This post was originally published on this site

It’s felt like a nonstop barrage of buybacks.

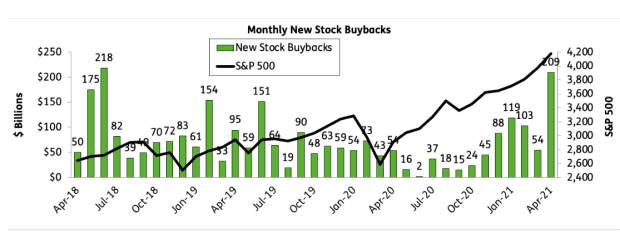

April alone saw $209 billion worth of stock repurchases announced by companies, the second-highest month on record behind the $209 billion from June 2018, following the Trump administration’s tax overhaul.

Nearly four years ago, then-President Donald Trump said slashing the corporate tax rate to 21% would be like “rocket fuel for our economy.”

Buybacks now have come back in vogue as the economy heals from the pandemic, even as CEOs line up to battle against the Biden administration’s proposed plan to bring the corporate tax back to 28% to help pay for a $2.3 trillion infrastructure package.

“It’s going to be a big earnings season for buybacks,” said Winston Chua, an analyst at research firm EPFR, adding that buybacks have remained elevated in May and likely will stay that way for several weeks before tapering off.

“Historically, share buybacks have a high correlation to the S&P 500 index,” Chua told MarketWatch. “But it’s not a pace that can be sustained.”

Here’s how April stacked up to other months on the buyback front.

A blizzard of buybacks.

EPFR Informa

The chart also shows buybacks climbing along with the S&P 500, which booked its last record finish on April 29. It was up 11.9% on the year at Thursday’s close.

The S&P 500

SPX,

on Thursday closed above the 4,200 mark for its second-highest finish ever, while the Dow Jones Industrial Average

DJIA,

booked its 23rd record close of the year, more than all of 2020.

First-quarter earnings mostly have trounced optimistic estimates put forth by Wall Street, validating expectations that business would come roaring back once COVID-19 became a less disruptive force in people’s lives.

Of the 419 companies in the S&P 500 that have already reported first-quarter results as of May 6, about 88% reported earnings that beat analysts’ expectations, the highest on record since Refinitiv started tracking the data in 1994.

Against this bullish backdrop, Berkshire Hathaway Inc.

BRK.B,

vice chairman — and Warren Buffett’s right-hand man– Charlie Munger said share repurchases designed solely to push the price of the stock higher were immoral, but that critics of buybacks made in the interest of shareholders were “bonkers.”

Berkshire’s share repurchases were $6.6 billion in the first quarter, down from $9 billion each in the third and fourth quarters of 2020.

Debt investors tend to look unfavorably on companies that borrow in the bond market to fund share buybacks that aim to push up a stock’s price. U.S. companies borrowed a record amount of debt last year during the pandemic, with proceeds mostly earmarked to refinance maturing debt at cheaper rates.

Investment-grade companies have been dominant players in buybacks, including Apple Inc.

AAPL,

which added $90 billion to its stock repurchase program in April.

The first week of May saw Eli Lilly and Co.

LLY,

detail a $5 billion share repurchase plan, as well as a host of other companies announcing similar buybacks.

Read next: Get ready for stock buybacks to roar back