This post was originally published on this site

Hello, again: Thanks for all the feedback from last week’s ETF Wrap. Please, keep it coming.

We’re going to focus this week’s Wrap on crypto. It is on the minds of a number of market participants, even if hand-wringing about the potential for surging inflation and a tweet from Tesla Inc.

TSLA,

CEO Elon Musk is sucking up most of the oxygen in financial markets, lately.

The Holy Grail for crypto enthusiasts has been a pure-play exchange-traded fund investing in crypto. It doesn’t seem that we’re any closer to getting one, at least before the end of 2021. Gary Gensler, as the new chairman of the Securities and Exchange Commission, seems intent on ensuring that investor protections are in place for moving forward, and rightfully so.

But MarketWatch caught up with Matt Hougan, chief investment officer of Bitwise Asset Management, formerly the chief executive officer of ETF.com, whose new fund may hold some appeal for those pining for a bitcoin ETF. One selling point, is that the fund may retain its attraction even if a bitcoin ETF eventually emerges.

Send tips, or feedback, and find me on Twitter at @mdecambre to tell me what we need to be jumping on.

Sign up here for ETF Wrap.

Weekly ETF moves

| Top 5 gainers of the past week | % Performance |

|

VanEck Vectors Oil Services ETF OIH, |

2.4 |

| Invesco Optimum Yield Diversified Commodity StrategyPDBC | 1.2 |

|

First Trust Global Tactical Commodity Strategy Fund FTGC, |

0.9 |

|

iShares GSCI Commodity Dynamic Roll Strategy ETF COMT, |

0.9 |

|

Global X Copper Miners ETF COPX, |

0.9 |

| Source: FactSet, through close of trading Wednesday, May 12, excluding ETNs and leveraged products |

| Top 5 decliners of the past week | % Performance |

|

iShares MSCI Taiwan ETF EWT, |

-9.8 |

|

Invesco WilderHill Clean Energy ETF PBW, |

-8.6 |

|

Amplify Transformational Data Sharing ETF BLOK, |

-8.3 |

|

ALPS Clean Energy ACES, |

-7.9 |

|

iShares U.S. Home Construction ETF ITB, |

-7.7 |

| Source: FactSet, through close of trading Wednesday, May 12, excluding ETNs and leveraged products |

Here’s what happened?

Weekly performance across the board for ETFs was lackluster as investors have been wrestling with the rising threat of inflation and have gravitated to themes and strategies they that they think will perform better in that environment.

See: The biggest ‘inflation scare’ in 40 years is coming—what stock-market investors need to know

VanEck’s oil-services

CL.1,

fund registered a 2.4% return among the best performers over the week. And evidence of inflation bubbling up appears to be helping boost commodity-focused funds, more broadly, including those for copper

HG00,

as the COVID-19 pandemic loosens its grip on parts of the world, amid a rollout of coronavirus vaccines and treatments.

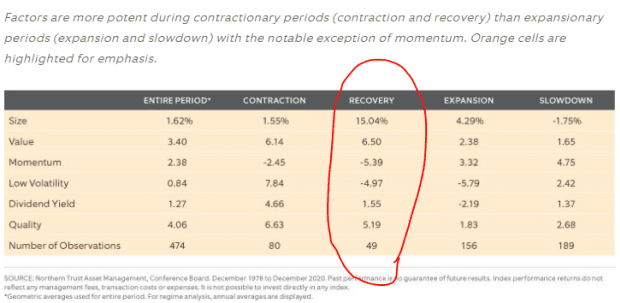

A recent research report from FlexShares indicates that factors like “value, size, and dividend yield,” tend to post strong gains during economic recoveries like the one the U.S. is experiencing presently.

“Given the historic relative outperformance of the size and value factors during an economic recovery—with an average excess return of 15% and 6.5% respectively during this type of environment—investors may want to consider ETFs with a tilt towards value stocks and a smaller market capitalization,” the folks at FlexShares write.

FlexShares

Is there an ETF for that?

Bitwise Asset Management launched the Bitwise Crypto Industry Innovators ETF

BITQ,

earlier this week.

There are plenty of funds that attempt to leverage from the growth in the crypto and blockchain market, but Hougan makes the argument that this fund is different primarily because it’s allowed to carry “crypto” in the title. That may sound like just window dressing but regulators compel a company/sponsor using a specific word in a fund’s name to put their money where their mouth is.

“It is the first ETF that has crypto in the name and the reason it is able to do that is that it is more than 80% is pure-play,” companies, Hougan said.

The ETF pro thought that people are excited about the idea of a bitcoin

BTCUSD,

fund because they are interested in the idea of the world’s No. 1 digital asset but may not want to hold it directly.

Bitcoin is inherently volatile and hard to value, which may be one reason why the SEC has thus far been hesitant to push forward with a ETF-wrapped crypto fund.

On Tuesday, the SEC in a statement said that investors “should consider the volatility of bitcoin” as well as “the lack of regulation and potential for fraud or manipulation in the underlying Bitcoin market.” The statement was a reference to the growing bitcoin futures market and mutual funds but the message implies that the SEC is moving gingerly in the sector.

On Thursday bitcoin prices on CoinDesk were down 10% at around $50,170, and had hit a 24-hour low of $46,294.12, a month after an all-time high around $64,000. Bitcoin’s slide accelerated on Wednesday after Musk said that he would no longer accept the crypto at Tesla stores. That has taken the broader digital-asset complex along for the ride lower, with assets tied to Ethereum

ETHUSD,

the second largest crypto in the world, also in the red. That includes meme asset dogecoin

DOGEUSD,

BITQ consists of 30 companies and is market-cap weighted but capped at 10%. It has crypto platform Coinbase Global

COIN,

as its biggest holding. Michael Saylor’s MicroStrategy Inc.

MSTR,

is another significant component, as well as Mike Novogratz’s Galaxy Digital Holdings

GLXY,

and bitcoin miners Riot Blockchain

RIOT,

and Marathon Digital Holdings

MARA,

This isn’t quite a bitcoin ETF, there are a bunch on file with the SEC, but for many investors who are able to stomach the wild moves of crypto, this could be a an alternative.

“This is not a bitcoin ETF but it does hold the companies that are building out the [crypto] infrastructure,” Hougan said.

It is worth noting that there is at least one notable entrant in the digital-asset world with a similar fund composition to BITQ.

VanEck Vectors Digital Transformation ETF

DAPP,

which made its debut last month, aims to give owners exposure to the “digital transformation of the economy,” and holds a number of the same companies as Bitwise but comes sans the “crypto” title and with a lower expense ratio at 0.65%, versus 0.85% for Bitwise.

DAPP is down early 16% so far this week.

Chart of the week

Tech stocks have been punished in the recent selloff that saw the Dow Jones Industrial Average, the S&P 500 index and the Nasdaq Composite Index all get clobbered on Wednesday. But Cathie Wood’s Ark Innovation fund has seen the worst of the downturn in equities, reports The Wall Street Journal.