This post was originally published on this site

U.S. stocks look set for a mixed start to the week, after the Dow Jones Industrial Average

DJIA,

and S&P 500

SPX,

closed at record highs on Friday, despite a weaker than expected April jobs report.

Economic data will also be catching the eye this week, with U.S. consumer prices on Wednesday, and retail sales and industrial production on Friday.

A cyberattack on a major pipeline system transporting fuel across the U.S. East Coast, confirmed by Colonial Pipeline over the weekend, is also in focus, pushing oil prices

CL00,

BRN00,

higher.

The S&P 500 looked set to eke out fresh highs on Monday, with futures pointing slightly higher. Friday’s disappointing jobs data bolstered hopes that the Federal Reserve will keep interest rates lower for longer, proving positive for stocks.

But in our call of the day, Goldman Sachs analysts said the market leadership of the S&P 500’s five largest stocks — Facebook

FB,

Amazon

AMZN,

Apple

AAPL,

Microsoft

MSFT,

and Google owner Alphabet

GOOGL,

(FAAMG) — was under threat from a number of risks on the horizon. The group represents 21% of the index, they said, higher than the 14% average share typically held by the top five stocks.

While the prospect of decelerating U.S. economic activity supports Big Tech’s outperformance and the group’s “remarkable” growth looks set to persist, analysts, led by David Kostin, noted several headwinds around the corner.

They said President Joe Biden’s plans to raise corporate and capital-gains tax rates pose potential risks to the quintet.

The proposed 28% corporate tax rate would hit FAAMG earnings by 9% relative to the consensus, they said, while the latter, a potential near-doubling of the capital-gains tax rate for wealthy Americans, could spark a selloff later this year.

“If the capital-gains tax rate becomes set to rise in 2022, investors subject to the higher rate may choose to realize some of their substantial capital gains in 2021 at the lower current tax rate,” the analysts said.

They noted that FAAMG stocks have appreciated by $5 trillion in the past five years, or 29% of the S&P 500’s market cap increase over that time.

The group’s valuation multiples also presents a risk, as does the possibility of rising interest rates in the coming months. Goldman’s rates strategists predict 10-year U.S. Treasury yields

TMUBMUSD10Y,

will rise to 1.9% by the year-end. “As yields rose sharply from November through March, FAAMG underperformed the S&P 500 by 7 percentage points (+21% vs +14%%). A similar period of rising rates in the second half of 2021 would likely hamper FAAMG returns,” Kostin said.

However, the 10-year U.S. Treasury yield remains “extremely low” in historical terms, supporting the valuation of high growth stocks.

But those all pale in comparison to what Goldman analysts described as the group’s “greatest threat” — antitrust intervention.

“With the exception of Microsoft, the other four face a laundry list of legal battles and investigations over their market power and competitive practices ranging from commercial litigation to DOJ [Department of Justice] and FTC [Federal Trade Commission] antitrust lawsuits to Congressional probes,” they said. But they added that their relative valuations remain stable, implying no major impact from antitrust actions.

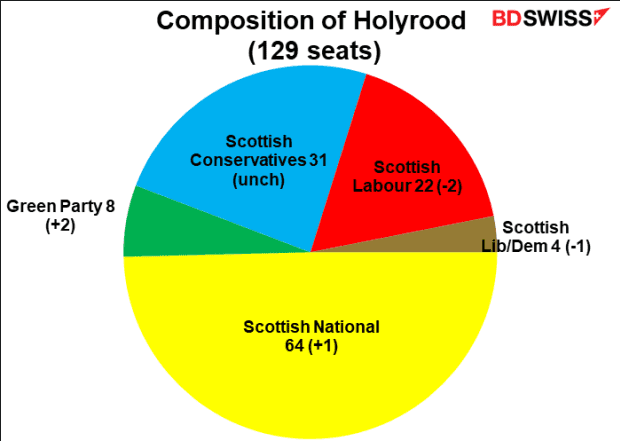

The chart

The Scottish National Party (SNP), which is campaigning for a referendum on an independent Scotland, fell just one seat short of an overall majority in the Scottish Parliament elections. SNP leader Nicola Sturgeon said a second referendum, after the country voted to remain part of the U.K. in 2014, was “a matter of when, not if.”

With the threat of a referendum on hold, at least for the time being, the pound enjoyed strong gains on Monday.

Source: BDSwiss Group

The markets

U.S. stock futures

YM00,

NQ00,

were mixed ahead of the open, after fresh closing records for the Dow Jones Industrial Average and S&P 500 on Friday. The pan-European Stoxx 600

SXXP,

was also flirting with a record high, led by commodity-related stocks as metals prices surged.

The pound

GBPUSD,

climbed toward $1.41, as concerns over a Scottish independence referendum were outweighed by expectations that U.K. Prime Minister Boris Johnson will announce a further easing of lockdown measures later on Monday.

The buzz

A cyberattack that has forced the shutdown of a vital U.S. fuel pipeline was carried out by a criminal gang known as DarkSide, Associated Press reported on Sunday, citing two people close to the investigation.

Popular cryptocurrency asset dogecoin tumbled more than 30% over the weekend, after Tesla

TSLA,

Chief Executive Elon Musk’s appearance on “Saturday Night Live.” Dogecoin

DOGEUSD,

was 5% lower early on Monday and was last trading at 54 cents, according to CoinDesk.

Ethereum

ETHUSD,

the No. 2 cryptocurrency by market value hit a new all-time high above $4,000 on Sunday and continued rising early on Monday.

The U.S. has “no doubt” undercounted the number of COVID-19 deaths, top infections-disease expert Dr. Anthony Fauci said on Sunday, adding that vaccines are a “game-changer” that mean future outbreaks will only be blips.

Random reads

Climate change threatens the future of the traditional cup of tea, research finds.

Baby whale freed in dramatic rescue mission after getting stuck in London’s River Thames.

The U.K. election race decided by the toss of a coin.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.