This post was originally published on this site

The air is leaking out of the crypto complex, highlighted by declines in popular trades, including bitcoin, dogecoin and crypto platform Coinbase Global on Monday.

At last check, bitcoin

BTCUSD,

was changing hands at $43,047.15 on CoinDesk, off nearly 9% and down around 30% from its mid-April peak near $65,000. Dogecoin

DOGEUSD,

the popular meme stock created in 2013, was trading at 48 cents, or off over 5%, and down more than 36% from its peak near 75 cents put in last Saturday as crypto champion and Tesla Inc.

TSLA,

CEO Elon Musk appeared on NBC sketch-comedy show “Saturday Night Live.”

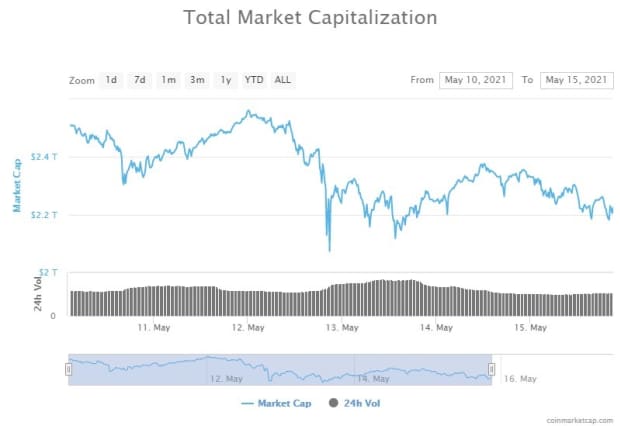

The broad-base crypto declines have wiped out over $500 billion from crypto to a market value of $2.02 trillion from a peak last week of about $2.546 trillion, according to CoinMarketCap.com.

CoinMarketCap.com

It has been a tough seven-day stretch for crypto, with dogecoin holding up better than most of its peers.

Bitcoin and Ether

ETHUSD,

on the Ethereum blockchain were down by over 20% over the past week. A popular derivative of bitcoin, litecoin

LTCUSD,

founded by Charlie Lee, was down over 30%.

Meanwhile, Coinbase shares were slumping 5.5% as the digital-asset platform, which tends to move in step with the broader crypto market, headed sharply lower.

Coinbase

COIN,

is down by about 30% since it went public about a month ago. It reported quarterly results last week what were in line with investor expectations and matched the company’s preliminary report that was released ahead of its April 14 listing on the Nasdaq Inc.

However, the bearish sentiment in bitcoin was starting to erode Coinbase’s momentum and that of other crypto-pegged assets.

The Bitwise Crypto Industry Innovators ETF

BITQ,

which made its debut last week, offers exposure to crypto-related assets and was down 6.2%, with Coinbase as one of its main holdings.

Musk has been at least partly blamed for the downturn in virtual assets, but some strategists say that the asset class’s sensitivity to news reflects the bubbliciousness of digital assets that had surged too far, too fast.

Crypto like dogecoin and bitcoin have enjoyed strong gains compared against traditional assets in the year to date. Dogecoin is up over 10,000% and bitcoin has gained 50% so far in 2021.

By comparison, gold futures

GC00,

are down 1.5% year to date. The Dow Jones Industrial Average

DJIA,

is up nearly 12%, the S&P 500 index

SPX,

has risen by more than 10% and the Nasdaq Composite Index

COMP,

has climbed over 3% in the same period.