This post was originally published on this site

Stay invested because rates can probably stay low, for a lot longer than many expect.

That is BlackRock, the world’s largest asset manager, pointing to the potential pitfalls of underestimating just how slow the Federal Reserve may be in starting to tighten monetary policy.

“Markets are pricing in a liftoff from near-zero policy rates as early as next year, even though the Fed through its new framework has committed to stay behind the curve on inflation,” wrote a team led by Jean Boivin, head of BlackRock Investment Institute, in a weekly note Monday.

“We caution against extrapolating too much from strong near-term activity data amid a powerful restart. We see a high bar for the Fed to change its policy stance and believe this may be underappreciated by markets.”

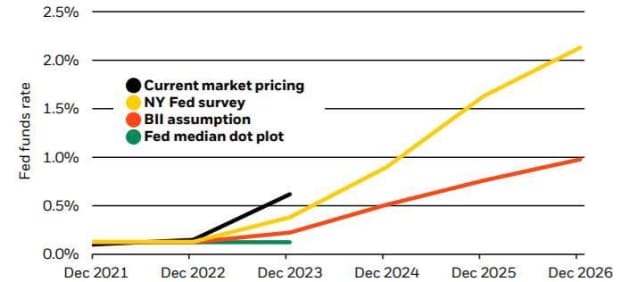

BlackRock’s own view calls for U.S. policy rates to take almost five years to reach 1%, or until the end of 2026.

BlackRock sees slow pace for higher rates

BlackRock Investment Institute

That would be about two years slower than what market participants recently forecast, during a March survey conducted by the New York Federal Reserve.

BlackRock also foresees a slower first Fed rate increase range at near 0% than other analysts.

“We see two reasons for this disconnect,” Boivin said of more aggressive market projections for Fed policy.

First, investors may be reading too much into growth data as pandemic-related restrictions. Second, investors may be too “wedded to the central bank’s old policy framework,” specifically when it comes to any temporary overshoot of its 2% inflation target.

Boivin’s team instead thinks “eye-popping growth numbers in coming months will be largely irrelevant” to the Fed’s rate outlook. They also expect 2% inflation will need to be in place for a “sustained period of time” before any tapering occurs of its roughly $120 billion a month bond-buying program.

“The Fed is in the process of building credibility in the framework and has set a high bar to change its easy policy stance, even in the face of higher realized inflation,” the team wrote. “The implication: stay invested as the restart broadens out.”

The U.S. 10-year Treasury yield

TMUBMUSD10Y,

was up 2.5 basis points to 1.601% on Monday as Eurozone yields climbed. U.S. stocks closed lower, after the Dow

DJIA,

topped 35,000 for the first time and slumping stocks of major technology companies pulled the S&P 500 index

SPX,

and Nasdaq Composite Index

COMP,

sharply lower.

Despite April’s disappointing employment figures, a trio of Fed officials said on Monday that they didn’t think the jobs market was stalling, including President Charles Evans who expects the labor market to expand at a healthy pace for the rest of the year.