This post was originally published on this site

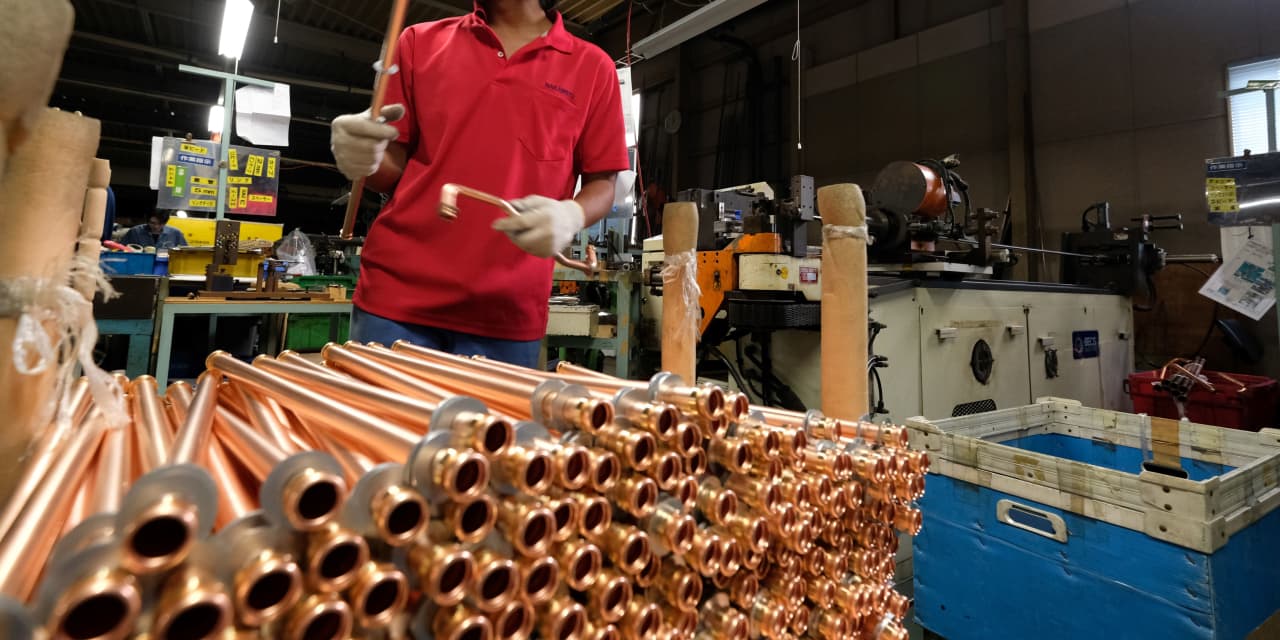

Copper futures were trading at a new record Friday, as the global economic recovery and the popularity of electric vehicles spurs demand for the red metal.

July copper

HG00,

HGN21,

was up 2.4% at $4.713 a pound on Friday and set for a weekly gain of 5.5%, which would represent the fifth straight weekly rise.

So far in 2021, the metal is on pace for a gain of about 34%, contributing to its 12-month rise of 98%.

A push for green energy, after President Joe Biden’s summit last month, has provided support for copper, MarketWatch’s Myra Saefong wrote.

Biden’s $2.3 trillion proposed infrastructure package, meanwhile, has also raised expectations for copper demand.

Copper is important in the production of electric vehicles, with Tesla Inc. TSLA at the head of an electric vehicle push that seems to be sweeping the globe.

Copper, known for its conductive properties as a metal, is used within vehicle production but it is also intrinsic to the various elements of electric vehicle infrastructure.

Jon Lynch, director of metals research and product development at the CME Group

CME,

recently wrote that automobile trends, including the U.K.’s announcement that it plans to phase out fossil-fuel vehicles by 2030 and plans by China to phase them out by 2035, is helping support copper’s price.

“With the advent of hybrid and battery electric vehicles, the amount of copper wiring used to power an automobile has increased,” he said.

Copper prices have also traditionally had a reputation of being able to forecast trend changes in the economy globally.