This post was originally published on this site

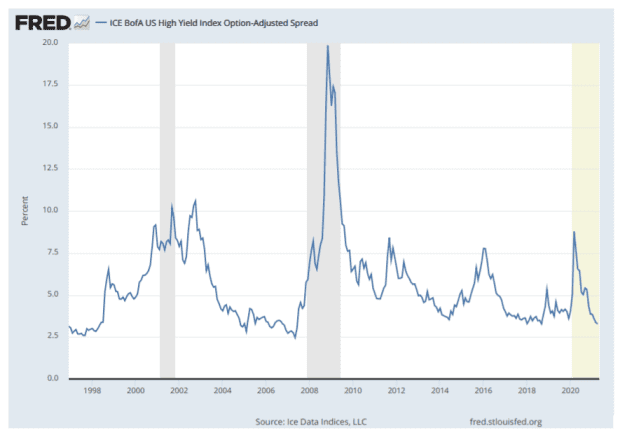

Credit spreads in the U.S. high-yield corporate bond market have been diving to near 2018 post-recession lows, a sign of how deep the hunt for yield has become during the pandemic.

But while bond returns have dwindled globally as central banks have propped up markets to spur economic growth, some investors say the nearly $1.5 trillion U.S. “junk-bond” sector isn’t the same as in the past, where higher default risks also meant higher levels of compensation.

“What you need to appreciate is that the market has changed. It’s evolved,” said Ken Monaghan, co-head of high yield at Amundi U.S. “If you look at the market, and the level of risk associated with it, it’s come down.”

So have spreads, or the premium investors earns on bonds above a risk-free rate

TMUBMUSD10Y,

At last check, the benchmark ICE BofA US High Yield Index’s spread was 329 basis points above the risk-free rate, or roughly 3.29%, before factoring in the relevant Treasury yield.

That’s near a key 3.16% threshold from October 2018, the low for junk bonds in the aftermath of the Great Recession.

Like stocks

SPX,

DJIA,

the junk-yield sector often rallies when markets are flush with liquidity, but also can be quick to sell off when sentiment sours.

The U.S. high-yield index spread surged to almost 20% in the wake of 2008 global financial crisis, but also plunged in its aftermath.

Spreads are near post-recession lows.

St. Louis Fed, ICE Data Indices

Spreads again climbed to almost 10% in early 2020 at the onset of the pandemic, but then ticked lower once the Federal Reserve stepped in with its extensive slate of crisis-era liquidity.

For context, the sector’s all-time low of 2.40% was booked in July 2007, or “before the world blew up,” said Monaghan, a high-yield market veteran since the 1980s when he worked at Salomon Brothers.

Monaghan also said the high-yield sector lately has been better at keeping a lid on risk-taking than in the past, including by being more selective about which leveraged buyouts it finances, mergers and acquisitions, and share buybacks.

“If you go back to the 2007 time frame, we were in a period of extraordinary M&A and LBO activity,” Monaghan told MarketWatch, adding that contrasts with last year’s record corporate-bond issuance, as well as volumes this year, that largely were earmarked to refinance existing debt at lower rates.

“That is kind of a benign use of proceeds,” he said.

Improving high-yield credit trends, as the U.S. ramps up vaccinations and the economy improves, were also highlighted this week by Joe Kalish, chief global macro strategist at Ned Davis Research.

“Many companies have taken the opportunity to refinance their debt at lower rates and longer maturities, thereby reducing default risk,” Kalish wrote in a Wednesday report. “Furthermore, as business improves, more companies should be upgraded.”

See: The next rising stars of the debt world? Probably corporate fallen angels

Like letter grades in high school, corporate credit ratings in the A and B category are considered better than the C group, or lower. The lowest ratings bracket for investment-grade is BBB

LQD,

before a company falls to BB

HYG,

or the highest junk-bond

JNK,

category.

In 2007, only 40% of U.S. high yield was in the BB ratings bracket, Monaghan said, but now it’s about 54.3%.

“That’s a pretty big shift from the last recession, and even in the past 10 years,” he said. “What that speaks to is the risking credit quality of the average bond in the high-yield bond index.”