This post was originally published on this site

Wall Street talking heads were stunned Wednesday when April’s 4.2% official inflation figure came in way higher than they had expected.

And when it comes to retirement accounts there’s one thing about inflation that really matters: It’s a risk that is not covered by the mainstream stock or bond funds in your 401(k). It doesn’t matter what Wall Street tells you.

The last time the U.S. economy saw sustained inflation, in the 1960s and 1970s, it devastated investors, and especially retirees living on fixed incomes. Data compiled by Yale finance professor (and Nobel laureate) Robert Shiller tells the grim tale.

From the time of the Kennedy assassination in 1963 until the middle of Ronald Reagan’s first term in 1982, the total return on U.S. stocks when measured in inflation-adjusted terms was about zero—or slightly less. Investors who had been expecting the “usual” 6% or 7% a year ended up with bupkis. And, worst of all, they’d lost 20 years they could never get back.

And while it was bad for stocks it was even worse for bonds. Shiller’s data shows that over the same period U.S. bonds actually lost a third of their value when measured in inflation-adjusted, or real purchasing-power terms. These are “total return” figures, including coupons and dividends. Oh, but they don’t count taxes and trading or portfolio management costs.

And these stocks and bonds did badly even though they started out seemingly pretty good value. The 10 year Treasury bond

TMUBMUSD10Y,

in 1963 sported a yield, or interest rate, of 4%.

Today? Try 1.6%. That is well below the current rate of inflation, or even the forecast rate. Which means these bonds are guaranteed to lose purchasing power even if inflation stays where it is.

What could go wrong?

The problem with inflation isn’t that it is necessarily coming, but that it’s a risk.

The Wall Street talking heads were issuing new inflation forecasts on Wednesday, and telling everyone not to worry: The current inflation surge, being caused by the reopening of the economy, is just “temporary.” But these were the same people who were just taken by surprise by April’s number.

If someone can’t even tell what the inflation rate was last month, how can they know what it will be a year from now? This is like a guy with a rifle saying he can hit a target at 2,000 yards when he’s just missed the barn door from 20 feet.

As the CFA Institute’s Joachim Klement writes, “A survey of the empirical track record of forecasts clearly shows one thing: Economists and investors are horrible at forecasting.” He calls making forecasts one of the seven deadly sins of investing.

Or as Casey Stengel said, “Never predict anything, especially the future.”

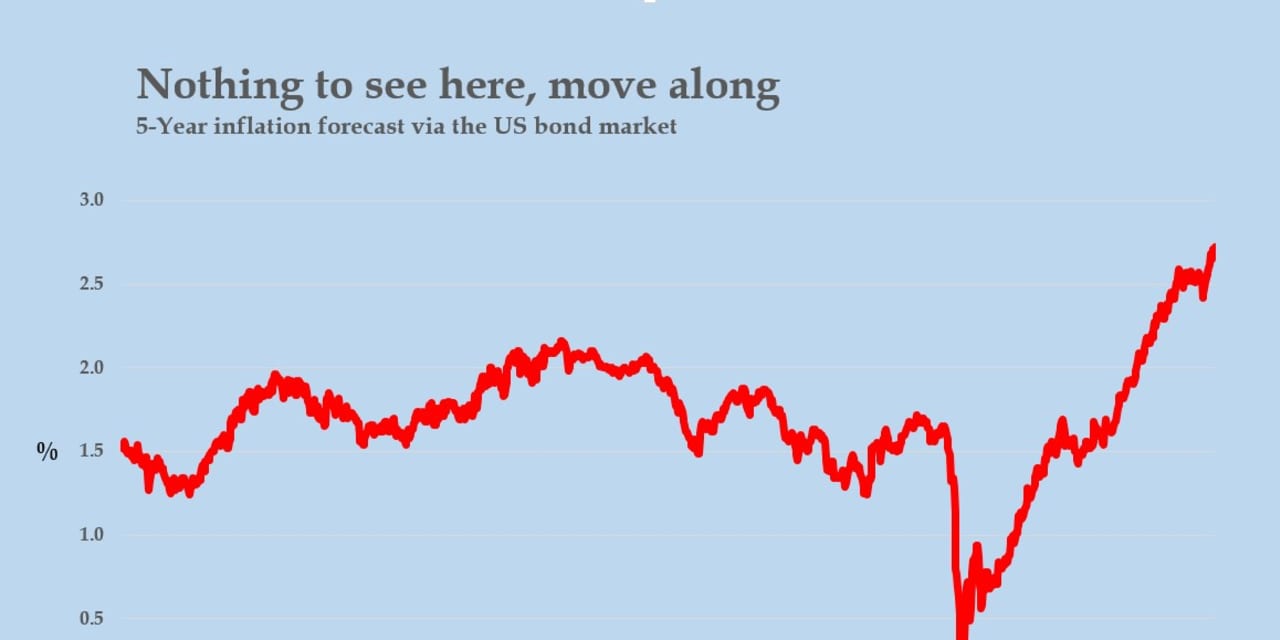

Meanwhile, the bond market has jacked its own five-year inflation forecast up to 2.7%. That may be peanuts by the standards of the 1960s and 1970s, but it’s the highest reading since the summer of 2008, before Lehman Brothers collapsed. The bond market’s forecasts are far from perfect, but they’re probably a lot better than the talking heads. At least in the bond market are effectively betting trillions of dollars on trying to predict the right number.

Once upon a time the Federal Reserve stopped rising inflation by jacking up interest rates. Could it do the same again if it had to? The last time the Fed tried raising rates, in 2018, the stock market plummeted 20% until it agreed to stop. It could be tough to raise interest rates in an economy so addicted to debt. Total US domestic debts—including Uncle Sam, the states and municipalities, businesses and households—now amount to about 300% of gross domestic product. That’s more than twice the level from a couple of generations ago.

In the past, safe havens against inflation have included gold bullion, other commodities, and real estate. They may protect investors again, though the past is no guarantee of future results. These days we also have Treasury inflation-protected securities, a bond issued by the federal government that effectively adjusts its value to keep up with rising prices. Many 401(k) plans may include them through vehicles such as the Vanguard Inflation-Protected Securities Fund (VAIPX). The problem at this point is that most of these TIPS now have negative inflation-adjusted yields. Only the longest-dated TIPS—think Pimco 15+ Year TIPS Index ETF

LTPZ,

—are guaranteed to hold your purchasing power, if no better. A mediocre investment, but they’ll work as insurance.