This post was originally published on this site

The clock is ticking down to a big reading on U.S. inflation, a red-hot topic for markets. Ahead of that, stock futures are pointing south, but by a less hefty amount than seen as of late.

Perhaps helping out were the dip buyers who picked off beaten-down technology stocks on Tuesday, helping the Nasdaq erase a nearly 2% drop. The Dow Jones Industrial Average

DJIA,

had its biggest one-day drop since the February rout.

But could the worst be over?

Providing our call of the day, Fundstrat Global Advisors’ founder Thomas Lee zeroes in on a couple of “panic events” that he believes could signal market capitulation. That occurs when investors dump their holdings, often driven by a correction, leading to a potential bottom for stocks.

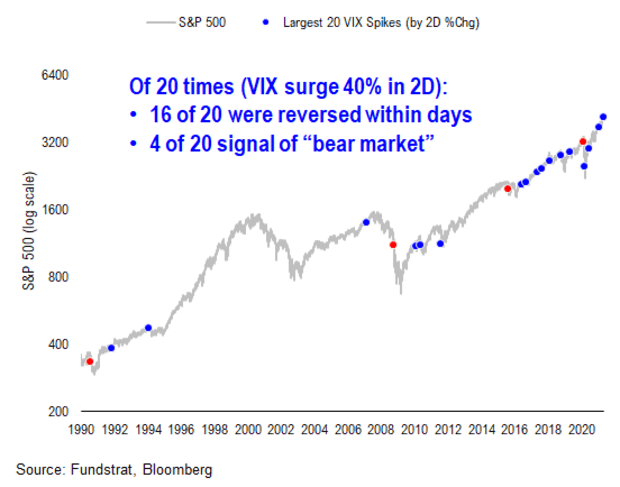

In a note to clients that published on Wednesday, Lee explained those events, starting with a 40% surge over two days for the Cboe Volatility Index, or the VIX

VIX,

Such action, he noted, has only been seen 20 times since 1990.

Based on similar instances of VIX spikes since 1990, “unless we are entering a recession, the VIX spike is simply a panic/reset. And this washes out investor sentiment,” said Lee.

His data show that since 1990, the S&P 500 has experienced four bear-market instances and 16 bull-market instances when the VIX has seen a similar two-day surge. The median forward return in those bullish follow-ups has been 1.6%, 6% and 8.7% on a one, three and six-month basis.

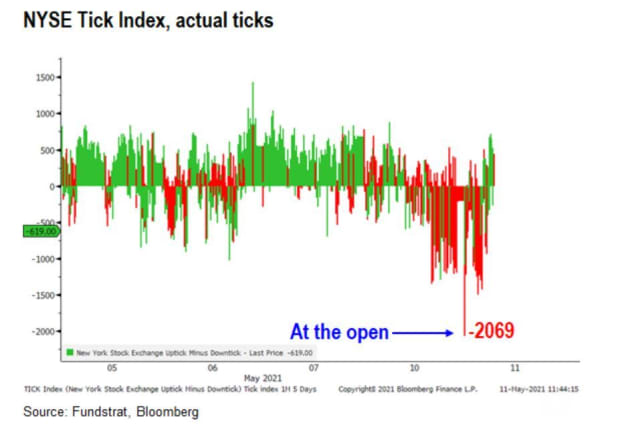

The second “panic event” also happened on Tuesday, when the NYSE Tick index, which compares the number of stocks moving up versus down, collapsed to its worst reading since 1999, dropping 2,069 points, said Lee.

He said all nine other worst TICK readings took place during bull-market periods, with the exception of 2001, though he doesn’t think markets are repeating that year, given stocks were already in a downtrend two years before that.

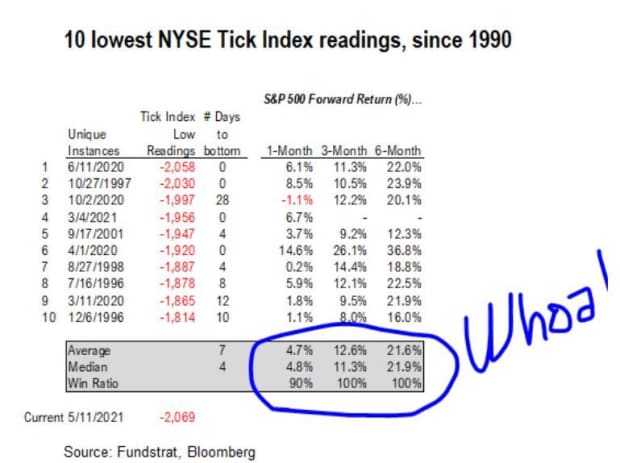

Here, he highlights (circled in blue) what happens after those low TICK readings:

“While many investors might view [Tuesday’s] plunge and the surge in the VIX as a negative sign, it might surprise you but these are actually bullish signals. Foremost, keep in mind that bull markets ‘ride an escalator, and fall down an elevator,’ meaning, in a bull market, stocks rise steadily and then plunge suddenly. Thus, a VIX surge and massive negative NYSE tick reading is positive,” said Lee.

If a capitulation is en route, he said, investors should rotate out of tech and into so-called “epicenter recommended areas,” referring to economically sensitive companies.

Here are 10 from his list of dozens such stocks: Advance Auto Parts

AAP,

motorcycle maker Harley-Davidson

HOG,

Wyndham Hotels

WH,

Prosperity Bancshares

PB,

Bank of New York Mellon

BK,

amusement-park company Six Flags

SIX,

energy companies Exxon Mobil

XOM,

and GE

GE,

airline JetBlue

JBLU,

and department store Kohl’s

KSS,

Read: ‘No doubt…that we are in a raging mania in all assets’, says Stanley Druckenmiller

Inflation day and ether surges

Economists expect consumer prices, due ahead of the open, to climb in April for the 11th straight month, and the annual rate could reach above 3.5% for the first time since 2011. Ahead of those data, U.S. stock futures

ES00,

NQ00,

are pointing south. Selling in Asia sent Taiwan’s TAIEX

Y9999,

down more than 8% at one point, while European stocks

SXXP,

have rebounded after the worst session of the year.

Days after a cyberattack, the Colonial Pipeline fuel outage continues to cause misery for U.S. drivers. The U.S. Energy Department says it is trying to help:

Digital currency ether

ETHUSD,

has resumed its run higher after a brief pullback, with most digital currencies moving up. As some on Twitter

TWTR,

are pointing out, the market cap of the cryptocurrency that runs on the ethereum blockchain (here’s a refresher on ethereum) is now bigger than that of JPMorgan

JPM,

The Securities and Exchange Commission’s Division of Investment Management warned that a volatile bitcoin

BTCUSD,

could create problems for related exchange traded funds.

Despite poor results in western trials, China’s Sinovac COVID-19 vaccine has eliminated the coronavirus that causes the disease among more than 25,000 Indonesian health workers. A new report says the pandemic was a “preventable disaster.”

There has been no let up in the attacks on the Gaza Strip, which is turning into the worst outbreak of violence since 2014.

Rep. Liz Cheney warned former President Donald Trump and his Republican supporters are trying to “undermine our democracy,” ahead of a vote that may strip her of a leadership post.

Random read

The newest U.S. chess master is 10 years old.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.