners in the coalition point to collective action as key, and financial institutions’ role in the economy as paramount.

“One of the reasons we have gross disparities in wealth is because of lack of capital,” said Wooden, the state treasurer. “Capital is oxygen.”