This post was originally published on this site

The executive instrumental in making Alphabet’s Google the largest global corporate buyer of renewable energy and the first company of its size to achieve 100% renewable energy for operations is now looking to propel the nation’s fleet vehicles — from buses to long-haul trucks to delivery vans — toward becoming fully electric.

Palmer is the new CEO of TeraWatt Infrastructure, a company founded in 2018 to develop, own and finance electric vehicle charging infrastructure in the U.S. TeraWatt’s plan is to fill in what it says is a multi-trillion dollar investment and infrastructure gap for EV charging as the nation presumably transitions in coming years toward an all-electric transportation network. TeraWatt is backed by Keyframe and Cyrus Capital, which jointly manage portfolios of over $3 billion.

TeraWatt in part is the go-between for logistics companies and utilities. The owners of the fleets will want to keep their focus on the supply chain, not worried about the technology behind keeping their fleet charged. Power generation will be local, renewables-focused, and storage is crucial. Still, this new EV demand will stress an electrical grid that will need a major update. That update has featured in debates already brewing in Washington and in the wake of notorious outages, like that seen in Texas over the winter and historically, in California.

TeraWatt will combine real estate holdings with capital investment to welcome evolving electric-vehicle charging technology along major U.S. roads.

While TeraWatt is focused largely on commercial fleets first, growth in charging will be key for scaling up a network for personal-use EVs as well.

Pledges from the Biden administration this spring has left Americans wondering how soon a complex network of EV charging to rival traditional gas stations — one that analysts say will need state and city buy-in and private-sector help — will fully come online.

Read: Biden’s plan for 500,000 EV charging stations faces tough road ahead

Biden proposed spending $174 billion to promote EVs and install 500,000 charging stations across the U.S. as part of a sweeping infrastructure announcement. Broadly, Biden wants Congress to approve $2 trillion to re-engineer America’s infrastructure, and counter offers are on the table.

Read: NIO is making a landmark push outside of China into this electric-vehicle-obsessed country

Palmer talked with MarketWatch about the new role and her vision for the EV charging network.

MarketWatch: What need does TeraWatt fill? Sounds like you handle everything from land acquisition for the charging sites to courting the financing to building out these sites and managing these locations.

Palmer: As the cost of ownership of an EV fleet comes down and even looks more attractive in lowering overall transportations costs for operators of fleets, charging infrastructure has to pick up. The EV technology is there; the infrastructure is not. And we need an answer for the hyperlocal power demand of fleets of medium- and heavy-duty vehicles charging simultaneously, imagine 20 buses having to charge at once, and the need for on-site generation and energy storage. It’s an industry in early days, no doubt. But from here, demand will be huge and we are starting from virtually no infrastructure to meet that demand.

MarketWatch: The Biden administration and congressional lawmakers from both parties have said the shift to more renewable energy and EV adoption will take private and public support. Do you agree with that and are you encouraged by this administration’s seemingly intense focus on updating energy use in this country?

Palmer: It’s true that government can help in very specific ways, leveraging federal right of way for access, for instance, and that will help the U.S. make the EV transition faster. But broadly, it’s also true that the need is so immense, and needed everywhere, there’s no doubt it will take public-private action.

MarketWatch: We hear regularly, from the federal government to local government to the private sector, about the need for modernizing the nation’s electric grid, for all use, not just vehicles. Does that have to precede TeraWatt’s big push, or it happens simultaneously to your expansion, or just what does that look like?

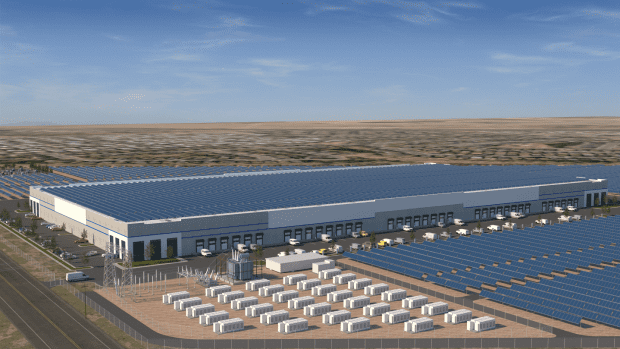

Palmer: EV fleets at this expected magnitude represent a whole new source of power demand. We’re talking about needing double the amount of current electricity generation. It takes a long time to upgrade a grid. That’s why our emphasis is also on onsite generation, onsite storage. These are the complete facilities we build.

But we envision a full grid that can be modernized. The S-curve is coming and we’ll be there. It will happen quicker than people expect. [In project management, an s–curve is a mathematical graph that depicts relevant cumulative data for a project—such as cost or man-hours, plotted against time.]

MarketWatch: Are there regions of the country that will get attention first?

Palmer: Simple answer is, the need is everywhere. TeraWatt leverages its proprietary database to acquire properties in strategic transportation locations, such as major highway exits between metropolitan areas and logistics hubs.

MarketWatch: It’s clear you built the renewable energy program at Google

GOOGL,

one it can claim as essentially leading the technology sector, really. When you joined, Google had eight data centers with under 3 TWh of annual electric consumption. By the time you left, it was operating dozens of data centers on four continents with over 13 TWh of annual electric consumption. Google has been using 100% renewable energy for operations since 2017. Can we imagine growth this fast for the EV fleets?

Palmer: The technology is here. It all exists. It’s just about scalability. This reminds me very much of where renewables, solar and wind, were a decade ago. It was expensive. Now we use renewables at scale for data centers, for instance. For fleet EV infrastructure, there is a strong corollary to that [renewables] timeframe.